As a seasoned crypto investor with a solid understanding of technical and fundamental analysis, I believe that Ethereum (ETH) has entered a critical support zone following a bearish correction phase. Based on my examination of both the daily and 4-hour charts, I am confident in predicting a mid-term bullish rebound.

Following a downturn in price, the market has now arrived at a pivotal point of resistance. This significant level is determined by the 100-day moving average and the 0.5-0.618 Fibonacci retracement levels.

Given the strong demand at this juncture, a mid-term bullish rebound is looking likely.

Technical Analysis

By Shayan

The Daily Chart

As a researcher studying the Ethereum market, I’ve conducted an in-depth analysis of its daily chart. Upon closer inspection, it appears that Ethereum has found significant support after experiencing a correction. This support zone encompasses the price range between $3421 (0.5 Fibonacci level) and $3289 (0.618 Fibonacci level). Notably, this area aligns with the crucial support provided by the 100-day moving average, which stands at $3387.

In this region, there exists significant prospect for increased market activity, making it an attractive area for investors to consider entering long positions.

Based on the current market conditions I’ve analyzed, I anticipate a rise in demand which could result in a bullish reversal towards the $4K resistance within the mid-term. Nevertheless, if the price falls below this level, the next line of defense for buyers would be the 200-day moving average.

The 4-Hour Chart

The 4-hour Ethereum chart reveals a recent correction, depicted by the formation of a bullish flag pattern in which the price has been consolidating.

As a crypto investor, I closely monitor the price action of my investments. Right now, the cryptocurrency hovers close to the bottom edge of an emerging bullish flag pattern, which is significant because it also aligns with a crucial support level around $3.3K. If this price breaks above the upper boundary of the flag, it could be a strong indication that the bullish trend will persist.

Should purchasers return and stimulate increased demand, the price may surpass the flag’s upper limit of $3.6K, triggering a robust upward trend toward the $4K resistance level.

If the sellers force the price down below the $3.3K support level, a significant decline toward the $2.9K support may ensue. In the long run, the price is predicted to stay within the $3.3K to $3.6K range until a breakout occurs.

Sentiment Analysis

By Shayan

As a market analyst, I recognize that Ethereum’s current position rests on a crucial support level, which holds substantial buying interest. However, to accurately predict Ethereum’s upcoming price actions, it’s indispensable to assess the prevailing market sentiment.

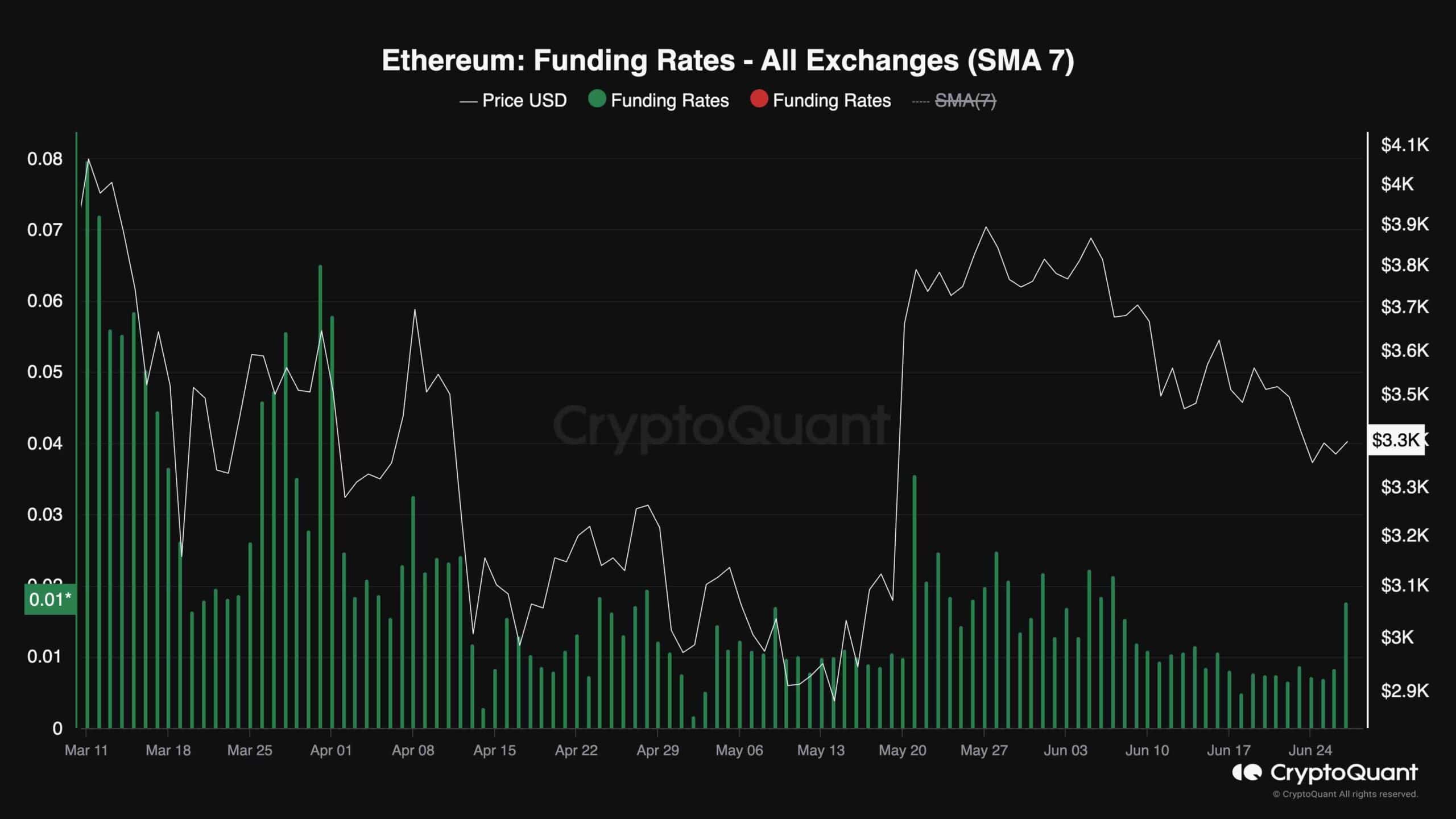

This chart illustrates the Ethereum funding rate, a metric that reveals whether traders are placing buy or sell orders more forcefully. A positive funding rate signifies bullish market attitude, while a negative one suggests bearish sentiment.

Recently, the funding rate metric experienced a significant jump following a brief downturn, aligning with Ethereum’s price correction phase.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development: the recent surge in price suggests that demand may be present just above the crucial support level of $3.3K. If this holds true, it could halt any further downward pressure and potentially spark a bullish reversal. Moreover, if the funding rate metric continues to trend upward, it’s a clear sign that sentiment in the futures market is becoming increasingly optimistic, making a mid-term bullish reversal even more likely.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- EUR AUD PREDICTION

- EUR INR PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

- COTI PREDICTION. COTI cryptocurrency

- FLX/USD

- KUJI PREDICTION. KUJI cryptocurrency

- NBLU/USD

- TURBOS/USD

2024-06-27 17:33