As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I can confidently say that the current market situation presents both challenges and opportunities.

For about a month now, Bitcoin has been on a downward trend, whereas the Nasdaq and S&P 500 have been experiencing growth. Is there a possibility that the ‘bullish’ sentiment will return once the financial markets increase their liquidity in the overnight sessions?

Over the last 30 days, which ended on September 13th, Bitcoin has experienced a decrease of approximately 6%. Conversely, the Nasdaq Composite has seen an increase of 3.7%, and the S&P 500 Index has risen by around 4% during the same period.

So what gives with Bitcoin?

Are major financial institutions on Wall Street potentially driving down cryptocurrency prices by selling off Bitcoin ETF shares and instead investing in tech companies such as NVIDIA (NVDA), Taiwan Semiconductor Manufacturing Company (TSMC), and ASML, thereby focusing solely on semiconductors while leaving the rest to Reddit users to decipher?

Are Bitcoin miners selling to keep up with rising industrial electricity costs since April?

Goldman Sachs Economist: 25 – 50 Basis Pt Cut

Jan Hatzius, Goldman Sachs’ chief economist, suggested on Monday that it’s possible we might see a cut of 50 basis points, but he believes a reduction of 25 basis points is more probable. He explained that the current Fed Funds rate of 5.5% is exceptionally high compared to other G10 countries.

Hatzius added the US has seen more progress on inflation than most of the G10.

Will Bitcoin’s Price Go Up When The Fed Cuts Rates?

Previous outcomes may not predict future success, yet history often repeats itself and victors frequently triumph once more. The key interest rate in the U.S., serving as a significant macrocurrent, tends to influence large ships such as popular Wall Street stocks and the decentralized digital economy of Bitcoin.

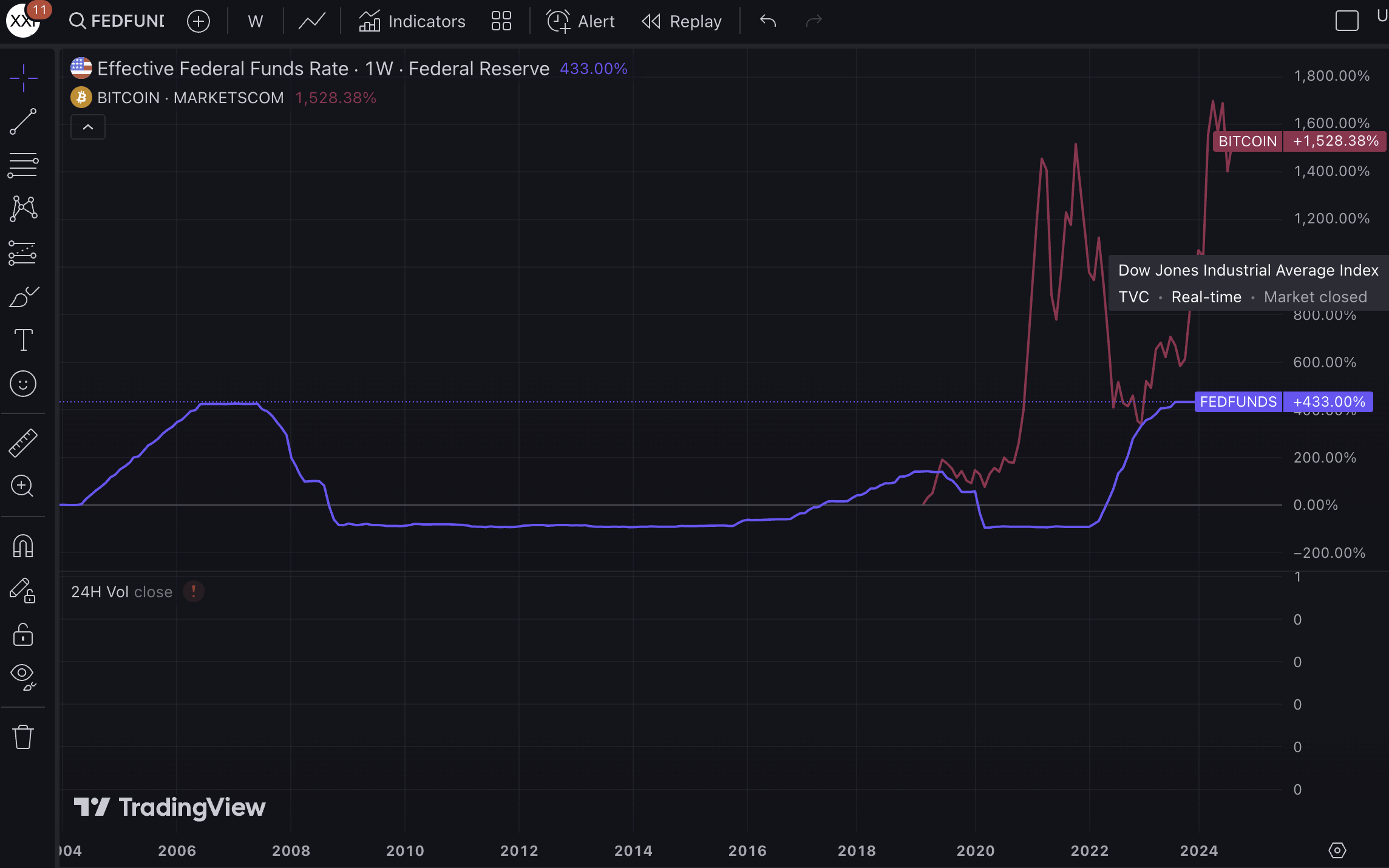

As a researcher, I’ve observed a compelling correlation between prolonged periods of low-interest macroeconomic environments and substantial Bitcoin price increases. The decade of the 2010s stands out as the timeframe with the highest return on investment (ROI) for Bitcoin holders, as this was when interest rates were relatively low, preceding the start of the Bitcoin line on the graph below.

In 2020, when interest rates fell to zero, Bitcoin’s value skyrocketed nearly eight times to unprecedented heights. As the Federal Reserve gradually increased rates, Bitcoin retreated but still doubled its value before the pandemic. Towards the end of 2023, the Fed decided to halt raising rates, and Bitcoin experienced a significant surge.

As a researcher delving into the intricacies of cryptocurrency, I’ve noticed an interesting pattern: the recurring news cycle surrounding cryptos, particularly the anticipation for a Bitcoin ETF that peaked around that time. However, it’s not just hype driving the market; the correlation over several months to monetary policy aligns closely with economic theory on supply and demand.

Previous Bitcoin supply halvings, occurring every four years, have been followed by significant price surges that peaked around 12 to 18 months post-halving. The latest Bitcoin halving transpired on April 19th.

Read More

- EUR INR PREDICTION

- Michelle Yeoh Will Not Appear in ‘Avatar 3,’ Says James Cameron: ‘She’s in 4 and 5’

- W PREDICTION. W cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- Skull and Bones: Gamers’ Frustrations with Ubisoft’s Premium Content Delivery

- NUUM PREDICTION. NUUM cryptocurrency

- LITH PREDICTION. LITH cryptocurrency

- OGV PREDICTION. OGV cryptocurrency

- Understanding the Spectrum of Gameplay in Team Fight Tactics (TFT): A Reddit Discussion

- PBX PREDICTION. PBX cryptocurrency

2024-09-16 00:38