What to know:

- Ether is now trading above $4,000 for the first time since March.

- The price of ETH is higher on Coinbase than on Binance, suggesting U.S. institutional interest in the token.

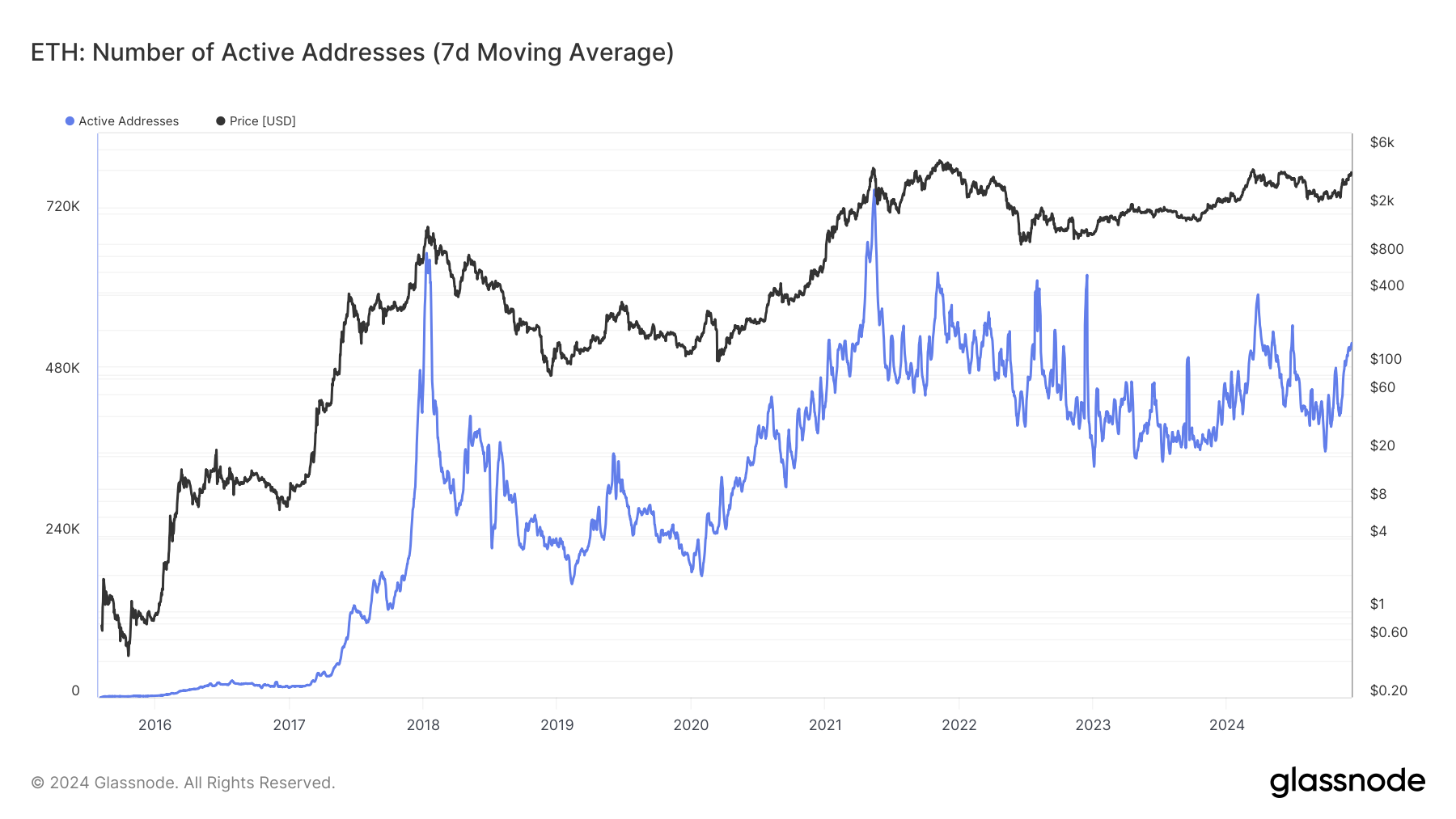

- Active addresses on the Ethereum network have also seen a sharp bump.

As a seasoned crypto investor with a decade-long journey in this digital frontier, I must admit that witnessing Ether’s surge above $4,000 for the first time since March feels like watching a phoenix reborn. The last time we saw such a price was just before the market’s turbulent dip, and it’s heartening to see the resilience of this digital asset.

On Friday, the value of Ethereum’s ether (ETH) surpassed $4,000 for the first time since March.

In the past 24 hours, the second-largest digital currency has increased by 2.4%. Over the last week, it has surged by 8.4%, outpacing bitcoin (BTC) in both periods. This upward trend is occurring as there was a significant influx of investments into spot ether exchange-traded funds on Thursday.

Currently, ether is valued at $4,033, barely 2% from reaching its highest point this year. It’s also approximately 20% short of its record high of $4,868. The ETH/BTC ratio, which has been under pressure since September 2022, has returned to 0.04 – a level that previously signaled a peak for ether compared to bitcoin on November 10.

The Coinbase premium on ether also continues to expand — meaning that ether is trading for a higher price on the exchange than on the most liquid crypto exchange, Binance. Coinbase premiums are generally seen as a sign of demand among U.S. institutional investors as well as retail participants. TradingView data shows a slight increase in ether’s price on Coinbase relative to Binance, suggesting the market is driven by activity from the U.S,., which coincided with the U.S. market opening around an hour ago.

Additionally, it’s worth noting that there’s been a significant rise in active Ethereum addresses based on a 7-day moving average. These numbers have climbed from approximately 368,000 to 523,000, spanning the period from September 24 to December 5. This increase suggests an uptick in on-chain activity, which could potentially boost Ether due to the “burn” mechanism, where increased activity serves to reduce the token’s circulating supply over time.

Currently, the CoinDesk 20 – a collection of the top 20 cryptocurrencies by market capitalization, excluding memecoins, stablecoins, and exchange coins – has decreased by 1.4%. The biggest losers within this group are stellar (XLM) and litecoin (LTC), which have experienced a drop of 3.1% and 5% respectively over the last 24 hours. On a positive note, Uniswap (UNI) and render token (RDNR) have seen significant growth, with gains of 11.7% and 6.4% respectively during the same timeframe.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-06 19:12