As a researcher with experience in the cryptocurrency market, I believe that Ethereum’s (ETH) recent approval by the US Securities and Exchange Commission (SEC) for ETFs is a significant development that could fuel further growth for the asset. Based on the analysis of various metrics, including price volatility and on-chain indicators, I am optimistic about Ethereum’s future prospects.

TL;DR

- The SEC’s approval of ETH ETFs has increased volatility, with analysts predicting potential rallies and significant future growth.

Positive on-chain metrics, like rising TVL and negative exchange netflow, indicate a possible bull run for Ethereum.

ETH’s Next Possible Step

As a crypto investor, I’m thrilled to share that Ethereum grabbed the spotlight last week following the US Securities and Exchange Commission’s (SEC) approval for ETFs based on Ether. This momentous event occurred on May 24, and it came as no surprise that it led to heightened volatility for this asset.

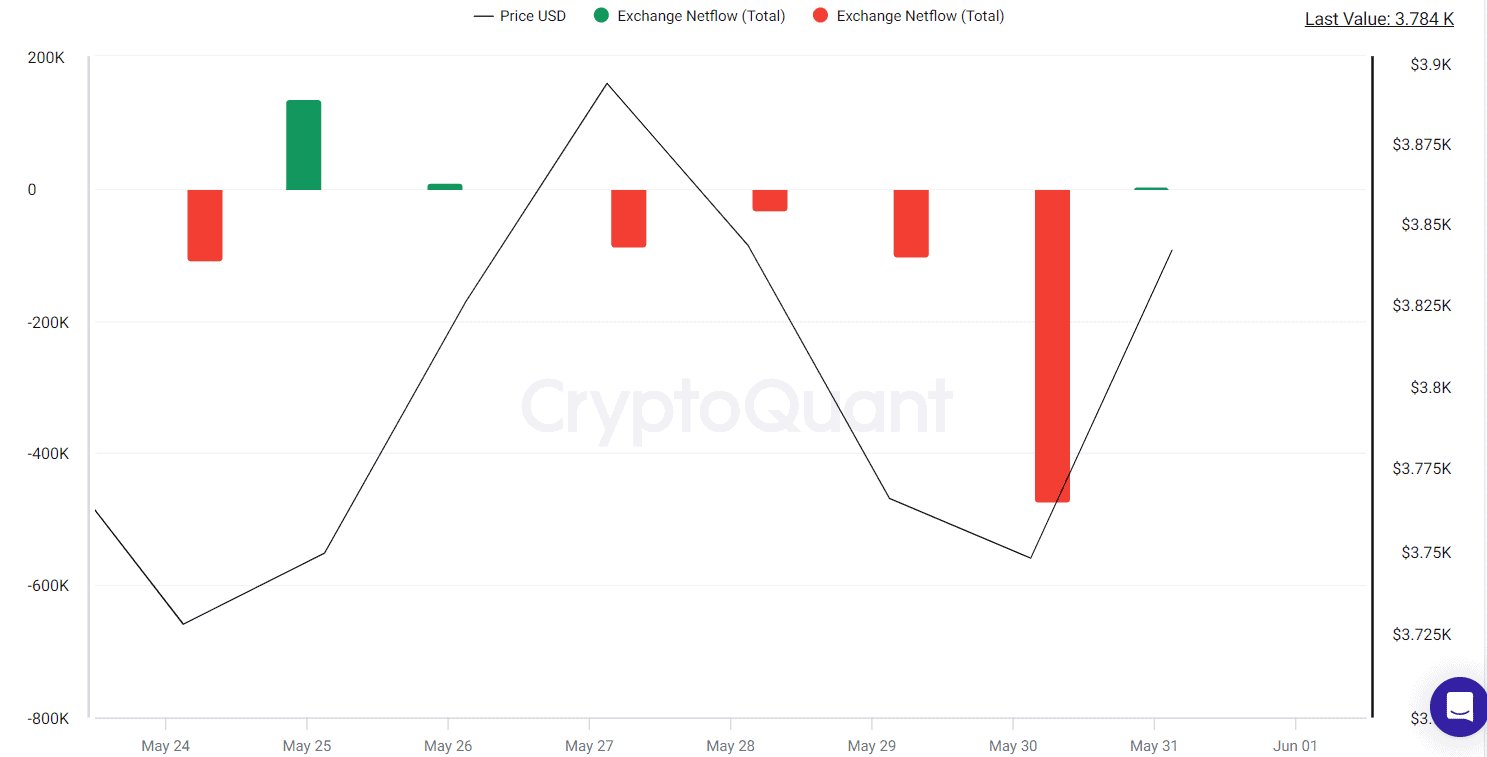

The price of it underwent significant fluctuations, ranging from $3,650 to $3,950, before stabilizing at approximately $3,800 as currently indicated by CoinGecko’s data.

Jelle, a user of X, made the case that Ethereum (ETH) is strengthening its position above the roughly $3,750 support level. According to him, the market may witness volatile price movements around this region for some time, possibly until Monday, before making significant gains. He urged investors against becoming complacent and suggested they prepare for a potential surge in ETH prices beyond the $4,500 threshold within the upcoming months.

Yoddha and Satoshi Flipper expressed confidence as well. Yoddha asserted that Ethereum’s bull market was on the horizon, potentially leading to a substantial price surge reaching $20,000.

As a crypto investor, I can tell you that Satoshi Flipper foresaw an illustrious future for Ethereum, believing that significant global banks and financial institutions would join its community following the SEC’s approval of the proposed ETFs.

As a crypto investor, I’d like to remind you of an intriguing development in the world of digital currencies. Not long ago, it was disclosed that one of Singapore’s leading financial institutions, DBS Bank, has amassed a significant crypto hoard. Specifically, they hold approximately 173,753 Ether (ETH). At present, this substantial stash is estimated to be worth around $670 million.

Taking a Closer Look at On-Chain Metrics

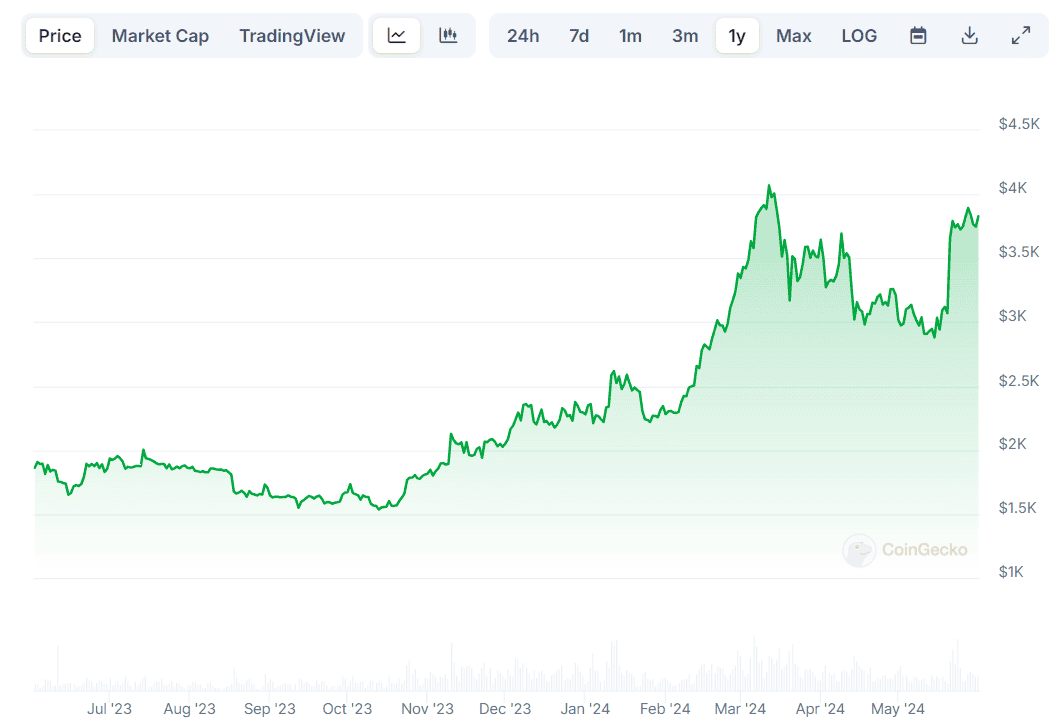

As a researcher studying the cryptocurrency market, I’ve observed an impressive surge in Ethereum’s (ETH) price tag over the past year. This upward trend has translated to a remarkable increase of more than 100%. Simultaneously, key performance indicators within the Ethereum ecosystem have been on the rise as well.

Based on DefiLlama’s data, the Ethereum network has experienced a significant increase in total value locked since October 2023. The current TVL, or Total Value Locked, is close to $65 billion. This measurement reflects the combined worth of assets deployed in various DeFi applications on the Ethereum blockchain, including staking, lending, borrowing, and more.

The rise in this indicates that more capital is being invested in the ecosystem, potentially signaling a favorable market outlook.

As an analyst, I’ve noticed another encouraging indicator for Ethereum: the exchange netflow has been predominantly negative over the last week. While some may view this as bearish, I believe it could be bullish for Ether’s valuation. The shift from centralized platforms to self-custody methods reduces the immediate selling pressure on exchanges, potentially leading to a more stable price floor and less volatility in the long run.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-06-02 09:56