As a seasoned crypto investor with years of market observation and countless lessons learned the hard way, I can confidently say that the current Ethereum trend is not looking particularly bullish. The persistent downward trajectory, coupled with insufficient bullish momentum, has me bracing for impact in the near term.

Ethereum is currently moving lower, as the market dynamics don’t seem strong enough for a bullish comeback yet.

For the short term, it appears that the cryptocurrency market may move into a stabilization period, where price fluctuations might lean slightly towards a downtrend.

Technical Analysis

By Shayan

The Daily Chart

Over the past day-to-day chart, Ethereum has been moving in a continuous decline since it was turned down at its annual peak of $4,000. The price has repeatedly formed lower valleys and higher points, resulting in a descending channel that echoes the general bearish mood in the market. This pattern underscores the skepticism among traders about Ethereum’s long-term direction.

Lately, an attempt to increase the price was unsuccessful near the midpoint of the channel, which is approximately $2.7K, causing a further drop in value, suggesting a bearish trend.

At present, Ether (ETH) is being traded within a crucial price band. It finds support at approximately $2,000, while its upward movement is restrained by the middle line of the channel around $2,500 as resistance. As long as the price remains within this band, more price stabilization or consolidation can be expected.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum experienced increased selling force near the resistance area situated between approximately $2,600 and $2,700, which is defined by Fibonacci levels. This led to a substantial fall in its price towards $2,000. The ongoing market behavior suggests that pessimism remains prevalent, as sellers seem determined to drive the price below its current annual low at the $2,000 mark.

Currently, Ethereum (ETH) appears to be creating an ascending wedge structure and is hovering close to its lower boundary. If ETH breaks through this level, there might be a continued drop towards the $2K mark, possibly even breaking past this level as support.

If there’s an uptick in demand for Ethereum in the near future, it could lead to a bullish recovery, potentially pushing the price back up towards the 0.5 Fibonacci level which stands around $2.6K.

Onchain Analysis

By Shayan

The continuous future market significantly influences the general trends in pricing across the broader cryptocurrency market.

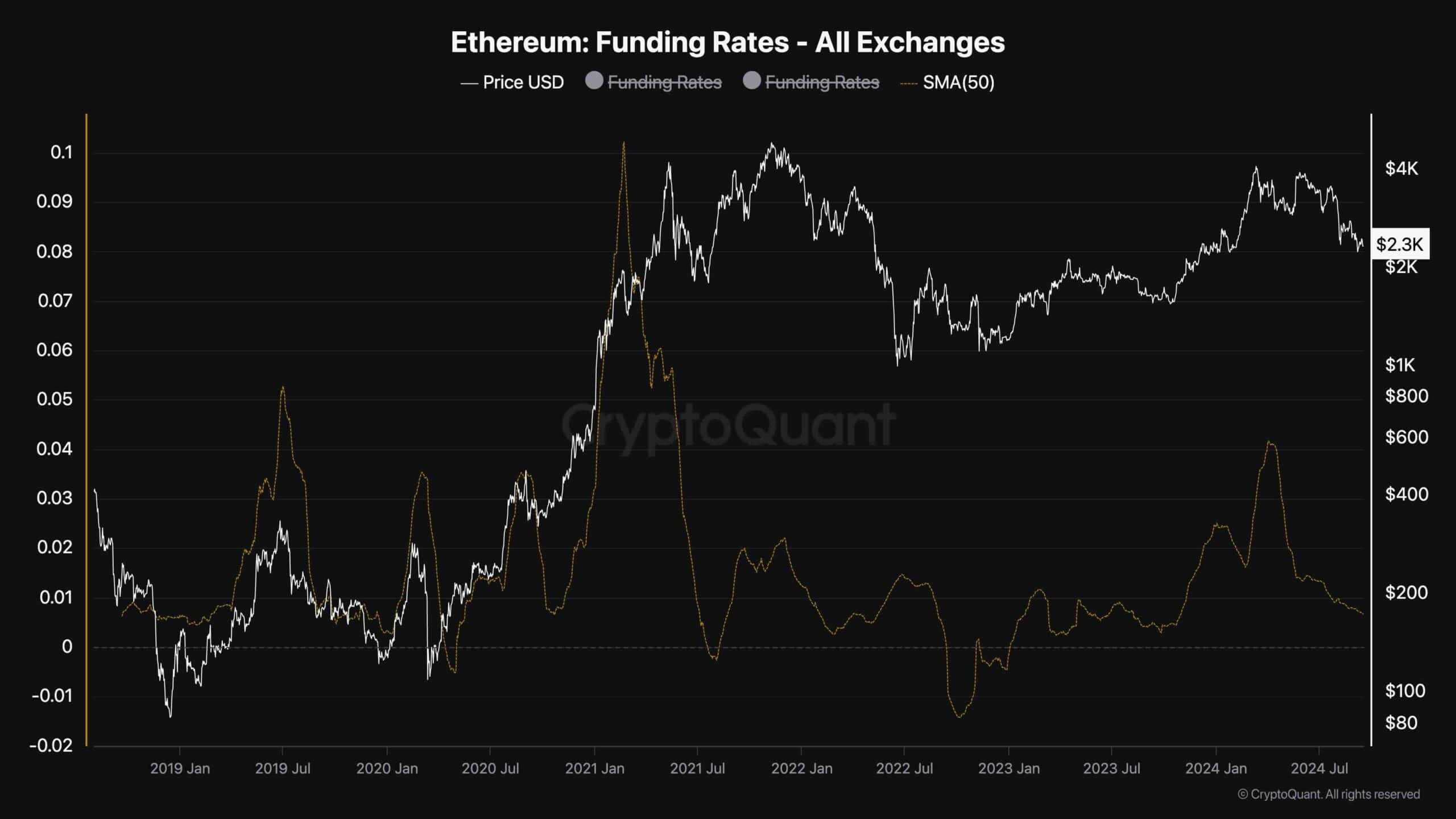

In other words, analyzing the attitudes of futures traders can offer useful predictions about possible price fluctuations. This diagram displays the 50-day moving average of Ethereum’s funding rates, offering a comprehensive perspective on whether buyers or sellers are placing more active market orders in the futures market.

Lately, the trend for Ethereum’s 50-day moving average of funding rates has been persistently dropping, touching its lowest points seen in the year 2024.

This consistent downward trend indicates a widespread pessimism among traders, suggesting they’re not eager to buy Ethereum. To see Ethereum rise and reach higher prices, we need a surge in demand within the perpetual futures market. If the ongoing trend of unfavorable funding rates persists, it seems probable that Ethereum will face more price drops in the near future.

From my perspective as an analyst, it’s crucial to acknowledge that while low funding rates are often interpreted as bearish signs, they can also serve as early indicators of market recovery. This is due to the fact that these conditions might initiate short liquidation cascades, potentially causing price reversals. However, whether this leads to a rebound depends significantly on the presence of robust spot buying pressure. If the demand from spot buyers isn’t strong enough, Ethereum’s price may continue to experience downward pressure.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

2024-09-16 23:16