Users can temporarily keep their cryptocurrency tokens secured in a process called staking, earning rewards typically as interest.

In contrast to blockchains that rely on the Proof of Work (PoW) consensus mechanism, such as Bitcoin, Polkadot employs the Nominated Proof of Stake (NPoS) algorithm instead.

NPoS in Polkadot involves complexities related to the compatibility of parachains, which are linked and safeguarded by the primary network, referred to as the Relay Chain. Among its numerous advantages, NPoS facilitates the staking function.

This guide offers a detailed exploration of the inner workings of Polkadot staking, encompassing various types of DOT staking, their respective benefits and drawbacks, potential hazards, and a simplified procedure for getting started with Polkadot staking right away.

If you want to find more in-depth information, you can also check out our Polkadot guide.

Quick Navigation:

- Understanding Polkadot staking

How to stake Polkadot

Requirements for staking DOT

Polkadot staking rewards and payouts

Risks and considerations

Frequently Asked Questions (FAQ)

Understanding Polkadot Staking

Staking in Polkadot may seem straightforward, but there are technical aspects, particularly when dealing with native DOT staking, which require a solid understanding of underlying principles. Therefore, acquiring a good grasp of these fundamentals is crucial for seamless navigation through staking systems.

It’s important that you have a solid grasp of the basics before we delve into the options for staking Polkadot according to your individual preference and comprehension level.

How does Polkadot staking work?

DOT staking is made possible through the network’s consensus algorithm – Nominated Proof of Stake.

At its core, this protocol depends on validators to confirm transactions and maintain network security. Validators are chosen by nominators, and they are compensated, along with the nominators, with DOT tokens as remuneration for their contributions.

That said, regular users can stake their DOT in multiple ways, which include:

- Native Staking

- Third-Party Decentralized Protocols

- Centralized Exchanges

Each of these has several intricacies, and we will break down each in depth in the guide.

Benefits of staking Polkadot (DOT)

Staking Polkadot (DOT) brings about advantages on two fronts – the economic and the protocol level.

- DOT holders can earn passive rewards for supporting validators. The reward will be dependent on the validators of choice, as well as how much DOT is staked in the system.

The barrier to entry can be very low, depending on the choice of staking.

Native Polkadot (DOT) staking is transparent and non-custodial.

A lot of major centralized exchanges support DOT staking – users have a plethora of options.

Additionally, keep in mind that staking Polkadot involves some risks and factors to take into account. Be sure to continue reading for more information on these aspects.

How to Stake Polkadot

Above, I noted that users have three options for deploying their DOT tokens based on their individual choices. Let’s delve into each one in detail.

Native DOT Staking

Staking DOT directly on the Polkadot network implies keeping your DOT tokens there for securing the network, without requiring third-party protocols or exchanges. The entire process takes place within the Polkadot ecosystem.

In this situation, you’re presented with an option based on the number of tokens you currently have, the amount you plan to wager, and your degree of technical proficiency.

To use Polkadot, you’ll require a digital wallet that is compatible with the Polkadot network. Here’s an authoritative guide containing suggested options for you to consider.

Joining a Nomination Pool

This is appropriate for beginners.

As a DOT holder, you won’t need to personally manage your nomination. Instead, you’ll be part of a larger group overseen by an operator. The key point is that this operator will handle the nomination process on behalf of all pool members. In other words, you’re not required to take any action beyond joining the pool, but keep in mind that the choice ultimately rests with the pool operator.

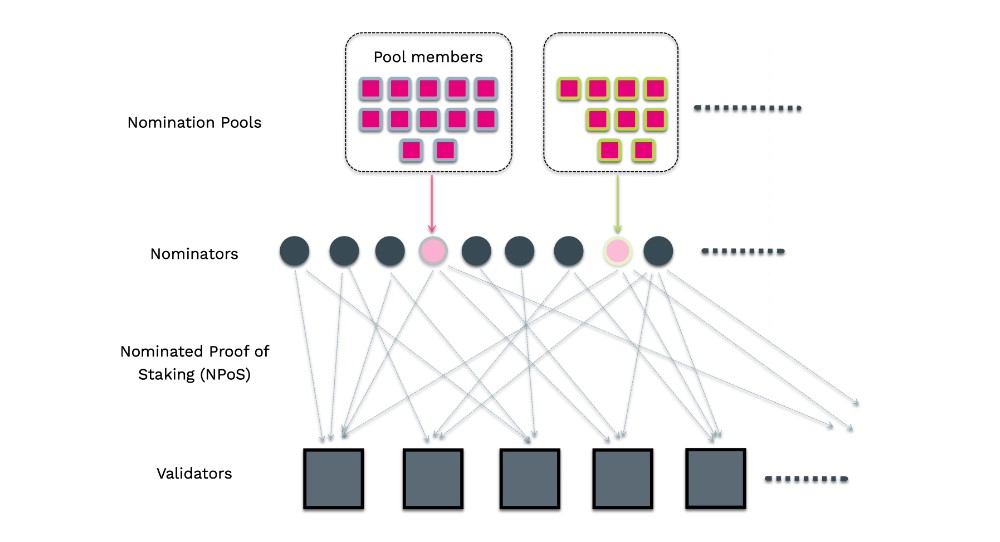

This is a visual representation of the process flow:

With just one dot, you’re eligible to join the nomination pool. You have the option of claiming your rewards individually or letting them accumulate by keeping them in the pool. The waiting period for unbonding is 28 days.

To join a pool, follow the steps:

- Navigate to the Polkadot (DOT) staking dashboard.

In the top left corner, you will see the “Pools” tab. Click on it.

After that, you will see which nomination pools are available.

Find the one that you want to join and click on “Join.”

You will now be able to enter the amount you want to bond.

Sign the extrinsic.

Opening a Nomination Pool

This is suited for intermediate users.

Operators of nomination pools have the power to choose validators. So if you trust your judgment in picking reliable validators, start your own nomination pool and invite others to contribute their DOT for a collective pool.

At the time I’m penning this down, it takes a minimum of 500 DOT to deposit for creating a nomination pool. This amount gets held in the pool’s account.

To open a nomination pool, follow the steps:

- Navigate to the Polkadot (DOT) staking dashboard.

In the top left corner, you will see the “Pools” tab. Click on it.

Find the “Create” button and click on it.

Give your pool a name and continue.

Choose up to 16 nominations. There is a built-in feature that allows you to choose certain validators automatically based on preset criteria.

You can now edit roles such as Root, Nominator, and Bouncer.

Choose the amount for the initial deposit. It has to be at least 500 DOT.

Review all of the above, and if everything is correct, confirm it with the “Create pool” button.

Nominating Directly

This option is also suitable for intermediate users.

Choosing validators directly through the nomination process sets you apart from just bonding tokens. This is an engaged role, not just a passive one. By taking part in this active task, you’re not only contributing to the ecosystem but also keeping a close eye on the validator your staked tokens support.

Normally, you need at least 250 DOT to propose a project, but this requirement can change. As of April 2024, it’s 550.29 DOT that is needed for nomination.

Intermediate users will find this process more appropriate for them; they can discover more about nomination procedures here.

That said, some of the key features include:

- You can send rewards to any account or compound them.

- The unbonding period is 28 days, but you can switch validators without unbonding.

- Bonded funds remain in your account and you can participate in governance with them.

- You manage the list of validators (up to 16) directly.

Running a Validator

This option is suitable for advanced users.

Verifying transactions and ensuring the integrity of the network is a role for individuals with adequate technical skills, who are eager to contribute hands-on to the security and block creation process.

First and foremost, you have to be selected by nominators.

next, it is essential to meet several key requirements outlined in the following text. Keep in mind that operating your own validator node entails a significant investment of time and energy, along with earning the confidence of the community.

Third-Party Decentralized Protocols

An alternate expression for this could be: Polkadot’s liquid staking allows you to earn a representative token in return, which functions similarly to DOT within specific ecosystems and enables various tasks.

Here are some of the key features of third-party staking:

- Generally able to stake any mount for a certain fee

- Unbonding is very flexibly

- You can tap into liquid markets through a third-party synthetic token

- Various protocols offer various benefits

However, it also comes with some additional risks.

- You would have to make some trust assumptions. Albeit medium, you’re still trusting a third-party to perform and remain operational.

- It may have an impact on network decentralization.

- Requires additional research.

Some of the more popular options for DOT liquid staking include Ankr, Acala, and others.

Centralized Exchanges

Some cryptocurrency platforms enable users to deposit their DOT coins for staking on their site. This is typically considered the most trusted choice since these exchanges have the ability to restrict or ban certain addresses or wallets at their discretion.

Among the choices presented are prominent American exchanges such as Coinbase and Kraken, along with the globally recognized leader in cryptocurrency trading, Binance.

Requirements for Staking DOT

Above, I noted that the prerequisites for staking DOT vary depending on the chosen system. To clarify, let’s examine these conditions in detail:

For Native DOT Staking:

- 1 DOT to join a nomination pool

500 DOT to create a nomination pool

550 DOT to nominate directly

When it comes to staking through a third-party app or a centralized exchange, the necessary conditions can differ depending on which option you select.

H2 Polkadot Staking Rewards and Payouts

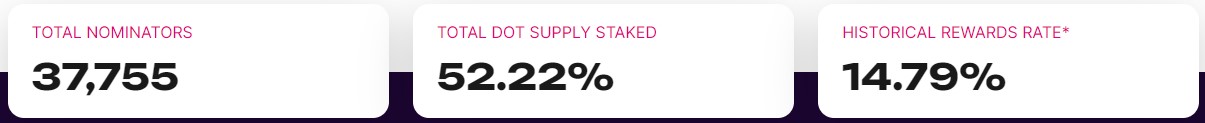

Rewards for staking can fluctuate based on the specific platform you use, and the methods used to determine these rewards may also differ.

H3-4 How are rewards calculated

For native DOT staking:

- The rewards are calculated every single era. This happens once every six hours on Kusama and once every 24 hours on Polkadot (approximation).

- The rewards are also calculated based on era points. These have a probabilistic component.

For third-party DOT staking:

- Rewards are determined by the third-party staking provider

For DOT staking on centralized exchanges:

- Rewards are determined and calculated by the exchange of choice.

Risks and Considerations

Just like other endeavors, DOT staking involves risks and factors to take into account. The particular risks depend on the chosen staking method, so let’s examine the risks for each of the three options: [Method 1], [Method 2], and [Method 3].

Risks associated with staking (slashing and potential penalties)

Risks associated with native DOT staking

To begin with, there’s a risk associated with native staking at the protocol level in Polkadot. Although Polkadot is known for its robust security history, like all blockchain networks, it carries a small but real possibility of experiencing failures.

Second and more importantly, there’s the risk of slashing.

In Polkadot and Kusama, the term “slashing” refers to a method used to discourage harmful actions and impose penalties on validators who go against the network’s rules and the expectations of their supporters (nominators).

Malicious validators face the consequence of losing a part of their pledged tokens. As a result, those taking part in a nomination pool or individually nominating validators should be aware that the validator they’ve selected could potentially incur a penalty.

Risks associated with third-party DOT staking

Using a third-party decentralized protocol for staking DOT instead of the native option involves assuming more risk at the protocol level.

The level of risk differs depending on the selected platform, yet generally speaking, the greater the annual percentage yield (APY), the more risk you assume.

Risks associated with DOT staking through centralized exchanges

Previously discussed, the level of trust is greatest when depositing DOT on a centralized exchange due to the entity being a reputable company in charge.

The company holds complete power to manage the platform’s activities, allowing it to temporarily suspend or restrict access to your account whenever desired.

Unbonding period and market volatility

If you choose to pledge or take part in a nomination pool, it will take 28 days for your tokens to be unrestricted again. This lengthy waiting period can be challenging, particularly during volatile market situations.

For individuals with a long-term perspective on their cryptocurrency investments and no plans to sell during an initial market downturn, Polkadot staking is typically advised.

Frequently Asked Questions

How to unstake DOT?

You can unstake DOT directly from the Polkadot staking dashboard and trigger the unbonding period. If you are using a third-party decentralized protocol, you can unstake it through its interface. If you’re using a centralized exchange, you can unstake DOT directly on the platform. Make sure you’re not breaking the staking terms because you might forfeit the staking rewards.

Can you stake dot on Coinbase?

Certainly!

Can I stake Polkadot in the USA?

Certainly!

Is there a Polkadot stake calculator?

Several outside platforms offer estimated staking rewards for Polkadot. However, it’s recommended to check the Polkadot staking dashboard for accurate and official information.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Aphrodite Fanart: Hades’ Most Beautiful Muse Unveiled

- KEN/USD

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

- Valorant Survey Insights: What Players Really Think

- Why has the smartschoolboy9 Reddit been banned?

2024-04-23 16:20