As a seasoned analyst with extensive experience in the cryptocurrency market, I have closely monitored Ethereum’s (ETH) price movements and market sentiment. Based on my technical and sentiment analysis, I believe that Ethereum’s recent correction might finally be coming to an end.

The current price of Ethereum is making an effort to break through a significant barrier. If it manages to do so, the recent downturn in its value may come to an end.

Technical Analysis

By TradingRage

The Daily Chart

Based on the day-to-day price chart, Ethereum has been trending downwards ever since it was unable to break through the $4,000 resistance mark back in May.

I’ve noticed that the market value of cryptocurrency has dipped below the $3,500 mark recently. Currently, it’s attempting to regain this level from beneath. If successful, there’s a strong possibility that we could see values surpassing the $4,000 threshold once again.

If the price of ETH is rejected, and it breaks below its long-term bullish trendline as well as the $3,000 mark where the 200-day moving average lies, then the situation could deteriorate significantly for Ethereum.

The 4-Hour Chart

On the 4-hour chart, there are emerging indications of a potential bullish turnaround. The price has recently breached the downward trendline pattern, which could signal an uptrend is on the horizon.

However, it is currently struggling to break through the $3,500 resistance level.

Despite the RSI suggesting a bullish trend with increasing momentum, there’s a possibility for the market to surge further and initiate the next phase of growth. However, this optimistic view may be invalidated if the price falls back within the defined channel.

Sentiment Analysis

By TradingRage

Funding Rates

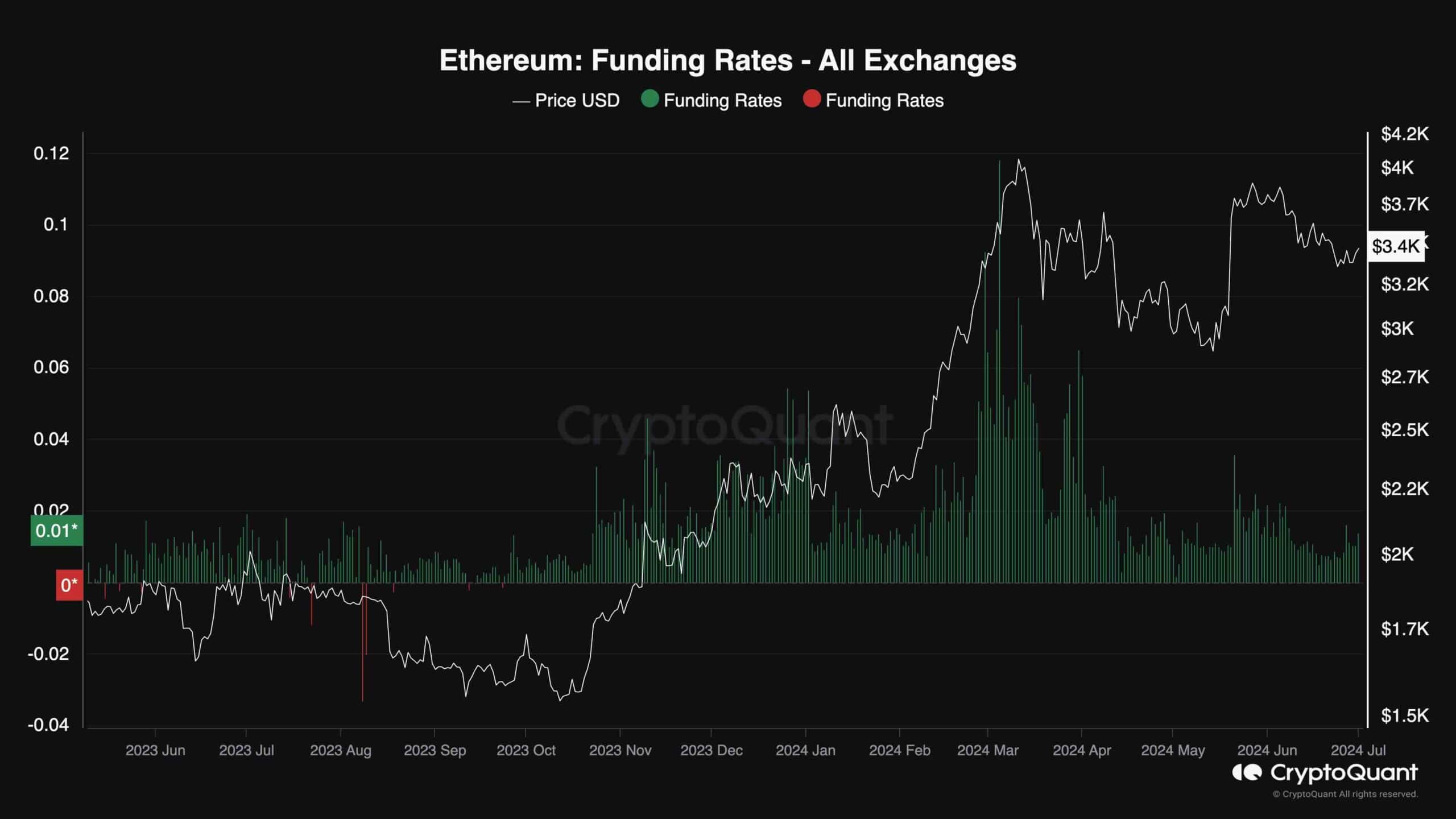

As a crypto investor, I strongly recommend analyzing the sentiment metrics in the futures market to supplement my technical analysis. The following chart illustrates the funding rates metric, which is an essential sentiment indicator. This metric reveals whether buyers or sellers are placing their futures orders more forcefully by displaying the net amount paid or received each hour. Understanding this information can offer valuable insights into the current market dynamics and potentially help me make informed investment decisions.

According to the graph, the funding rates have been trending downward since the initial price rejection of $4,000 in March. This implies that the current funding rate levels suggest that the futures market is no longer excessively heated, potentially allowing for a sustained price increase.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- ICP PREDICTION. ICP cryptocurrency

- TANK PREDICTION. TANK cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- BSW PREDICTION. BSW cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

- USD DKK PREDICTION

2024-07-01 17:27