What to know:

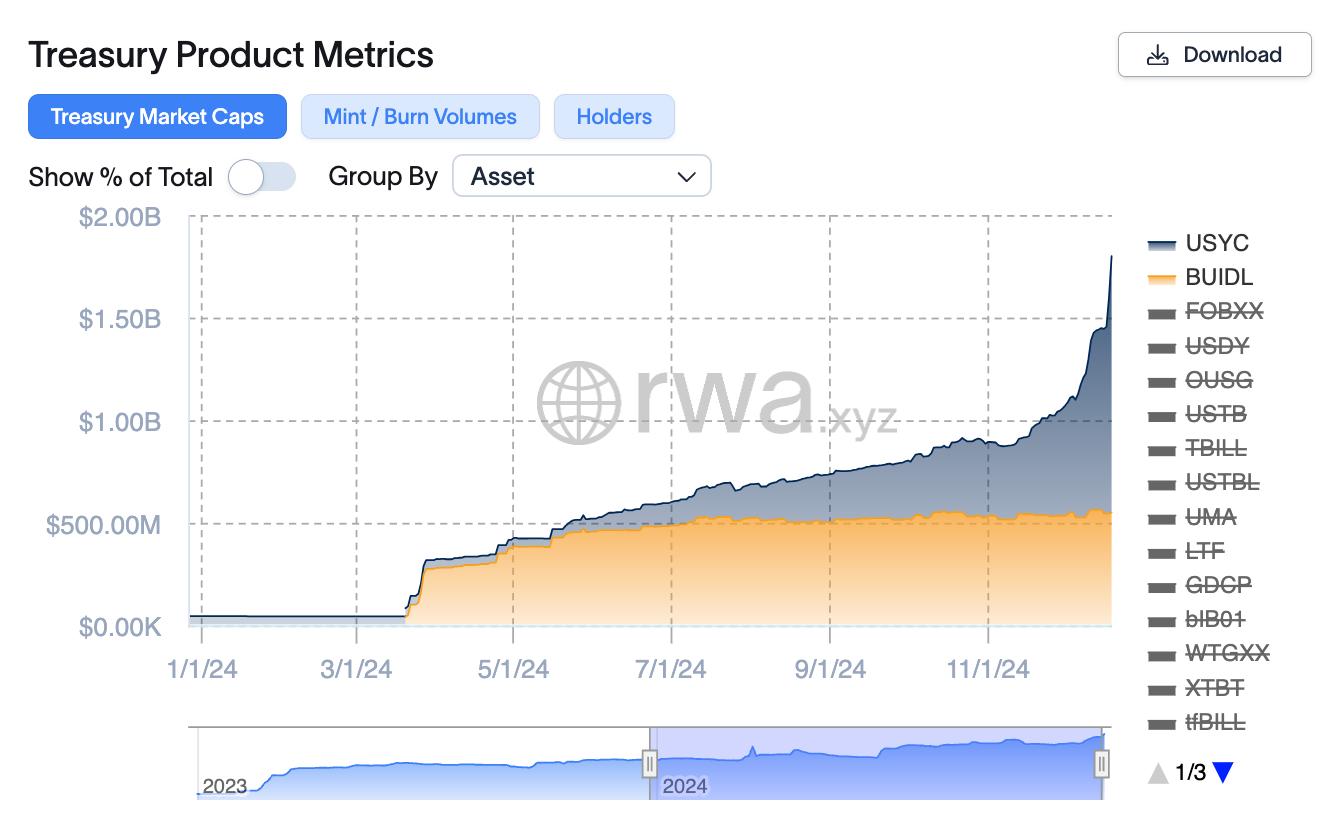

- Asset manager Hashnote’s USYC has become the largest tokenized U.S. Treasury product, toppling BlackRock and Securitize’s BUIDL, rwa.xyz data shows.

- Much of the growth was due to the rapid ascent of DeFi protocol Usual and its USD0 stablecoin, with USYC serving as a primary backing asset.

- Hashnote’s quick growth highlights how tokenized product issuers can grow by making their tokens interconnected with the broader blockchain economy.

As a seasoned researcher with a penchant for exploring the dynamic world of blockchain and finance, I find the rapid growth of Hashnote’s USYC token truly intriguing. Having closely observed the evolution of the tokenized Treasuries market over the past few years, it’s fascinating to see how interconnectivity within the blockchain ecosystem can drive growth and adoption.

There’s been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.

According to rwa.xyz data, the market capitalization of Hashnote’s USYC token surpassed $1.2 billion, more than quadrupling in size during the past three months. This growth has outpaced the $450 million BUIDL token, a large product issued by BlackRock and Securitize, which had been the largest since April.

The USYC token symbolizes the Hashnote International Short Duration Yield Fund, as stated on their official site. This fund primarily invests in short-term financial instruments such as reverse repo agreements involving U.S. government-backed securities and Treasury bills, which are held at the Bank of New York Mellon.

The rapid expansion of Hashnote highlights the significance of integrating tokenized financial products with decentralized finance (DeFi) platforms. This integration allows their tokens to be used as components in other projects, enhancing scalability and broader acceptance – a concept often referred to as composability within cryptocurrency circles. Moreover, it demonstrates growing interest among crypto investors for stablecoins that yield returns, with these stablecoins increasingly tied to tokenized financial products.

For instance, USYC has significantly profited from the swift rise of the emerging decentralized finance (DeFi) platform called Usual, along with its real-world asset-backed, income-producing stablecoin denominated as USD0.

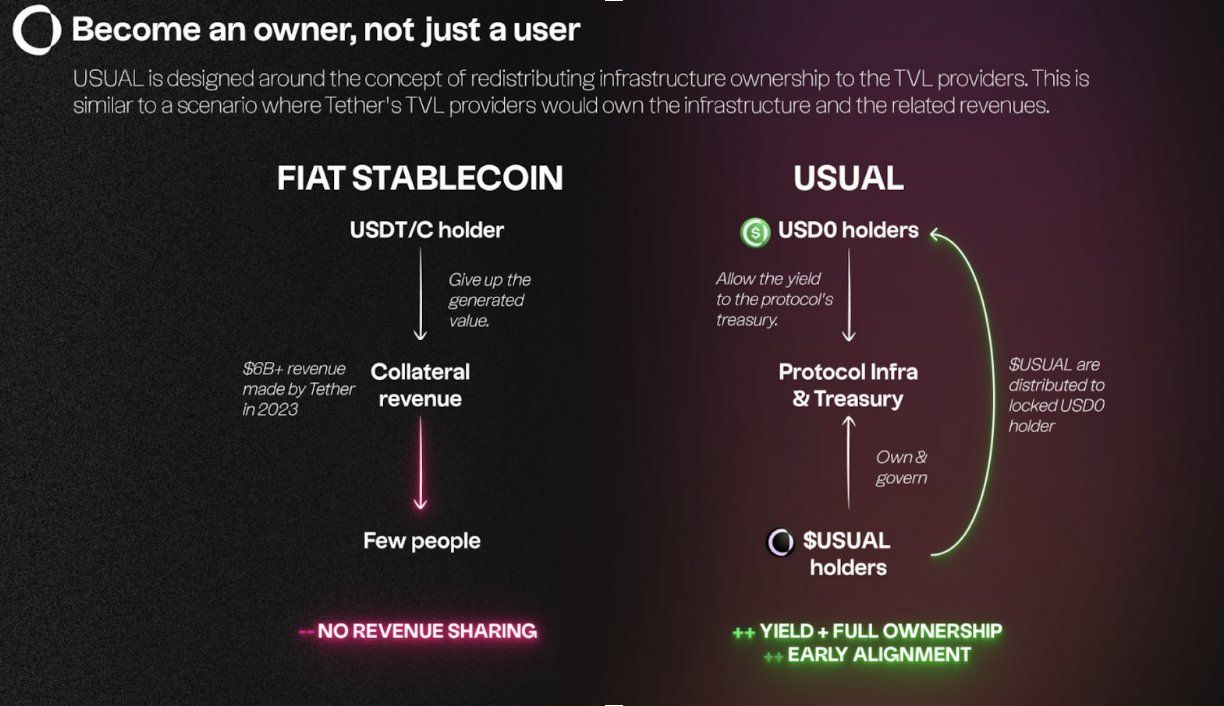

As an analyst, I am observing a strategy being implemented by decentralized stablecoins like USD0, where they are actively competing for market share with centralized options such as Tether’s USDT and Circle’s USDC. This is done by sharing a portion of the revenues generated from backing assets with the holders. Currently, USD0 is predominantly backed by USYC, but the protocol intends to expand its reserve assets by incorporating more Resources-Backed Assets (RWAs) in the future. A recent development is the inclusion of Ethena’s USDtb stablecoin into their reserves, which operates on the BUIDL platform.

According to David Shuttleworth, partner at Anagram, the bull market led to a significant increase in investments into stablecoins. However, he emphasizes that a fundamental concern with the most prominent stablecoins persists: they don’t offer returns for users and do not provide access to the profits they generate. Furthermore, users are unable to acquire ownership of the protocol through holding USDT (Tether) or USDC (USD Coin).

He noted that “Usual” stands out because it returns both the earnings and control within the protocol to its users.

Over the past few months, the protocol’s USD0 stablecoin has accumulated approximately $1.3 billion due to crypto investors seeking profitable on-chain yield prospects. A major factor fueling this growth was the recent airdrop and exchange listing of the protocol’s governance token (USUAL) on Wednesday. USUAL began trading on Binance that same day, outperforming the unstable broader cryptocurrency market by increasing around 50% since then, according to CoinGecko data.

Earlier this year, BlackRock’s BUIDL token experienced significant growth due to the DeFi platform Ondo Finance adopting it as the primary reserve asset for their yield-earning product, specifically the Ondo Short-Term US Government Treasuries (OUSG) token.

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- W PREDICTION. W cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- EUR IDR PREDICTION

- Clash Royale: Is It Really ‘Literally Unplayable’?

- Clash Royale Deck Help: Users Seek Tips To Level Up

- Exploring the Best Non-Final Fantasy Games That Capture FF’s Magic

- What Persona Fans Hope to See in Persona 6 and What Might Disappoint

2024-12-20 23:38