As a researcher with extensive experience in the crypto market, I find Andrew Kang’s analysis on Ethereum ETFs insightful but cautiously bearish. While Bitcoin ETFs brought new buyers to the table, the impact of Ethereum ETFs is less clear-cut due to several factors.

The response and public perception towards Ethereum spot ETFs have been relatively subdued compared to the excitement surrounding Bitcoin ETFs when they were introduced earlier this year.

Andrei Kang, a crypto entrepreneur and investor, shared his insights in a detailed analysis published on June 23rd about how Ethereum ETFs (Exchange Traded Funds) might influence the X factor.

Bitcooin Exchange-Traded Funds (ETFs) have made it simpler for numerous new investors to include Bitcoin in their investment portfolios. Nevertheless, the influence of Ethereum ETFs is not as straightforward.

ETH Price Could Tank

Based on his calculations, Kang anticipates that investments in Ethereum ETFs will account for between 10% and 15% of the total inflows into Bitcoin ETFs. This equates to approximately $500 million to $1.5 billion in actual purchasing power over the course of six months.

Last week, it became known that Fidelity planned to invest $4.7 million into its Ethereum Exchange-Traded Fund (ETF) to initiate purchases. In March, Standard Chartered forecasted that the Ethereum ETF would attract inflows worth $45 billion within the first year of trading.

Despite Kang’s assertion, he put forth multiple explanations as to why the influence of an Ethereum ETF might be less substantial compared to a Bitcoin ETF.

Ethereum is generally considered a technological asset compared to Bitcoin, which is often viewed as a macro asset. Furthermore, there’s less institutional demand for Ethereum due to its current evaluation metrics being more complex and challenging to justify for conventional finance investors.

Those heavily involved in the world of cryptocurrencies naturally hold significant mental space and faith in Ethereum. However, among non-crypto native investors, Ethereum holds far less importance as a significant allocation in their portfolios.

— Andrew Kang (@Rewkang) June 23, 2024

Additionally, Ethereum’s situation prior to any ETF (Exchange Traded Fund) debuts differs from Bitcoin’s. Ethereum has already experienced a 4x increase from its lows, while Bitcoin saw a 2.75x rise before its ETFs were launched.

Based on his analysis, Kang anticipates that ETH‘s price will fluctuate between $3,000 and $3,800 prior to the ETF debut. However, following the launch, there is a possibility of a downward trend, with prices potentially dipping to the range of $2,400 and $3,000. A drop to this lower estimate would result in a 30% decrease from the current value of the asset.

If Bitcoin reaches $100,000 by the end of this year or in the early part of next, I believe Ethereum and other altcoins will likely follow suit and experience significant price increases as well.

Kang maintains a pessimistic view on Ethereum relative to Bitcoin. He predicts that the ETH/BTC ratio will continue to decline over the coming year, with a projected range of around 0.035 to 0.06.

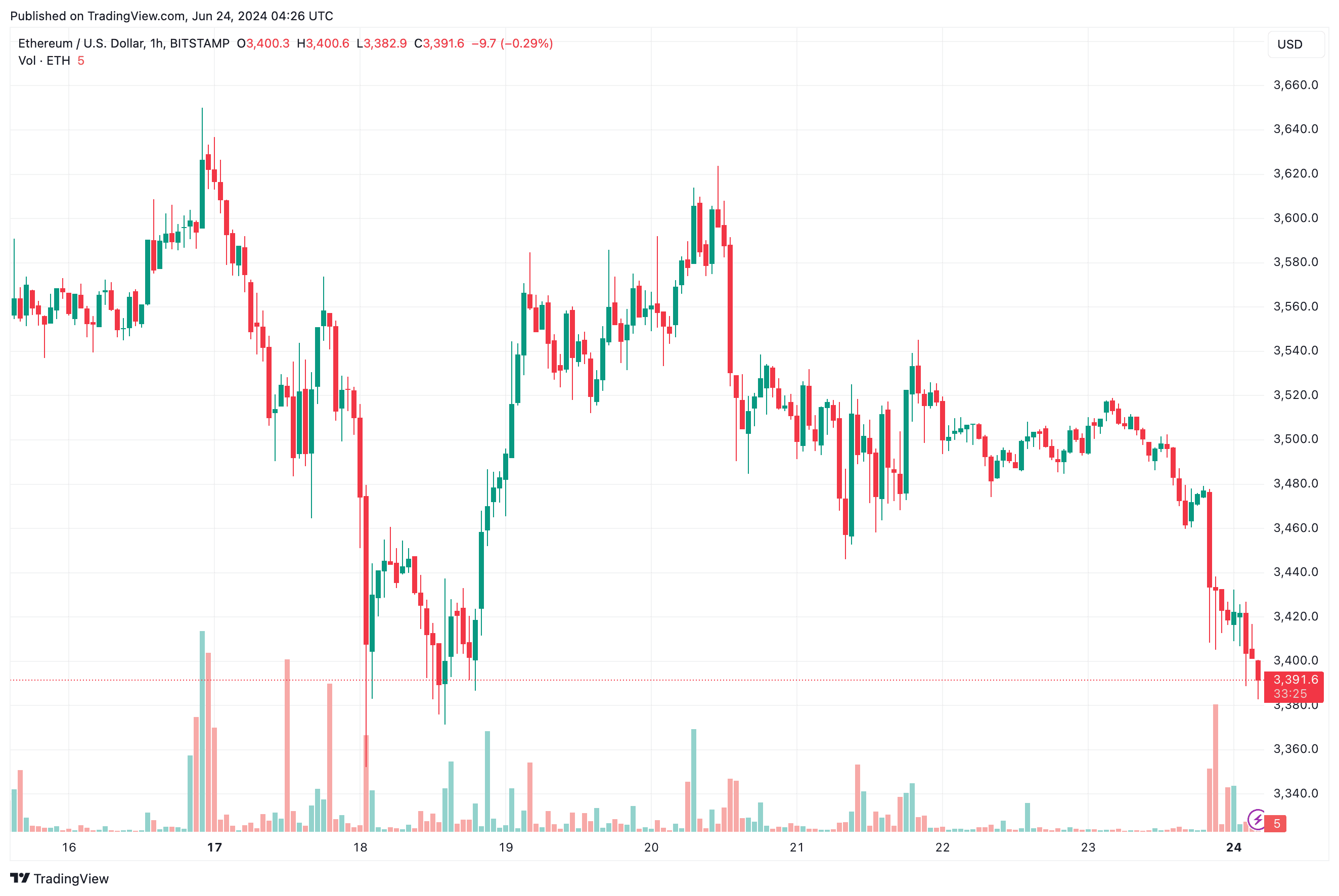

ETH Prices Dip Below $3,400

In the last 24 hours, ETH‘s price dropped just like the entire cryptocurrency market, which is currently shrouded in doubt.

Currently, Ethereum is being bought and sold for a price under $3,400. There’s been a decrease of 3.4% in its value today, and it has dropped by 5.3% over the past week.

As a researcher studying the cryptocurrency market, I’ve observed that other significant players in the market, such as Bitcoin, have experienced a decline as well. Specifically, Bitcoin dipped below $63K, resulting in a 2.5% loss over the past day. Similarly, Binance Coin (BNB) and Solana suffered losses of 3% and 6.2%, respectively.

Not All Bearish On Ethereum

Large asset managers like BlackRock were the sole optimistic forecasters, proposing the use of Ethereum for tokenizing real-world assets. However, it’s unclear how significant this development would be for Ethereum’s value and when exactly it might occur.

Last week, I learned from ConsenSys that the US Securities and Exchange Commission (SEC) was wrapping up its investigation into the Ethereum Foundation.

As a market analyst, I would interpret this statement as follows: My assessment is that Ethereum’s (ETH) upcoming developments could strengthen its classification as a commodity within the regulatory framework, rather than being considered a security. This shift in status carries significant positive implications for ETH and potentially other altcoins, as it may lead to increased demand and market acceptance.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- PLASTIK PREDICTION. PLASTIK cryptocurrency

- CSIX PREDICTION. CSIX cryptocurrency

- GAMMA PREDICTION. GAMMA cryptocurrency

- MCB PREDICTION. MCB cryptocurrency

- ALD PREDICTION. ALD cryptocurrency

2024-06-24 07:53