What to know:

As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless trends come and go. However, the rapid growth and potential of the cryptocurrency market, particularly Bitcoin (BTC) and Ethereum (ETH), has captured my attention like no other emerging asset class in recent years.

It’s likely that investment advisors will surpass hedge funds in holding the largest shares of US-listed Bitcoin (BTC) ETFs by next year, according to CF Benchmarks.

Eleven exchange-traded funds (ETFs) focused on Bitcoin (BTC) made their debut in the United States on January 11, offering a method for investors to acquire exposure to cryptocurrency without needing to manage and safeguard it personally. Since they were first introduced, these ETFs have amassed more than $36 billion from investors.

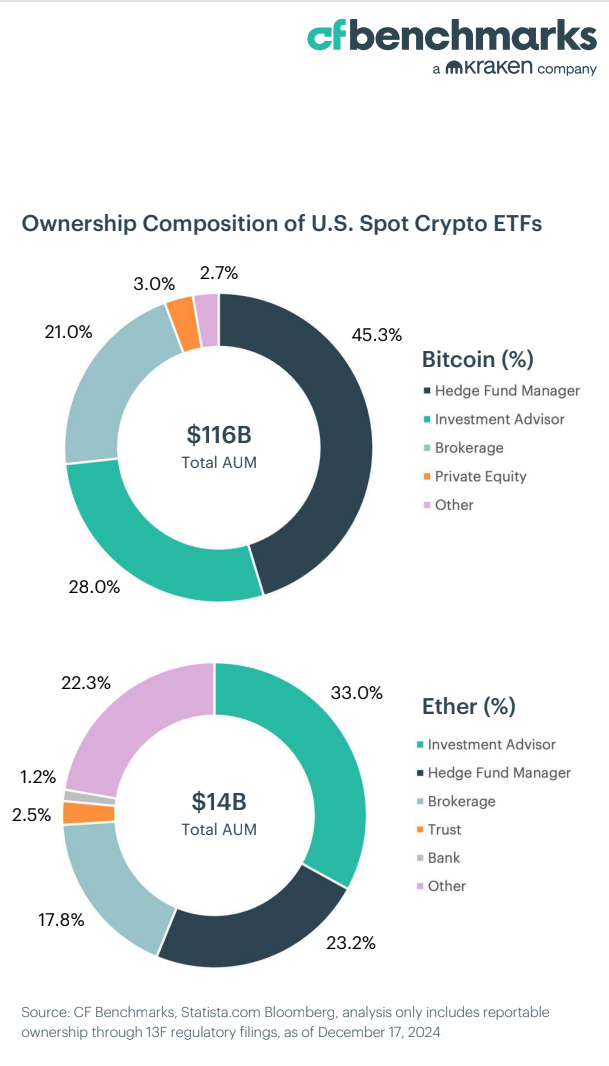

The majority ownership of ETFs (Exchange Traded Funds) is predominantly held by hedge fund managers, accounting for approximately 45.3%, with investment advisers, acting as intermediaries to retail and high-net-worth investors, holding a significantly smaller portion at around 28%.

2025 might bring a shift, as per CF Benchmarks’ predictions, with investment advisers expected to hold more than half of the market share in both Bitcoin (BTC) and Ethereum (ETH) ETF sectors. Notably, CF Benchmarks is a U.K.-regulated index provider that manages several significant digital asset benchmarks like the BRRNY, which are often used by various ETFs.

In their yearly report, CF Benchmarks predicted that the allocation of investment advisors for these specific assets could surpass 50% each, given that the $88 trillion U.S. wealth management sector is increasingly adopting these financial vehicles. By 2024, it’s anticipated that this adoption will exceed the previous record-breaking $40 billion in net inflows combined.

According to the index provider, this evolution in our offerings is primarily influenced by an increase in client requests, improved grasp of digital assets, and the maturity of our products. This shift is expected to significantly alter the existing portfolio composition as these items become regular inclusions in investment models.

Investment advisors currently hold a dominant role in the Ether Exchange-Traded Fund (ETF) market, and it’s expected they will widen this advantage even more in the upcoming year.

The underlying blockchain of Ether, Ethereum, may profit as asset tokenization gains traction, whereas Solana might further increase its market presence if there’s clearer regulatory guidance in the United States.

2025 is projected to see an increased pace in the movement toward asset tokenization, reaching over $30 billion in tokenized Real World Assets (RWAs), according to the report.

Newcomers such as Ripple‘s RLUSD and Paxos’ USDG are anticipated to contest Tether’s USDT, which currently holds a significant market share that has grown from 50% to 70%.

Under President-elect Donald Trump’s administration, there could be a surge in blockchain usage as regulations become clearer. This might necessitate an increase in the transaction processing speed of blockchains, potentially doubling their current capacity to handle over 1600 transactions per second (TPS).

In summary, it’s worth noting that the Federal Reserve appears to be adopting a more accommodating stance, resorting to unusual tactics such as controlling yields or increasing asset acquisitions, in order to tackle the challenging combination of rising debt repayment costs and a sluggish job market.

As an analyst, I suggest a revised interpretation of this statement could be: “Increased monetization of debt may lead me to anticipate higher inflation rates. Consequently, I believe hard assets such as Bitcoin become more attractive as safeguards against currency devaluation due to monetary dilution.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-23 17:49