As a seasoned analyst with extensive experience in the cryptocurrency market, I believe Ethereum’s current price action presents a significant opportunity for both buyers and sellers. The technical analysis suggests that Ethereum has reached a pivotal support region on the daily chart, which aligns with the 0.5 ($3421) to 0.618 ($3289) Fibonacci levels and the 100-day moving average ($3412). This area is crucial as it represents a substantial demand zone and a potential reversal point for Ethereum’s downtrend.

The price of Ethereum has touched down at a significant and robust level after a short period of correction, providing an opportunity for a possible bullish turnaround.

However, if Ethereum sellers breach this pivot, a cascade in the market is likely.

Technical Analysis

By Shayan

The Daily Chart

Examining Ethereum’s daily chart more closely reveals that it has approached a significant support zone following a brief correction. This area includes the price range between $3289 (0.618 Fibonacci level) and $3421 (0.5 Fibonacci level). Notably, this zone aligns with the robust backing of Ethereum’s 100-day moving average, currently priced at $3412.

As a researcher examining these data points, I can observe that the convergence of these supporting signals underscores the robustness of this significant threshold and the present market dynamics, potentially halting any further price declines.

At this significant price level, there is anticipated clash between buyers and sellers, resulting in increased market instability and possible forced sales. The final result could shape Ethereum’s future direction. If sellers prevail and break through the critical support area, a rapid decline to the 200-day moving average at $2996 is imminent.

The 4-Hour Chart

Four hours ago on the Ethereum chart, a head and shoulders formation emerged, leading to heightened selling pressure and a subsequent price drop beneath this pattern’s neckline.

The recent development and the contrasting downturn in the RSI indicator’s direction have intensified bearish energy, resulting in a substantial drop for Ethereum. Subsequently, Ethereum has constructed a descending flag formation on its chart – a commonly observed bullish reversal pattern if broken from above.

At present, the price is fluctuating near a significant support zone. This zone is defined by the 0.5 Fibonacci level ($3420) and 0.618 Fibonacci level ($3289), along with the flag’s lower limit. This region is witnessing heightened volatility and price swings.

If sellers weaken this essential support, a sudden drop to the $2.9K level could ensue. On the other hand, should buyers regain strength and reduce the current oversupply, a rally back up to the flag’s peak at $3.6K is probable.

Sentiment Analysis

By Shayan

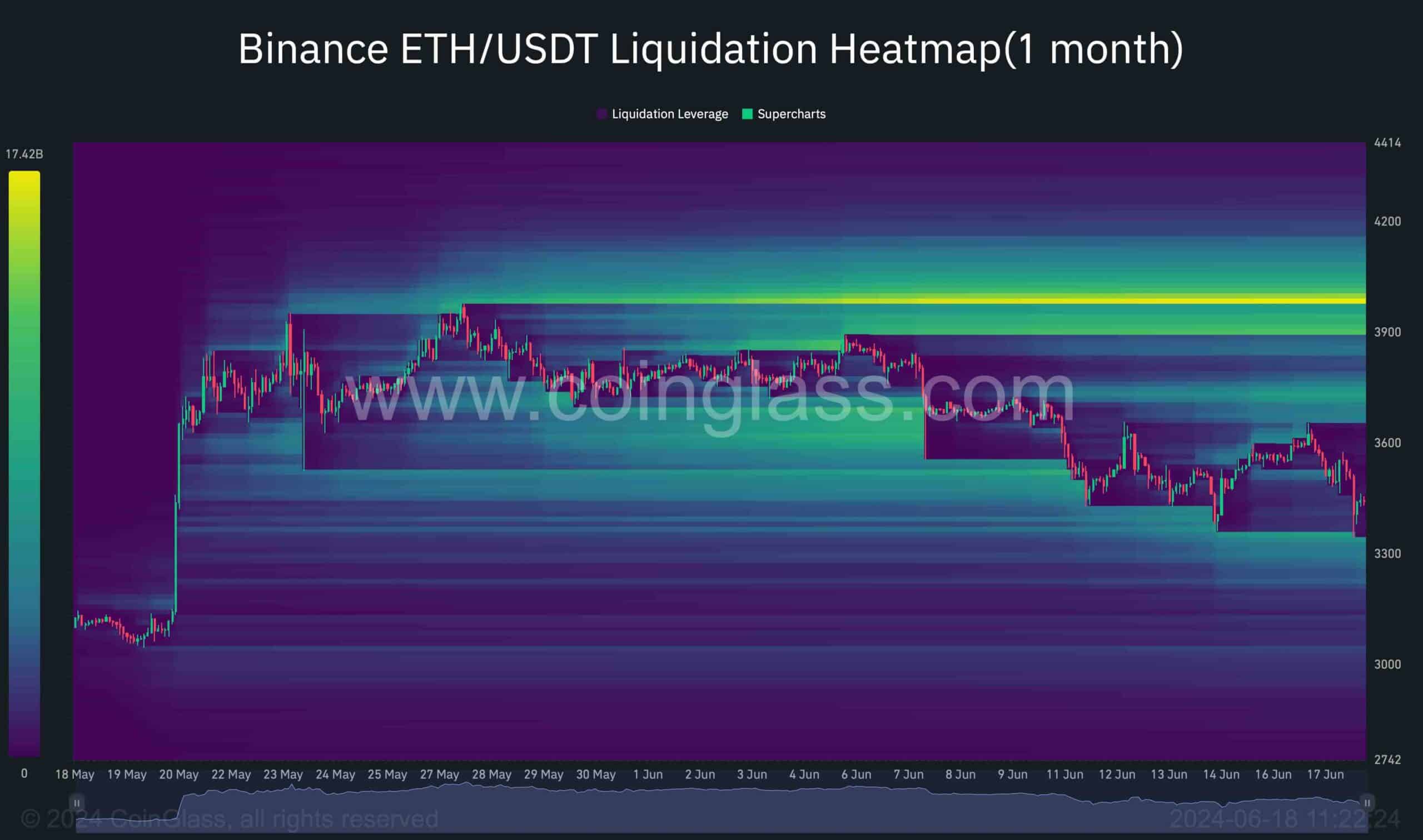

The cost of Ethereum has seen increased selling activity around the $4,000 threshold, resulting in a substantial drop. This trend may be due to traders’ eagerness to initiate short positions at this key point. It’s essential to examine potential liquidation points for estimating future price goals over the intermediate term.

Based on the chart’s illustration, a substantial amount of liquidity lies above the pivotal $3.9K level. This area may host buy-stop orders placed by influential short sellers at this key turning point. Should demand surge back into the market and the price undergoes a bullish rebound close to the $3K level, this liquidity pocket is expected to be the primary focus for buyers.

Approaching this significant liquidity threshold could result in heightened market instability and possibly initiate a short squeeze situation. In such an event, short sellers would be compelled to buy back their shares, leading to a surge in price. However, if the downward selling pressure persists and Ethereum fails to regain higher ground, it may instead experience further consolidation or depreciation.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- PROM PREDICTION. PROM cryptocurrency

- ETC PREDICTION. ETC cryptocurrency

- CEL PREDICTION. CEL cryptocurrency

- VR PREDICTION. VR cryptocurrency

- ISP PREDICTION. ISP cryptocurrency

2024-06-18 15:37