As a seasoned crypto investor with a few battle scars to show for it, I must admit this week has been a rollercoaster ride. The volatility we’ve witnessed is reminiscent of a wild bull run in the Wild West, where the ground beneath your feet is never quite stable.

It was a crazy week in the cryptocurrency industry, filled with a lot of volatility, a resurgance that the entire community was debating about, as well as the story of the underdog coming back at it. Let’s dive in.

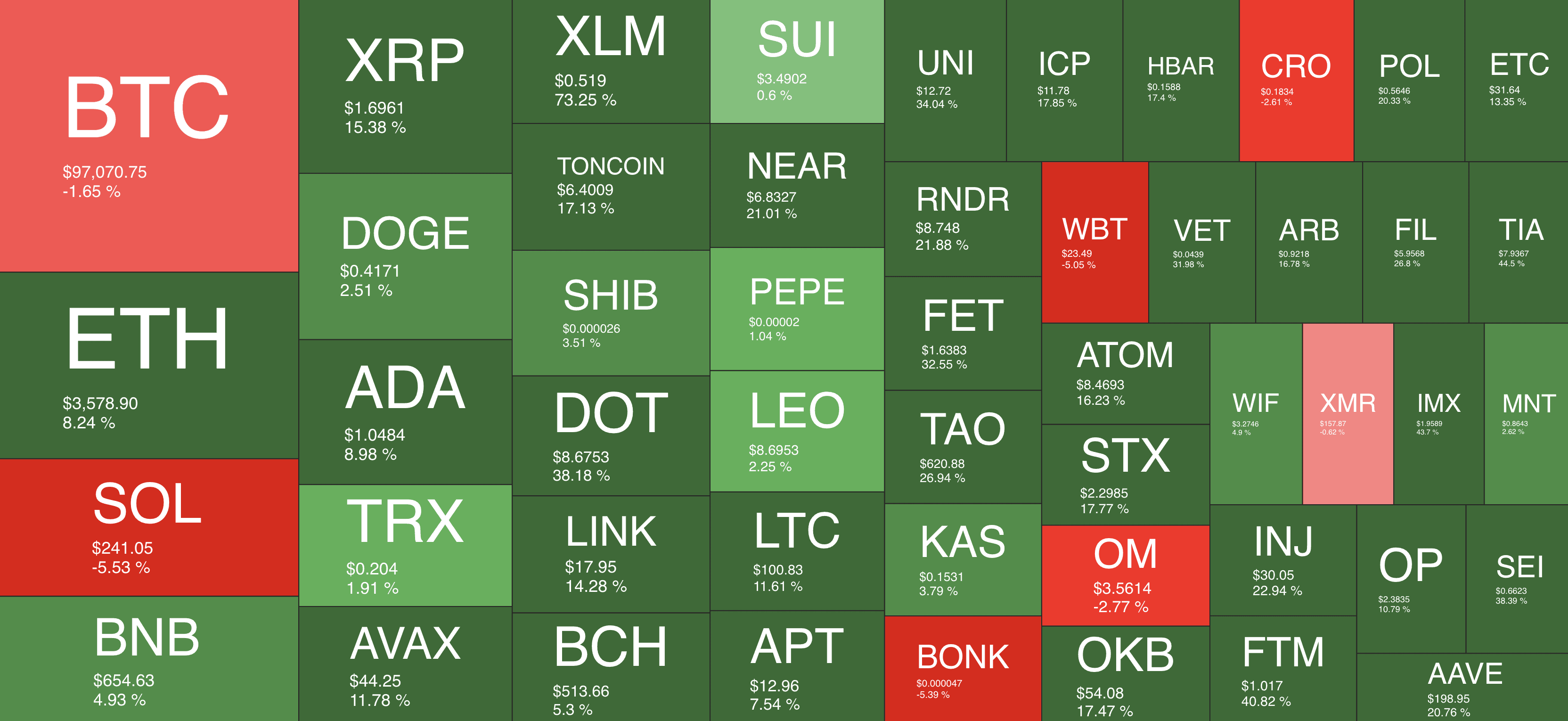

Initially, we have Bitcoin. Over the weekend, its value spiked multiple times trying to surpass $100,000, but it failed due to an overly massive resistance from sellers. Consequently, this led to a price drop, with the value dipping close to $90,000 throughout the week. However, things took an unexpected turn. The atmosphere became quite contrasting compared to less than a week ago when BTC exceeded $90,000 for the first time.

Despite initially lingering at those low prices, the bulls swiftly regrouped and began driving upwards. Currently, Bitcoin is being traded at approximately $97,000, with some analysts predicting that it could surge past the $100,000 mark in the near future.

Let’s discuss Ethereum‘s recent progress over the last seven days. Despite some jokes in the community about its slower pace during this bull market, it has managed to outpace many others. In fact, this week alone, it has climbed by more than 8%. Now, it seems to be aiming for its next milestone at $3,700.

Among all, Ripple‘s XRP emerged as the top performer over the last seven days. It has been performing exceptionally well throughout the past month and has even surpassed BNB to take the 5th position in terms of total market capitalization, although it currently holds this position with a narrow lead.

The coming weeks should reveal some intriguing developments, yet it seems that the market continues to simmer with intense activity.

Market Data

Market Cap: $3.53T | 24H Vol: $212B | BTC Dominance: 54.5%

BTC: $97,240 (-1.7%) | ETH: $3,582 ( +8.1% ) | XRP: $1.70 (+14.5%)

This Week’s Crypto Headlines You Can’t Miss

I’ve just learned that MicroStrategy has outdone itself yet again! They’ve purchased another 55,500 Bitcoins, setting their total holdings at an impressive 386,700 BTC, valued at a staggering $37.6 billion. That means they’ve amassed nearly $15 billion in paper profit on this investment so far.

In its latest move, MARA (formerly Marathon Digital) has amplified its Bitcoin reserves to an impressive $3.3 billion by acquiring 6,474 BTC, bringing their total holdings to 34,797 BTC. This expansion was made possible through a $1 billion convertible note offering in November. The mining company is now planning to issue another $700 million in convertible notes for more Bitcoin purchases and corporate endeavors, following MicroStrategy’s lead in utilizing debt to buy Bitcoin.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Original Two Warcraft Games Are Getting Delisted From This Store Following Remasters’ Release

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- Starseed Asnia Trigger Tier List & Reroll Guide

- FFXIV lead devs reveal secrets of Endwalker’s most iconic quest, explain favorite jobs, more

- Harvey Weinstein Transferred to Hospital After ‘Alarming’ Blood Test

2024-11-29 20:36