As a seasoned researcher with a penchant for deciphering market trends and a personal history marked by financial crises and bull runs, I find myself both exhilarated and cautious about Bitcoin’s current surge. The $80K milestone is undeniably historic, but the overbought RSI signals on both the daily and 4-hour charts give me pause.

The US election hype might be over, but Bitcoin’s bullish momentum is seemingly here to stay.

The largest cryptocurrency is trading well above $80,000 for the first time in its 15-year history.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Since Bitcoin bounced back from around $50,000, its value has consistently reached higher peaks and troughs, surpassing several resistance points. However, following Donald Trump’s decisive victory in the US election, the digital asset has witnessed a robust surge, setting a new record high and even breaching the $80,000 mark.

At present, Bitcoin is approximately valued at $82,000, and investors are optimistic that it will surpass the $100,000 mark soon. However, there’s a concerning Relative Strength Index (RSI) indication on the daily chart, suggesting the momentum is overbought. This might cause a temporary pause or adjustment in its value within the near future.

The 4-Hour Chart

On the 4-hour chart, we see a very similar pattern to what’s on the daily chart, as the market has been steadily ascending at a quick pace.

Yet again, the RSI is demonstrating a clear overbought situation. However, considering the overall market structure and the available support levels nearby, even a correction is likely to end by rebounding from the $80K or, eventually, the $74K support area.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Active Addresses

As a researcher, I’ve noticed that Bitcoin prices have reached unprecedented heights lately, leading some analysts to express concern about a potential market euphoria that might trigger a crash. Nevertheless, upon closer examination of the Bitcoin network activity, this scenario doesn’t appear to be an immediate reality.

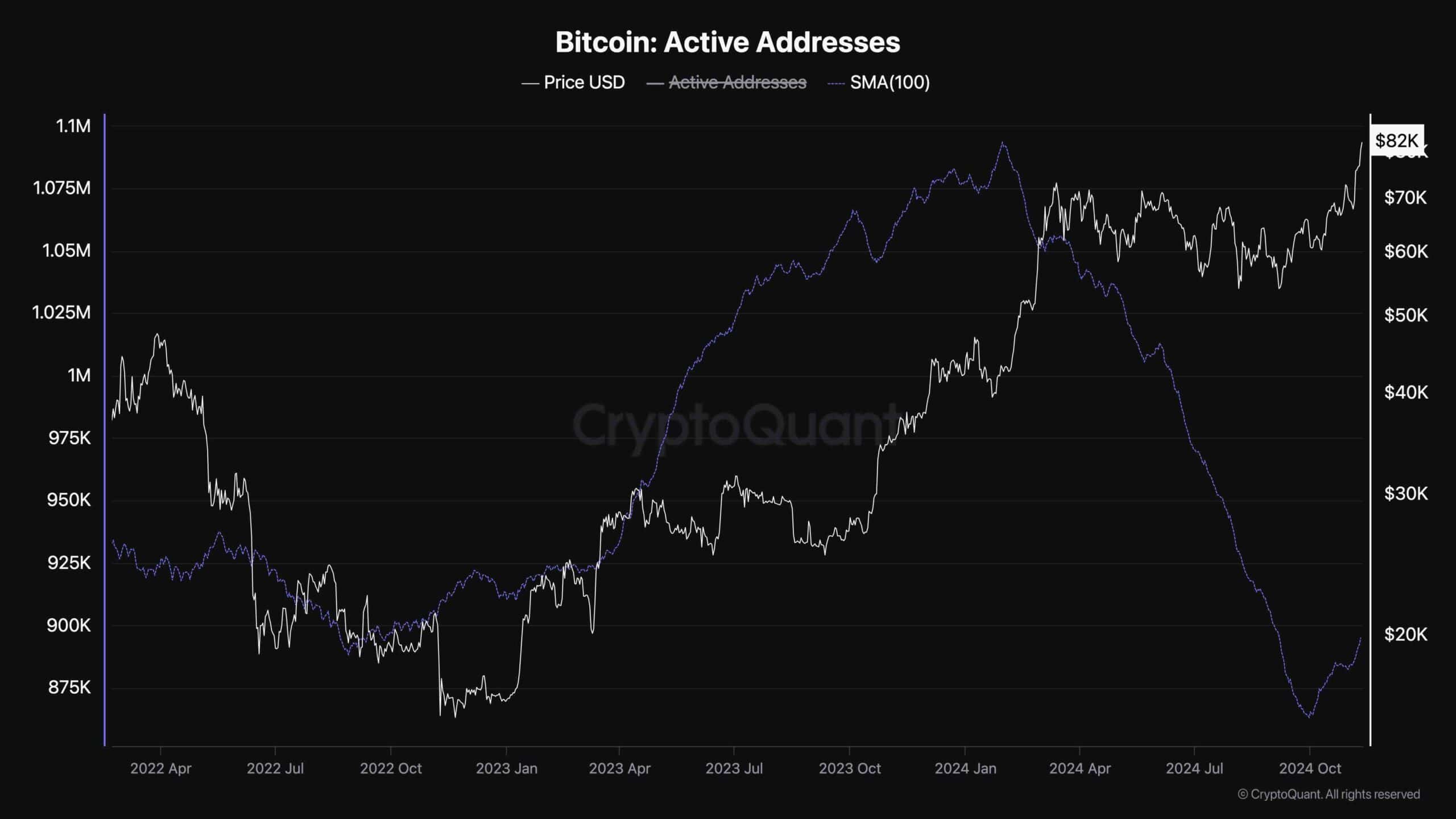

This chart presents the Bitcoin active addresses metric, which shows the number of active wallets in the world’s largest blockchain network. Typically, this value reaches record highs around market tops due to retail traders rushing into the market.

The chart shows that the 100-day moving average of active addresses is around the same values seen during the $15K low at the beginning of the year. Yet, note that while this could point to huge upside potential for the price if this number does not rise quickly, it also shows a massive divergence, which could result in a shortage of demand and make things difficult for the price to continue higher.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-11-11 16:03