In recent weeks, Ethereum‘s price has been adjusting after being turned down at the $4,000 barrier, which was strongly rejected in March. However, there are indications that the market may soon change direction.

Ethereum Price Analysis: Technicals

By TradingRage

The Daily Chart

Every day, the Ethereum price on the graph has been creating a large downward trending channel since the start of the correction. Lately, this channel’s bottom line was tried and touched, causing ETH to bounce back up.

The market has stayed above the $3,000 mark as a floor, giving investors optimism for an uptrend to hit the $3,600 resistance point in the near future. However, if this trend line continues, we may not see significant additional gains.

The 4-Hour Chart

On the 4-hour scale, the latest price movements become more clear. It’s obvious that the price has been held up by the $3,000 support, preventing any further decline. The market appears to be shaping up as it forms a new base.

The cryptocurrency is presently moving toward the middle of its downward trendline, and if it manages to rise above this level, it could provide an opportunity for another attempt to surmount the $3,600 resistance. With the RSI (Relative Strength Index) indicating readings above 50%, there’s a strong possibility that the price will continue climbing in the upcoming days due to the bullish momentum.

Sentiment Analysis

By Shayan

Ethereum Open Interest

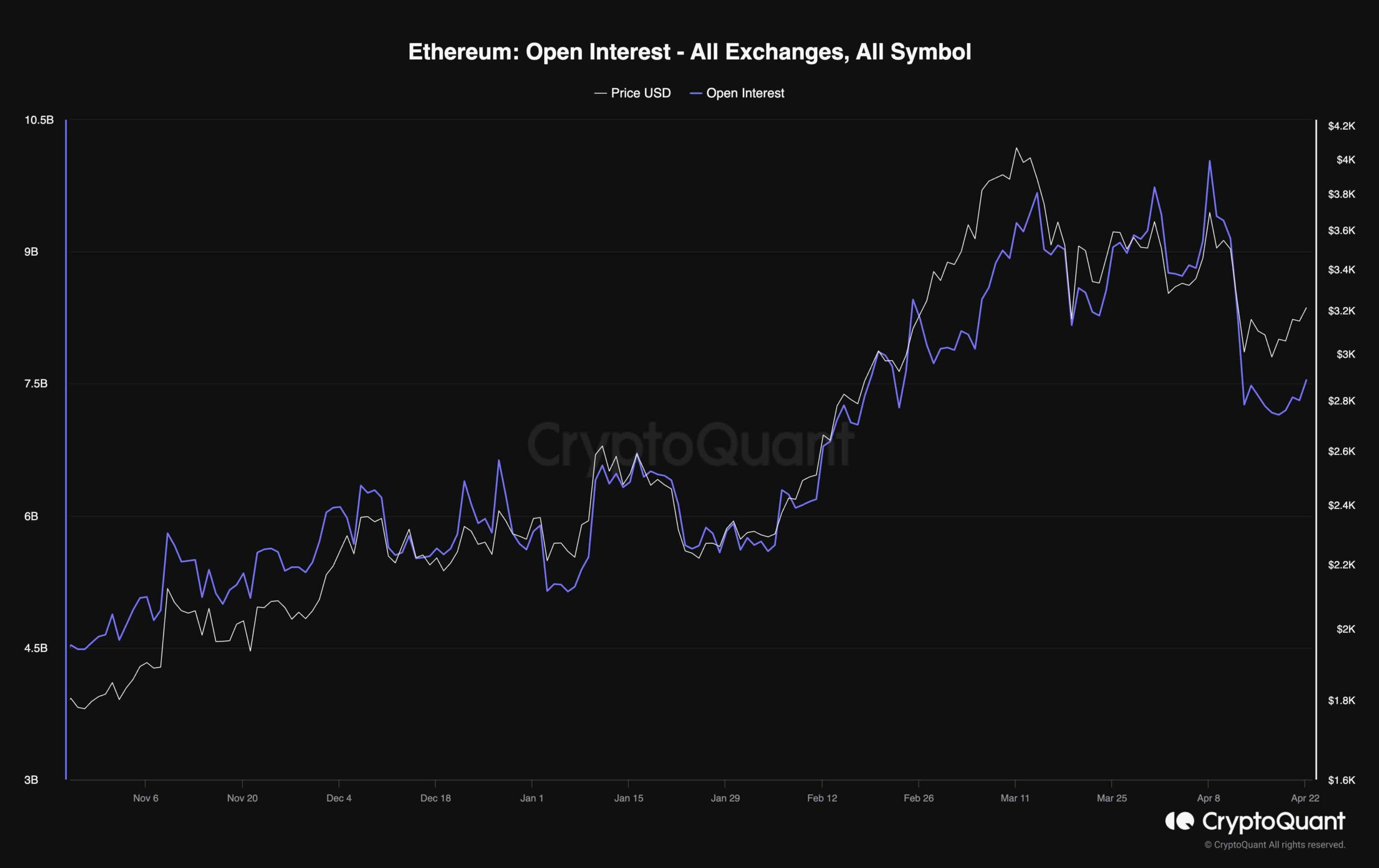

The feeling in futures markets significantly influences large price swings. The balance between buyers and sellers, along with the threat of major position liquidations, fuels market instability.

One simple way to rephrase this: Open Interest serves as a significant measure when evaluating sentiment towards cryptocurrencies. It represents the total number of active, unfilled perpetual futures contracts across multiple crypto exchanges.

Due to Ethereum’s current drop in value, it’s worth mentioning that the Open Interest figure has also gone down significantly. This correlation implies that there’s been less action in the Ethereum futures market recently.

After this development with ETH, there’s a good chance that investors will take new stances, be it by going long or short. This could mark the start of a significant price trend in the cryptocurrency market.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- COW PREDICTION. COW cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- DHT PREDICTION. DHT cryptocurrency

- FIDA PREDICTION. FIDA cryptocurrency

- PSP PREDICTION. PSP cryptocurrency

2024-04-22 14:54