As a researcher with a background in financial markets and experience in analyzing crypto derivatives, I find the upcoming Bitcoin and Ethereum options expiry on May 31 to be an intriguing event. The significant difference in open interest between the two assets suggests distinct market sentiments.

The cryptocurrency market has experienced a minor downturn this week due to decreasing optimism following the SEC’s approval of Ethereum ETFs in the United States last week.

Despite this, the unpredictability of Bitcoin‘s price may surge when approximately $4.7 billion worth of Bitcoin options contracts are due to expire on May 31.

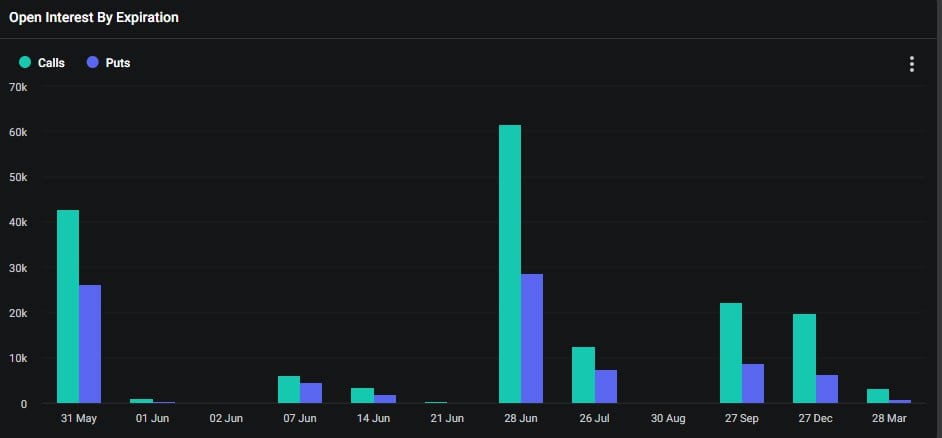

According to Deribit, the significance of the approaching 69,200 contract expiration surpasses last week’s occurrences due to typical monthly end derivative market activity being substantial.

Bitcoin Options Expiry

As an options analyst, I’d interpret the put/call ratio of 0.61 for this specific Bitcoin options tranche as indicating a higher volume of open long call positions compared to short put positions. In simpler terms, more traders are betting on Bitcoin’s price rising (long calls) rather than expecting it to fall (short puts).

As a researcher examining the options market, I’ve observed significant open interest with unexpired contracts. Specifically, at strike prices of $70,000, $75,000, $80,000, and even $100,000, there is a substantial outstanding balance of $886 million.

With a relatively low threshold of $60,000, this option boasts the largest open interest (OI) of approximately $519 million. This observation implies that Bitcoin derivatives market participants maintain optimistic outlooks, anticipating potential price hikes.

The total OI notional value for all outstanding BTC options contracts is a whopping $19 billion.

Today, approximately $3.7 billion worth of Ethereum options contracts are set to expire, in addition to the large volume of Bitcoin options. With a notional value of around 910,000 contracts, the put and call ratios stand at 0.84. The distribution between long and short sellers for these Ethereum contracts is more balanced than it is for Bitcoin contracts.

Furthermore, the combined open interest for Ethereum futures contracts has remained close to record highs of approximately $17 billion over the past few days, fueled by anticipation regarding the potential approval of a spot Ethereum exchange-traded fund (ETF).

Crypto Martket Outlook

In contrast to most spot market occurrences, today’s options expiry event is a significant exception. The total market capitalization has remained stable at approximately $2.68 trillion during this day. Over the previous 12 days or so, crypto markets have exhibited minimal price fluctuations.

Bitcoin experienced a 1.2% increase and was currently priced at $68,489, while Ethereum saw a slight decrease and was trading at $3,751 as of the present moment.

Most altcoins continued to lose value, deepening their recent losses, while meme coins experienced more pronounced setbacks.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-31 09:10