As a seasoned crypto investor with a few years of experience under my belt, I’ve learned to keep an eye on market indicators and trends when making investment decisions. The recent dip in Bitcoin’s value to $61,500 due to Coinbase’s operational issues is disheartening, but it doesn’t change my long-term bullish outlook for the asset.

TL;DR

- Bitcoin’s value fell to $61,500 due to issues at Coinbase but analysts predict a rally above $70,000 soon.

- Positive market indicators and exchange trends suggest reduced selling pressure, hinting at a potential price increase for the asset.

Is it Time for a New BTC Rally?

Although Bitcoin’s price reached over $63,000 on May 13, it has since dropped back down to around $61,500 on May 14. One possible explanation for this decline could be the operational difficulties experienced by Coinbase.

According to CryptoPotato’s report, there was an unexpected “technical issue” at the US-based cryptocurrency exchange that left many users unable to execute transactions or make withdrawals. The problem has been resolved a few hours ago, but Bitcoin continues to trade below $62K.

Many experts predict that the price of Bitcoin (BTC) could reach $70,000 or more in the near future, according to several analysts. Captain Faibik, a user on the X platform, has set a midterm goal of $78,000 and plans to allocate 25% of his portfolio to purchasing Bitcoin when it reaches that level.

Crypto Rover identified an “inverse head and shoulders formation” on Bitcoin’s price graph, implying a potential increase towards $72,000.

Rekt Capital and Titan of Crypto expressed optimistic views as well. The former believed that the asset has surpassed the “caution period” following the halving and is now preparing for a substantial price increase. A reminder that the halving, which decreased miners’ rewards from 6.25 BTC to 3.125 BTC, occurred last month.

A prominent figure in the cryptocurrency sphere, Titan of Crypto, posited that Bitcoin’s bull market is far from over. According to his analysis, the Risk-Adjusted Return Oscillator (RAR) indicator has moved into “overbought territory,” suggesting a potential eight-month prolongation before the asset attains its cycle top.

The Resurgence Signals

One significant sign that Bitcoin’s value could rise in the coming days is the Market Value to Realized Value (MVRV) ratio, which has seen a notable decline over the past few weeks.

As a researcher studying market trends, I’ve found that a Moving Average Ratio (MVR) score above 3.5 indicates that the price may be approaching its peak, while a result below 1 could suggest a potential bottom. In early May, for instance, the MVR dipped under 2, triggering a buy signal for the leading digital asset based on this analysis.

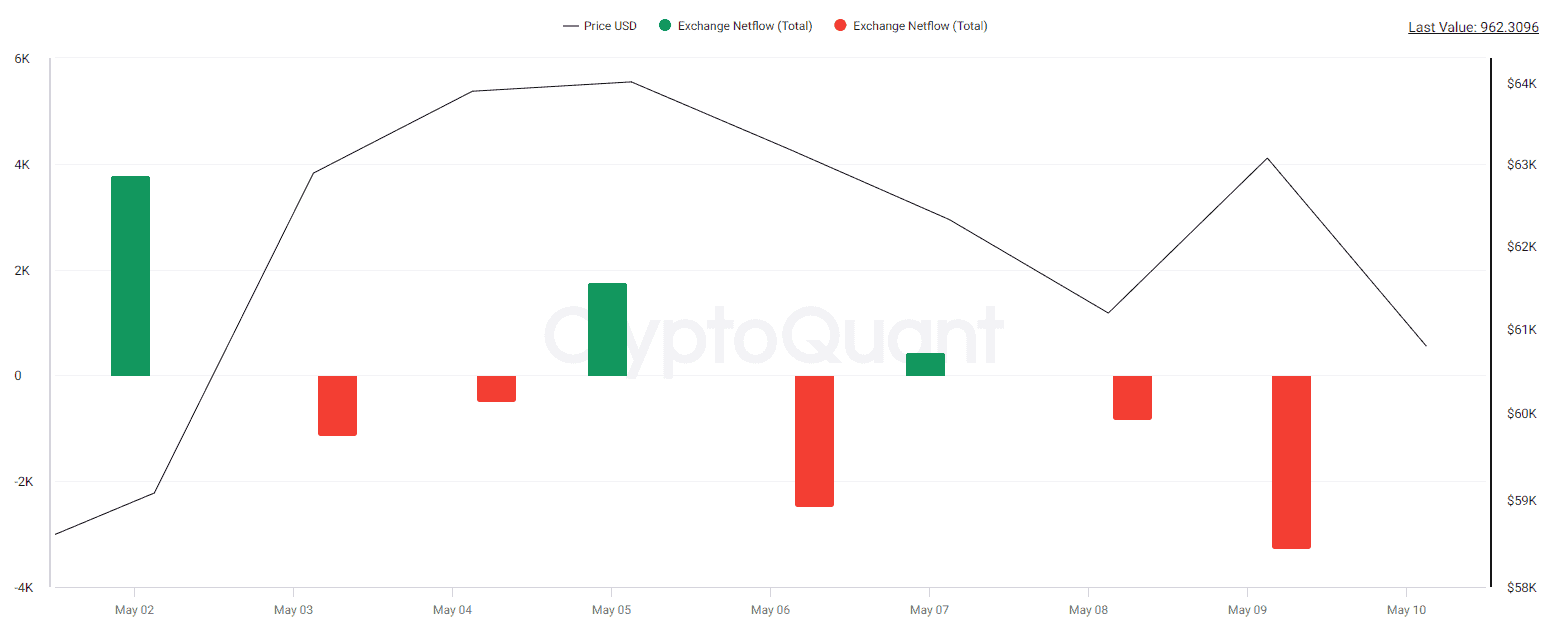

The flow of Bitcoin (BTC) between exchanges is another important factor to consider. In the past week, there have been more outflows than inflows, indicating that investors are moving their coins from centralized platforms to self-custody methods. This trend is seen as positive because it decreases the amount of BTC available for immediate sale, which can be bullish for the price.

Read More

- ACT PREDICTION. ACT cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- W PREDICTION. W cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Why has the smartschoolboy9 Reddit been banned?

- Understanding Shinjiro: The Persona 3 Character Debate

- Unlocking Destiny 2: The Hidden Potential of Grand Overture and The Queenbreaker

- AAVE PREDICTION. AAVE cryptocurrency

- KEN/USD

2024-05-14 15:51