As a seasoned crypto investor with a keen eye on market trends, I’ve noticed Binance experiencing a significant surge in Ethereum buyer demand. This bullish sentiment is fueled by optimistic rumors surrounding the potential approval of a much-anticipated spot Ether ETF.

There’s strong interest from buyers in purchasing Ethereum on Binance, driven by anticipation that an anticipated spot Ethereum ETF may soon be approved. As a result, traders are actively buying Ethereum using market orders, despite the higher price tags.

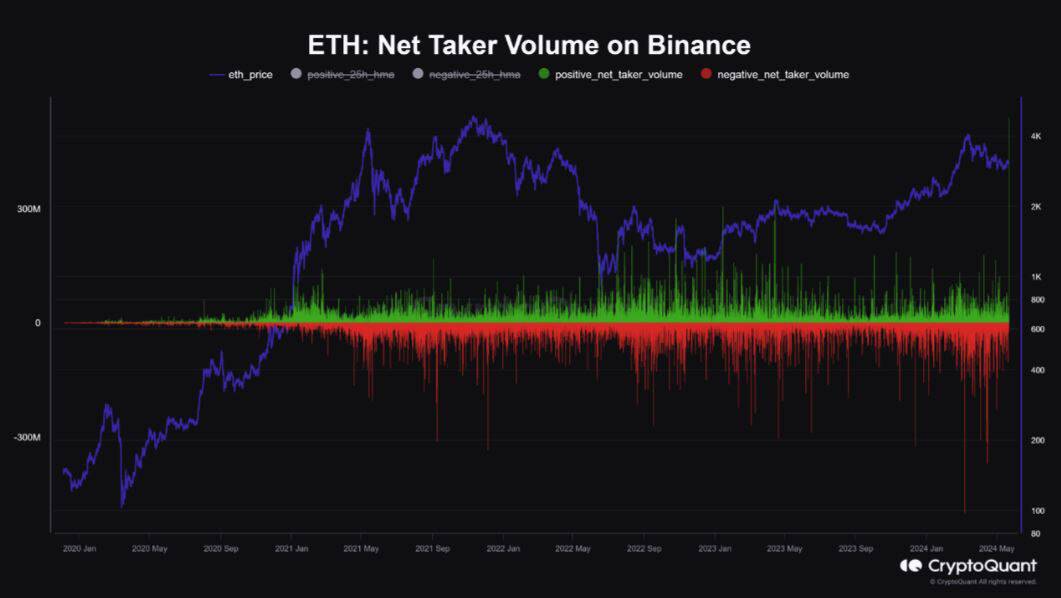

CryptoQuant observed a significant surge in Ethereum’s net taker volume on a prominent exchange, reaching a record peak.

Ethereum Taker Demand Surges on Binance

The Net Taker Volume indicator calculates the gap between the amount of volume transacted through market orders that aim for instant executions rather than optimal prices.

Based on CryptoQuant’s recent analysis, the significant increase in Net Taker Volume could be attributed to the anticipation of ETF Specialist James Seyffart’s highly anticipated approval announcement for a spot Ethereum ETF. According to Seyffart, there is a 75% chance that this approval will be granted.

As an analyst, I’ve observed a significant shift in trading behavior among Binance users following this recent news announcement. Specifically, there has been a surge in buying Ethereum using market orders, resulting in a substantial imbalance between the Taker Buy and Sell volumes within a single candle. To be more precise, the Taker Buy Volume surpassed the Taker Sell Volume by an astounding $530 million, setting a new record for the largest single-candle Net Taker Volume ever recorded on Binance for Ethereum trading.

It’s clear that Binance traders had a strong belief in Ethereum’s potential price increase and were prepared to pay premiums to secure instant purchases of the cryptocurrency. This could be due to their expectation that an Ethereum ETF might be authorized, leading to a significant price rise.

“Binance traders are making taker orders on the Ethereum ETF news like there is no tomorrow.”

Increased Likelihood of Spot Ether ETF

As a crypto investor following the market closely, I’ve recently updated my estimation based on new information. Following Seyffart and Eric Balchunas, senior analysts at Bloomberg, I now believe that the probability of a spot Ethereum ETF getting approved has significantly increased, from 25% to 75%.

The core of their contention rested on the increased political scrutiny faced by the US Securities and Exchange Commission (SEC) as one possible explanation. Additionally, they highlighted the SEC’s historical passive approach towards reviewing applications for these ETFs, implying a potential unwillingness on the part of the regulatory body to give them serious consideration.

Balchunas has recently changed his perspective on the SEC’s decision regarding an Ethereum ETF. He now suspects that external influences, possibly from political quarters, may be affecting the regulatory body’s stance, causing him to reconsider the probability of approval.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

2024-05-22 07:28