As an analyst with extensive experience in navigating the volatile crypto markets, I must admit that the current state of Ethereum has me intrigued. The cryptocurrency is standing at a pivotal point, testing the $2.6K-$2.7K resistance zone, a region that has been notorious for its supply glut in recent months.

At present, Ethereum stands at a crucial moment, as its value is being tested against the resistance area of around $2,600 to $2,700. If it manages to surpass this barrier, it could indicate a positive trend in the medium term, possibly pushing the price up to $2,800 and even higher.

However, if the resistance holds, Ethereum may enter another bearish consolidation.

Technical Analysis

By Shayan

The Daily Chart

In recent times, Ethereum’s value has significantly increased, mainly due to an increase in purchasing activity near the $2,300 support point. This upward momentum could suggest a potential change towards bullish trends, as Ethereum has managed to break above the middle trendline of its descending channel, which is typically indicative of a possible bullish reversal.

Currently, the asset seems to be facing a significant barrier, which includes the Head and Shoulders (H&S) neckline and the 100-day moving average (MA) around $2.6K.

Should Ethereum manage to surpass this significant barrier in its path, it would suggest that the Head and Shoulders pattern has been completed, which is an optimistic reversal sign. This bullish development could pave the way for a mid-term upward trend, possibly driving the price towards the $2.8K mark, another notable resistance point. Furthermore, a leap above the 100-day Moving Average would underscore the strength of buyers in the market.

Yet, this potential resistance spot might cause a reversal, given that it’s known for having substantial supply. If buyers lose ground, there could be a downtrend, causing a pause in the bullish trend, potentially halting further price increases.

The 4-Hour Chart

On the 4-hour graph, Ethereum found robust support at approximately $2,300, creating a double bottom structure, which is often a bullish sign. This pattern sparked a significant price surge, propelling Ether towards the resistance area defined by the 0.5 and 0.618 Fibonacci retracement levels around $2,600 and $2,700 respectively.

As I delve into my analysis of Ethereum’s price movements, I’ve noticed that this specific resistance level has been quite formidable. Over the past few months, Ethereum has encountered numerous refusals at this point. The upcoming price action holds significant importance as it could decisively shape Ethereum’s trajectory. If this resistance persists in pushing back the price, it might instigate a decline towards the $2.3K mark. Conversely, should Ethereum manage to break above the $2.7K threshold, it could pave the way for additional growth and potentially trigger an upward surge.

Onchain Analysis

By Shayan

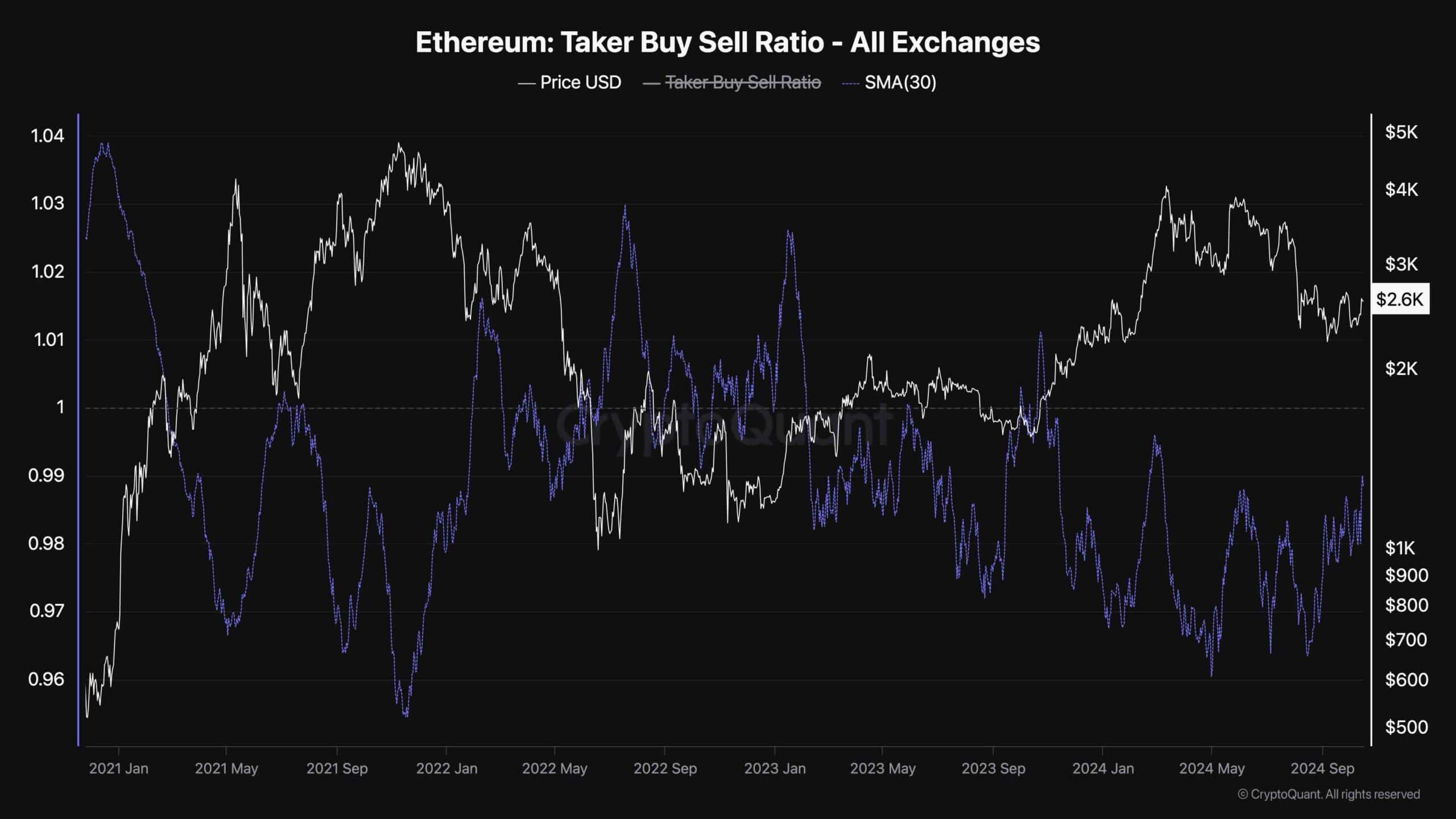

The Taker Buy-Sell Ratio is a key futures market metric that measures whether buyers or sellers are more aggressive in executing their orders. This ratio provides valuable insight into futures traders’ sentiment and can be an essential complement to traditional price analysis.

Analyzing the recent market trends, I’ve noticed a striking increase in the number of buy orders executed in the Ethereum futures market following its bullish rebound at approximately $2.3K. This surge has significantly influenced the Taker Buy-Sell Ratio, pushing it to its highest level in weeks. This trend indicates that future market participants are confident about Ethereum’s near-term price direction, expressing optimism for its short-term trajectory.

This metric indicates a shift in market sentiment, as aggressive buying signals that traders expect the price to continue rising. If the Taker Buy-Sell Ratio surpasses 1, it reflects that buyers are overwhelmingly dominant, which often aligns with the start of a bullish trend.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- CGO PREDICTION. CGO cryptocurrency

- PRCL PREDICTION. PRCL cryptocurrency

- NUUM PREDICTION. NUUM cryptocurrency

- Rob2628: The Best Builds to Play in Season 5 Diablo 4

- PENDLE PREDICTION. PENDLE cryptocurrency

- Top Gift Ideas for Your League of Legends-Obsessed BF on a Budget

- TARA PREDICTION. TARA cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

2024-10-16 20:51