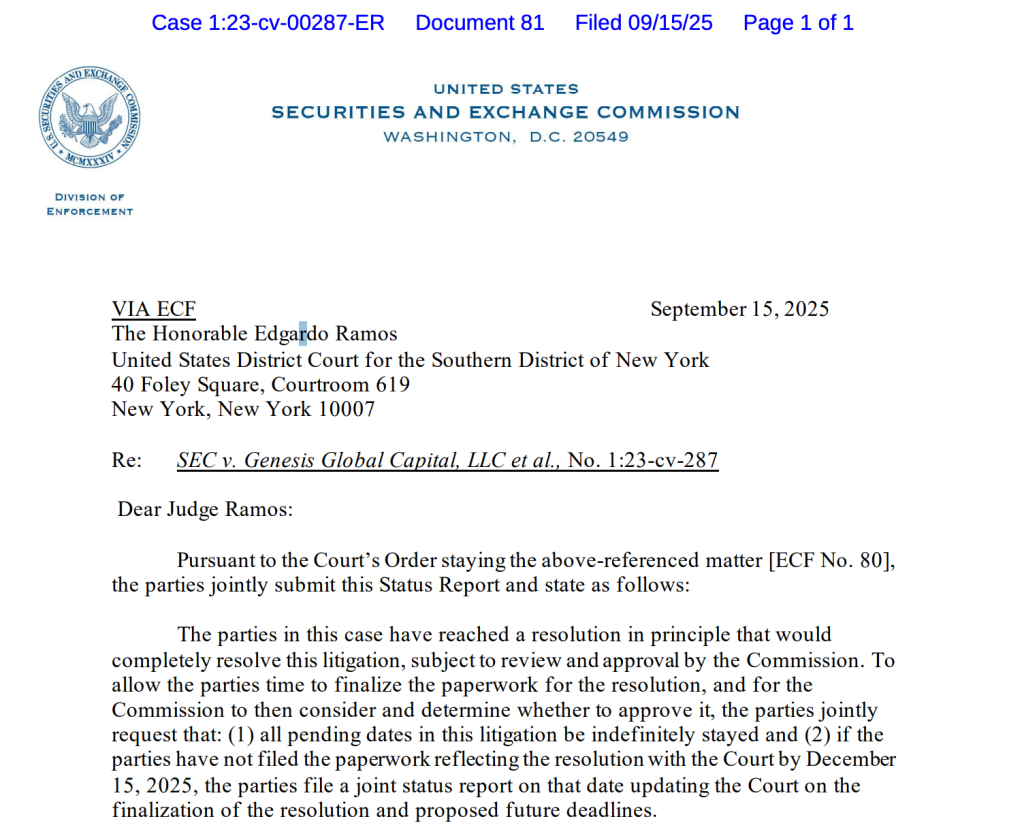

So, after three years, countless legal fees (I assume, because lawyers are not known for working pro bono, despite the saintly image they project), and a whole lot of finger-pointing, the SEC and Gemini are apparently on the verge of shaking hands. Or, more accurately, signing a document drafted by people who charge by the millimeter. It all revolves around Gemini Earn, a program that, according to the SEC, was less “earn” and more “potentially problematic for retail investors.” They reached a “resolution in principle,” which is lawyer-speak for, “Okay, fine, we’ll do what you want, just please stop calling.”

What Sparked the Dispute?

Back in January 2023 – it feels like a different century, doesn’t it? – the SEC decided Gemini and their friends at Genesis Global Capital were running an unregistered securities offering. Basically, people were lending their crypto to Genesis (which, in retrospect, was about as safe as lending your car keys to a ferret), and getting interest in return. The SEC, in its infinite wisdom, decided this was…illegal. A shocking twist, I know. 🕵️♂️

Billions of dollars were involved, pooled like a particularly ambitious kiddie pool. Then Genesis promptly imploded, and everyone realized they’d basically participated in a very complicated, very digital Ponzi scheme. The SEC, seizing the moment (and probably needing a win), decided this was a defining moment for crypto lending. Dramatic, really.

Why Are They Settling Now?

Oh, so many reasons. Let’s just say a bunch of things nudged them toward compromise. Here’s the Cliff’s Notes version:

- Genesis already coughed up $21 million. Which, let’s be honest, is probably just pocket change to someone involved in crypto.💰

- The SEC, under its new temporary boss, seemed to develop a sudden case of… restraint? Apparently, they decided pursuing another Gemini case wasn’t the best use of their time. Or maybe they ran out of paper.

- Gemini wants to go public. And going public while embroiled in a lawsuit with the SEC is about as appealing as wearing Crocs to a black-tie event.

Impact on Crypto Lending

This might actually change things. If Gemini agrees to play by the SEC’s rules – stricter compliance and whatnot – other crypto platforms might be forced to follow suit. Which, for the average investor, is probably a good thing. Though, honestly, most of them probably just want to get their money back. Is that too much to ask?

The SEC is very clear: if you offer interest on crypto, it’s a security. Which means paperwork. Lots and lots of paperwork. And disclosures. Even more paperwork. The horror. 📄

Policy and Business Turning Point

The Winklevoss twins, of Facebook fame (or infamy, depending on your perspective), have been particularly busy in Washington, trying to convince everyone that crypto is the future. They were even spotted at the signing of some stablecoin bill, which just proves that money and politics are a pretty predictable pairing. Who knew? 🤔

Whether this settles quietly or sparks stricter regulations remains to be seen. But it’s a prime example of those moments when business, politics, and regulation collide in the weird and wonderful world of crypto.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

What was the Gemini Earn case about?

The SEC said Gemini Earn was like a secret club for investors lending crypto to Genesis without the proper warnings. It was all very exclusive. And potentially illegal.

Why did the SEC target Gemini Earn?

Because they offered interest payments – essentially saying, “Give us your crypto, and we’ll give you more crypto!” – which the SEC apparently considers a highly suspect activity. Go figure.

How much was Genesis fined in this case?

A measly $21 million. They probably found it under the couch cushions. 🛋️

Does this mean Gemini is free from all SEC actions?

Not quite. They’re still on probation, basically. It’s like getting a slap on the wrist and told to behave.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

2025-09-16 08:38