As a seasoned researcher with extensive experience in analyzing the cryptocurrency market, I find myself intrigued by the recent surge of optimism surrounding Ethereum following former president Trump’s 2024 election victory. The technical and on-chain analysis presented here offers valuable insights into the potential bullish momentum that ETH may experience.

After Donald Trump’s triumph in the 2024 presidential election, there’s been an upsurge of enthusiasm and demand for cryptocurrencies.

Ethereum didn’t escape the trend either; at one stage, its value surged by 10%, touching the significant resistance point of $2,500. If it manages to persistently breach this barrier, it could potentially boost its bullish energy further.

Technical Analysis

By Shayan

The Daily Chart

Each day on its chart, Ethereum experienced increased purchasing efforts close to the $2.3K support level, which lines up with the midpoint of a long-term downward trending channel. This buying force has been pushing the asset towards the 100-day moving average, a position that corresponds with the $2.5K resistance area. Historically, this part of the chart has hosted sellers, indicating it as a notable obstacle for Ethereum’s further price rise.

If the buying force persists, there’s a possibility that Ethereum could burst through its current resistance level, triggering a short-squeeze and further fueling the upward trend. In this optimistic outlook, the 200-day Moving Average at around $2,800, coinciding with the upper boundary of the channel, might be the next objective for buyers to reach.

The 4-Hour Chart

On the 4-hour chart, we can see Ethereum’s strong start from $2.3K, a key support area that formed the bottom of a descending flag pattern. The intense buying interest at this level has propelled Ethereum towards encountering significant resistance around $2.6K to $2.8K. This resistance is determined by the 0.5 to 0.618 Fibonacci ratios.

In simple terms, this region signifies a significant source for Ethereum’s supply. As a result, there might be a brief period where Ethereum buyers face selling pressure, leading to a possible consolidation stage.

For Ethereum to mark a confirmed bullish trend, it would need a breakout above this resistance zone with strong volume, which could open the path toward a prolonged uptrend. In the meantime, price action around this resistance level will be pivotal, as it will determine whether Ethereum can build upon its current momentum or faces a temporary pause in its bullish rally.

Onchain Analysis

By Shayan

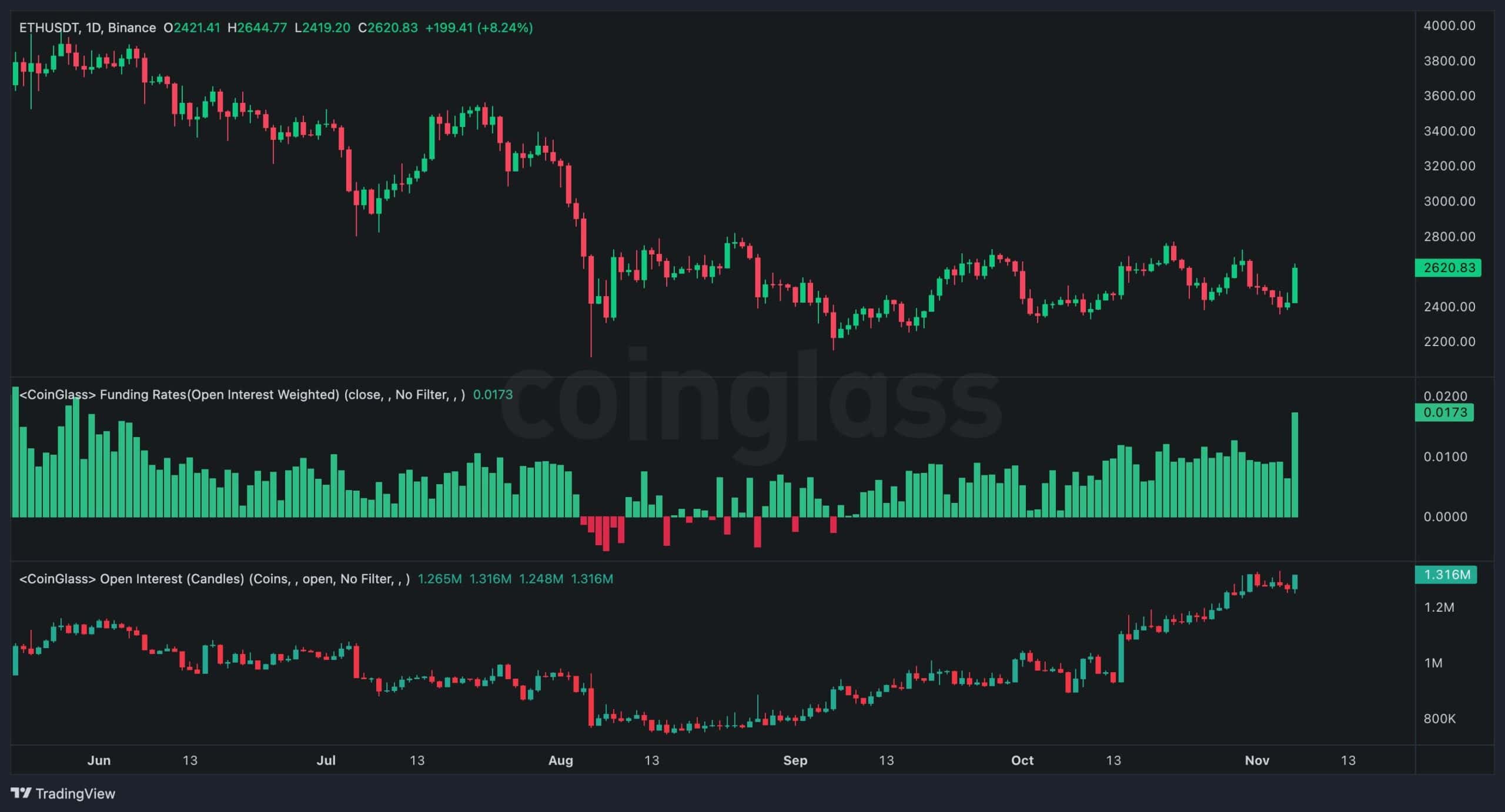

The recent climb of Ethereum towards the $2,500 resistance area has ignited hope among investors, who believe it may mark the start of a fresh bullish trend. Data from the futures market, including open interest and funding rate statistics, offer clues about traders’ feelings and activity levels.

The graph clearly demonstrates that open interest and funding rates have been positively trending during this recent upward swing, surpassing levels from earlier months. This growth suggests heightened involvement and generally optimistic feelings among futures traders. Though increased participation typically fuels a prolonged bull market, excessive enthusiasm in the futures market can also introduce potential risks.

At present, neither open interest nor funding rates have escalated to critical points yet, implying there’s potential for further growth without an immediate danger. Nevertheless, an abrupt increase in these figures might lead to increased market volatility and potentially trigger a rapid chain of long liquidations, which could result in a quick price decline.

Given these dynamics, investors may want to exercise caution in the short term by closely monitoring these metrics and managing risk levels carefully to prepare for potential volatility.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-11-06 17:17