As a seasoned crypto investor with over five years of experience navigating market volatility and geopolitical events, I have learned to maintain a balanced perspective amidst market fluctuations. The recent dip in Bitcoin’s price due to Middle Eastern conflicts might seem daunting at first glance, but it is essential to remember that the market has shown resilience and found its footing once again.

The cost of Bitcoin has seen a drop lately due to reports of conflict in the Middle East, but it appears that the market is now stabilizing.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Today’s graph indicates that Bitcoin’s price has dropped below the $64K mark and the nearby region of the 200-day moving average. Yet, the $60K area appears to be offering support, causing BTC to climb again towards the 200-day moving average.

If the market fails to hold above the 200 Daily Moving Average, it’s likely that we might see a continued decline, potentially reaching levels around $56K or even $52K.

The 4-Hour Chart

Examining the 4-hour timeframe, it’s clear that the market’s pattern has transitioned into a more bearish one. This transformation occurred when we noticed a drop below the previous uptrend line a couple of days back.

It appears that the market has possibly found a base around $60K, since the Relative Strength Index (RSI) indicated an oversold condition. The coming events hinge on whether the price can surpass $64K or if it gets denied and falls even lower instead.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Net Realized Profit and Loss (NRPL)

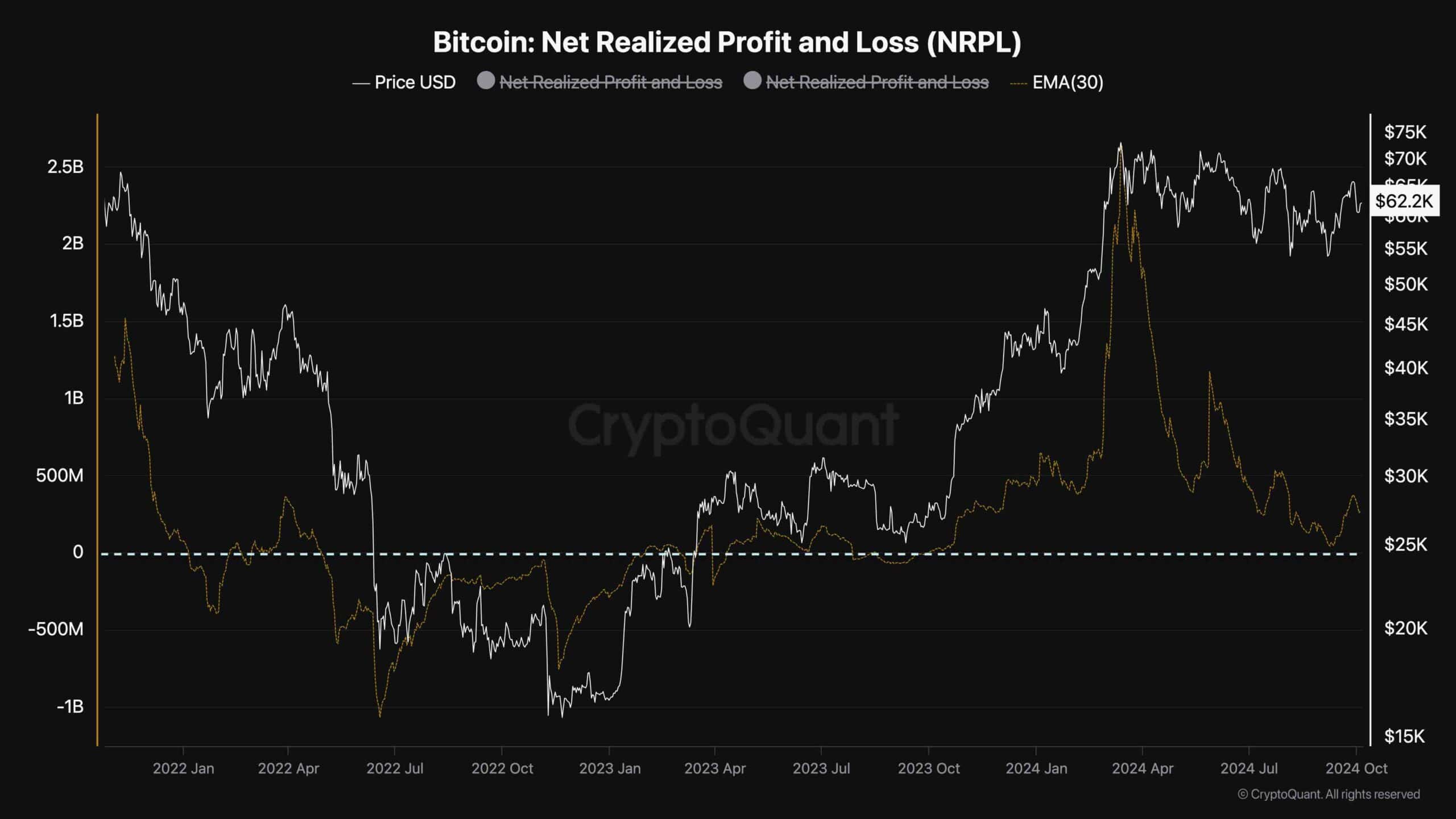

In simpler terms, over the past six months, the price of Bitcoin has remained relatively stable, leading investors to question if we’ve reached a peak or if higher prices are on the horizon. At such times, examining the Bitcoin Net Realized Profit and Loss (NPRL) metric could provide valuable insights.

The metric measures the net profits or losses investors realize. Positive values are associated with net profits, and negative values show net losses.

It’s clear that so far, the market hasn’t shown a major decline, instead moving within a limited range. Interestingly, the Net Realized Profit/Loss (NRPL) has dropped to levels last seen when the price was approximately $30K, at a time when the bull market was just getting started.

Given no significant changes in other factors, it seems plausible that Bitcoin could potentially initiate a new upward trend within the next few months.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- DCB PREDICTION. DCB cryptocurrency

- LAZIO PREDICTION. LAZIO cryptocurrency

- EUR INR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

2024-10-06 09:14