Over the last several days, Bitcoin and the wider cryptocurrency sphere have gone through significant drops. Bitcoin dipped below $60,000 before bouncing back only to plummet once more, while the majority of alternative coins mimicked this trend.

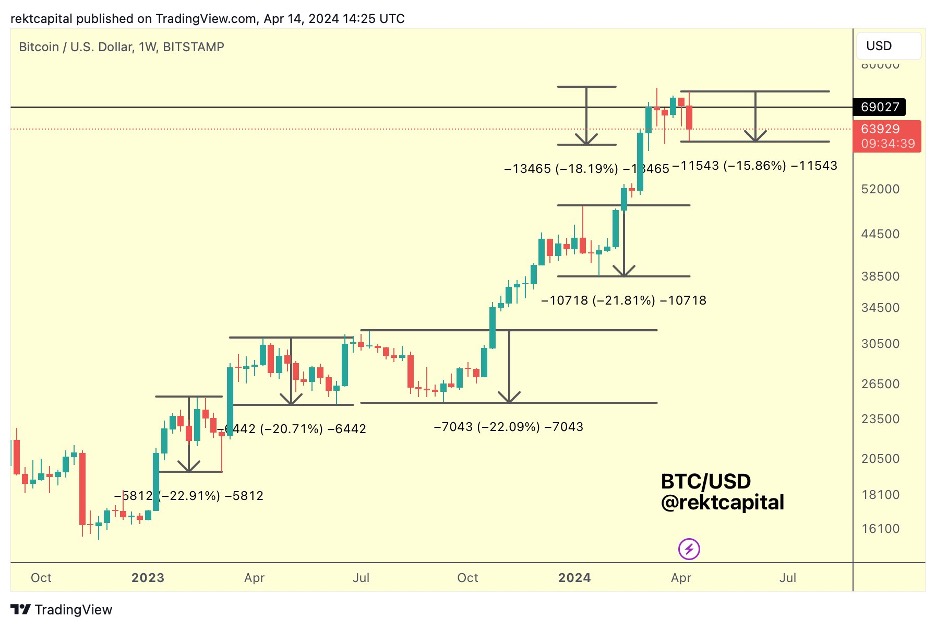

Famous cryptocurrency trader Rekt Capital pointed out that Bitcoin’s price behavior has shown consistent patterns of decline since the end of the 2022 bear market. On specific occasions, these declines amounted to approximately 20%, while once there was a retreat of nearly 18%.

The recent drop in Bitcoin’s value, estimated to be around 16%, is nearly as deep as the 18% decline experienced back in March. Following each downturn, Bitcoin experienced notable price increases.

- Source: X

In relation to this, crypto investor Trader Tardigrade expresses the view that Bitcoin’s current price movements are typical for its 2024 cycle. Previously, there have been multiple instances where Bitcoin’s price experienced significant drops, only to be followed by a subsequent price rise.

BTC Still On Track for 2024 Cycle Top

Currently, well-known Bitcoin expert CryptoCon expressed a positive outlook on Bitcoin’s current difficulty trying to surpass resistance from record highs. He believes that even though some metrics are showing signs of overheating, Bitcoin’s trajectory aligns with the anticipated cycle top by the end of 2024.

In the years 2017 and 2020, just prior to all-time highs (ATHs), MVRV encountered challenges around this particular juncture. Our analysis indicates that a market peak, which we currently anticipate in December 2024, may have been brought forward by approximately one year.

#Bitcoin continues to face resistance at ATHs, but according to the MVRV-Z, that’s normal!

In 2017 and 2020 leading up to ATHs MVRV faced some difficulty at this exact point.

The alignment of our current situation suggests an earlier-than-expected peak in the market cycle, potentially occurring as early as December 2024.

— CryptoCon (@CryptoCon_) April 13, 2024

According to experts and market watchers, it’s common for Bitcoin’s price to experience declines before a halving event based on historical data. Therefore, the current dips in price should not come as a surprise.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-04-17 13:18