As a researcher with a decade of experience in the volatile and unpredictable world of cryptocurrencies, I can confidently say that the 2024 US presidential elections have proven to be a game-changer for the market. The surge in prices we’ve witnessed since Donald Trump’s victory is unprecedented, with Bitcoin breaking its previous all-time high and Ethereum making a strong comeback after a sluggish summer.

Bears who have been selling off the market, betting that cryptocurrencies would fall, have found themselves on the losing end since Donald Trump’s victory in the 2024 U.S. Presidential election, as nearly all cryptocurrencies have been experiencing upward trends instead.

Over the past couple of hours, Bitcoin hit a new high above $77,000, Ethereum is approaching $3,000, and a significant investor (referred to as a ‘whale’) was taken by surprise on BitMEX.

This week has been quite remarkable in the world of cryptocurrencies. The momentum began when it was clear that Trump would be the next U.S. president on Wednesday morning. Bitcoin, which received favorable mentions from the Republican candidate during his campaign, took the lead and surpassed its March record high of $73,737 on Wednesday as well.

Yesterday’s Fed rate cut marked only the start for the most significant digital currency, as it continued to surge, reaching an unprecedented peak of $76,800. After a momentary dip today, Bitcoin resumed its upward trajectory hours ago and surpassed $77,000 for the first time in history. According to CoinGecko data, its current record high stands at $77,020.

However, the trend of altcoins lagging behind seems to be changing now. Ethereum, which had a slow summer, has suddenly surged by 19% over the past week. This surge has brought Ethereum close to $3,000 for the first time in more than three months.

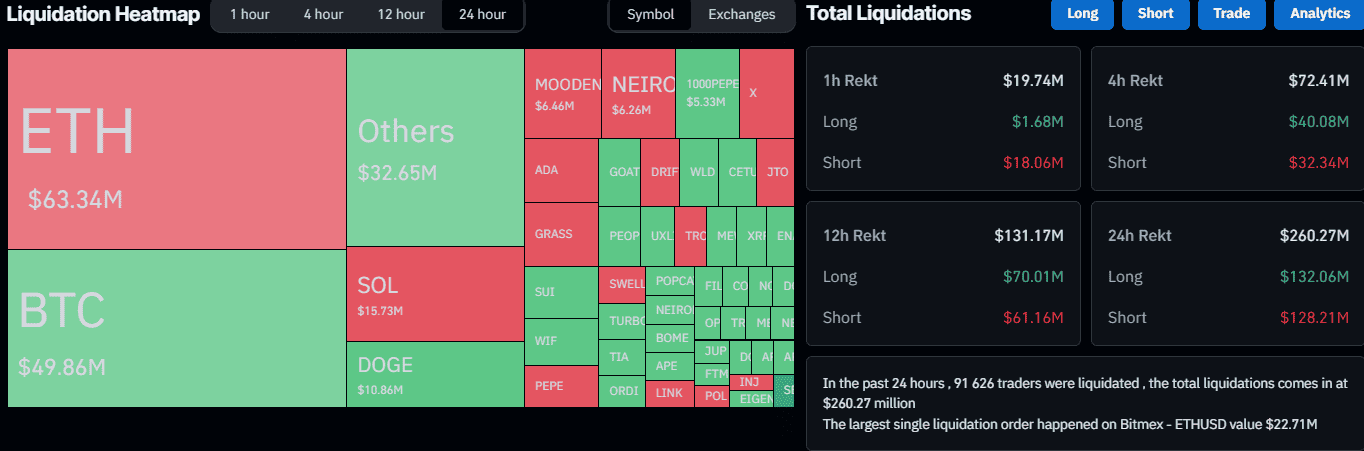

According to information from CoinGlass, yesterday’s price surges resulted in approximately $260 million worth of liquidations. Over 90,000 traders who had overextended themselves were adversely affected, with the largest single position being executed on BitMEX and it was a substantial one.

It’s worth noting that unlike the Bitcoin bear from this past week, the whale we’re discussing here had taken a short position on Ethereum. The estimated loss from this move is approximately $23 million.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Sim Racing Setup Showcase: Community Reactions and Insights

- W PREDICTION. W cryptocurrency

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Dead by Daylight: All Taurie Cain Perks

2024-11-08 22:28