As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself intrigued by Ethereum’s current state. The consolidation phase we’ve been in for months has been both frustrating and exhilarating – like watching a ping-pong match where neither player wants to make a decisive move.

For several months now, the value of Ethereum has remained stable, neither indicating a strong upward trend nor a downward one. However, it seems that this state of equilibrium could shift in the near future.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On a day-by-day basis, the price moved within a broad, symmetrical triangle formation, repeatedly touching its upper and lower limits.

The market’s trajectory hinges significantly on whether it bursts through the current trend towards higher or lower levels. At present, the Relative Strength Index (RSI) stands at approximately 50%, suggesting a degree of ambiguity within the market.

The 4-Hour Chart

Examining the 4-hour timeframe, it’s clear that the asset has dropped below the $2,500 mark not long ago. Now, it’s attempting to return to that level, and if successful, a surge towards the $2,800 resistance area appears quite likely.

On the other hand, a rejection could lead to a further decline toward the $2,300 support level. Yet, judging by the RSI and its increasing values, the momentum is shifting bullish, and the scenario toward $2,800 seems more probable.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Ethereum Exchange Reserve

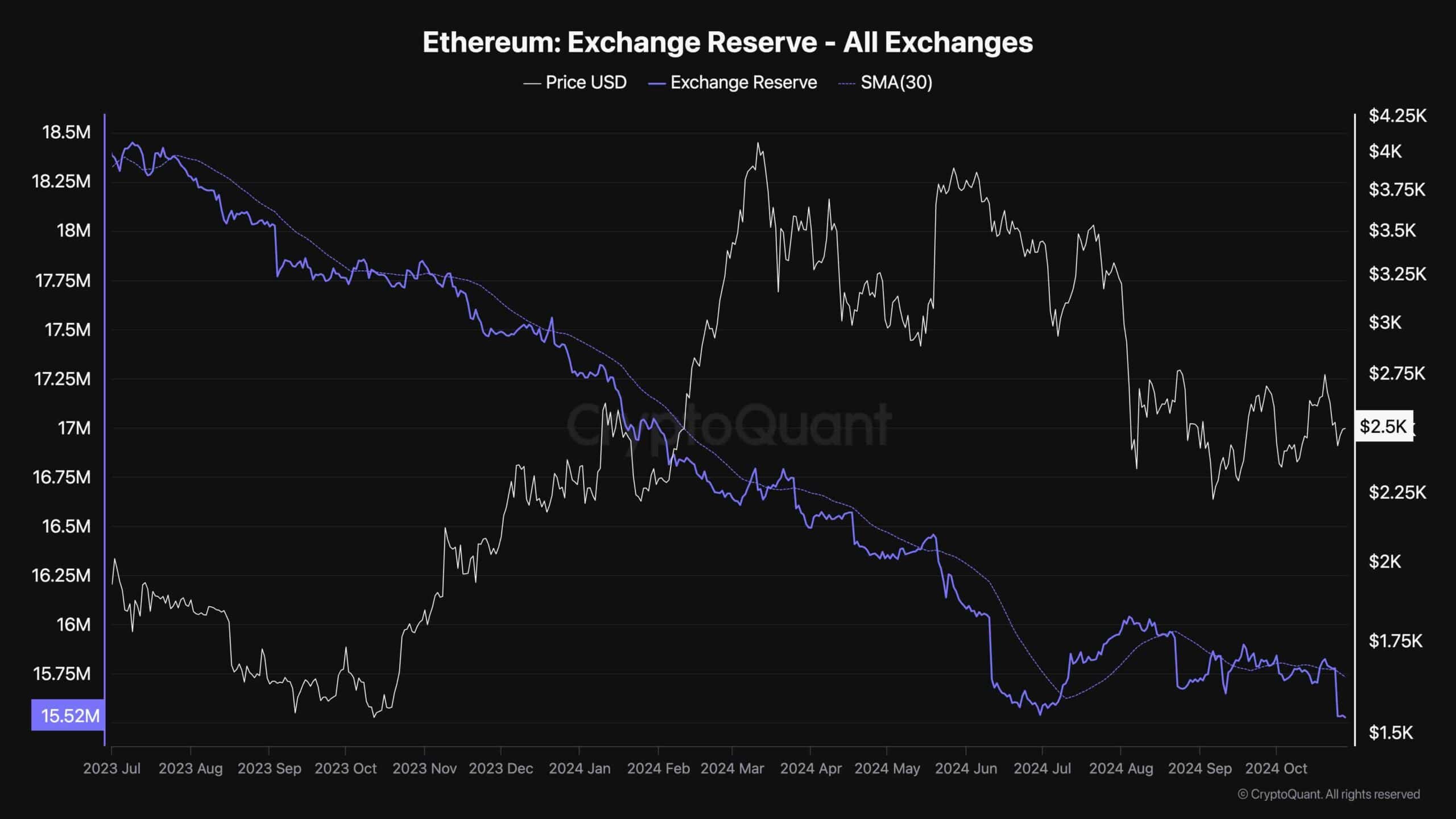

As the graph showing prices remains stable, investors ponder if it’s a phase of stockpiling (accumulation) or selling off (distribution). Examining the data related to the exchange reserves could prove useful during such periods.

The exchange reserve metric measures the amount of ETH held in exchange wallets. As the chart suggests, the exchange reserve has been gradually dropping recently, with a significant decline occurring in the last few days. This points to an aggregate accumulation in the spot market, which could lead to a supply shock and rally higher if the futures market remains stable.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR INR PREDICTION

- USD UAH PREDICTION

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- BOBA PREDICTION. BOBA cryptocurrency

- MINTME PREDICTION. MINTME cryptocurrency

- KUJI PREDICTION. KUJI cryptocurrency

- FLIP PREDICTION. FLIP cryptocurrency

2024-10-28 15:06