As an experienced analyst with a knack for deciphering market trends and a deep understanding of Ethereum’s price dynamics, I find myself cautiously optimistic about the near future of ETH. The current consolidation above $2,000 is indeed intriguing, but it’s important to remember that the market often plays tricks before revealing its hand.

The cost of Ethereum has been stabilizing within a broad band above the $2,000 threshold. However, it could potentially shift quite soon.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the course of each day, the price trend fluctuates within a span of $500, oscillating between the resistance at $2,700 and the support level at $2,200 on the daily chart.

In simple terms, the market has repeatedly tried but failed to surpass $2,200 as an upper limit. This trend suggests that we might see a push towards $2,200 in the coming weeks. Contrastingly, the Relative Strength Index (RSI) is getting close to 50% from below, indicating that the downward pressure may be easing off. This could potentially lead to a reversal of the current trend soon.

The 4-Hour Chart

As an analyst, I find that the four-hour chart provides a significantly clearer perspective on the recent price consolidation we’ve observed. This market appears to be forming a large symmetrical triangle pattern, with both boundaries having been tested not once, but twice.

Given that the $2,500 mark has been breached to the downside and subsequently revisited from below, it’s probable that the market will approach the lower trendline shortly.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

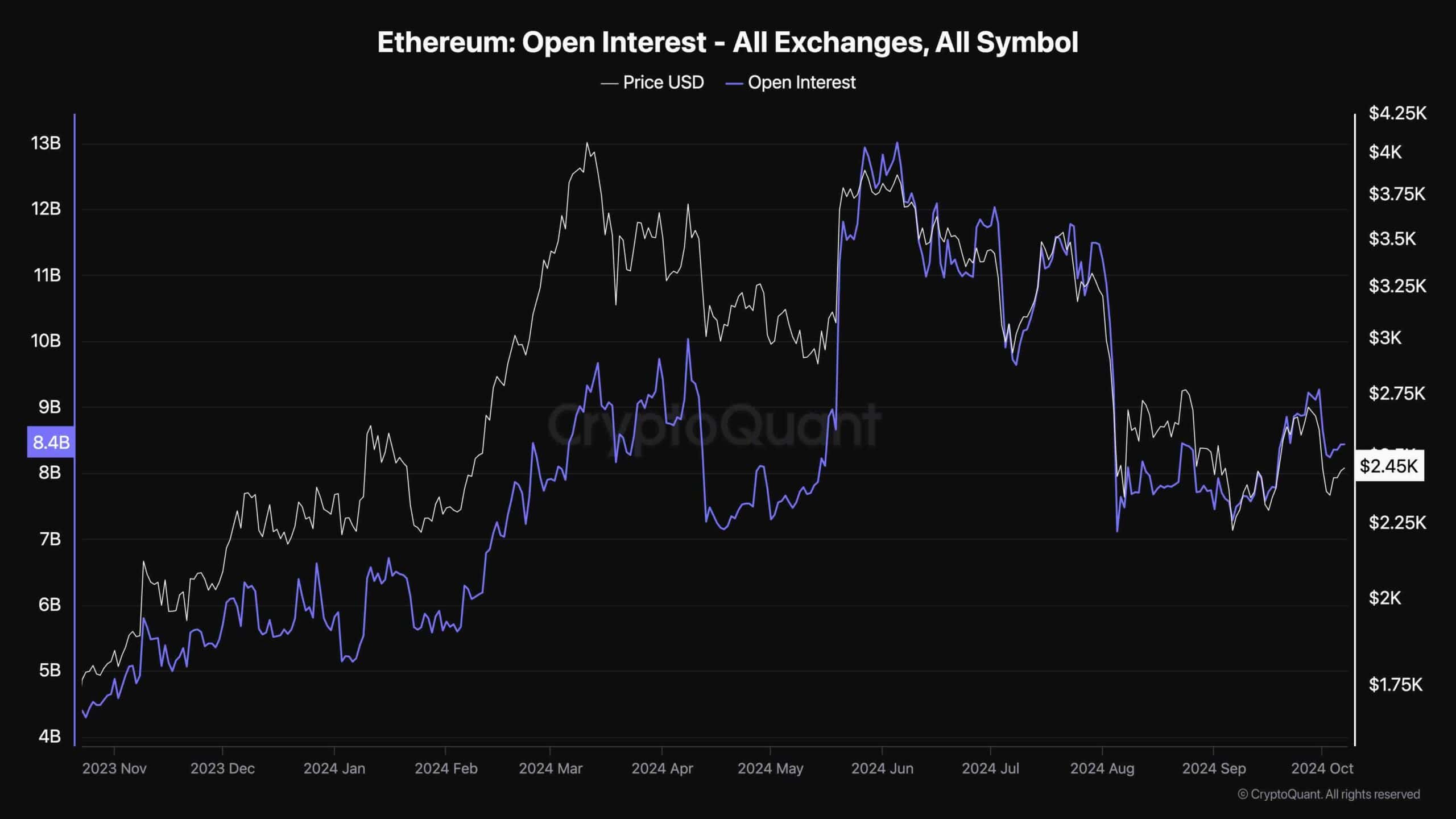

Ethereum Open Interest

This diagram illustrates the open interest (OI) measure, which represents the overall count of active futures contracts currently in play. The level of trader engagement and market action is reflected by this metric; an increase in OI implies heightened interest, while a decrease suggests that traders are either closing their positions or experiencing liquidation.

The graph demonstrates a strong correlation between Ethereum’s Open Interest (OI) and its price, where both seem to follow each other closely. From the end of 2023 through early 2024, there’s a substantial increase, which suggests high market participation and optimistic outlook among traders.

In mid-2024, there was a significant drop that hints at a substantial negative event or mass selling, which pushed traders to abandon their investments, resulting in decreased trading activity and a fall in prices.

Although there have been some ups and downs, both the Open Interest (OI) and the price are currently below their previous highs, indicating a more conservative approach by traders. However, if the current lull in the futures market is matched with enough demand in the spot market, it could trigger a steady increase or rally.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- USD NZD PREDICTION

- EUR INR PREDICTION

- GBP CAD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2024-10-07 16:02