As I ponder upon the tumultuous journey of Changpeng Zhao (CZ), I find myself both awestruck and saddened by the turn of events that have befallen this once-revered figure in the cryptocurrency world. The man who built Binance from scratch, a platform that redefined trading and ushered in a new era of decentralized finance, now finds himself entangled in a web of legal issues, facing criminal charges, and navigating the treacherous waters of regulatory scrutiny.

Speaking about cryptocurrencies often evokes thoughts such as Bitcoin, Ethereum, Binance, blockchain technology, and so forth. However, those who have been immersed in this industry for some time are likely to associate it with Changpeng Zhao – a highly impactful and undeniably crucial figure within the field.

And let me tell you this—his story is full of ups and downs, success and controversy.

As an analyst, I’m discussing an extraordinary individual who, at just 15 years old, was working as a burger flipper and gas pump attendant at a service station. Remarkably, he would go on to establish the world’s largest cryptocurrency exchange. His fortune is estimated to be anywhere from $30 to $60 billion (although the exact figure remains unclear), yet he has faced significant legal challenges with U.S. authorities. After navigating these issues, he channeled his energy into creating an educational platform – a testament to his resilience and vision. This is only a snapshot of his life’s journey.

This is the story of Changpeng Zhao.

Quick Navigation

- Who Is Changpeng Zhao (CZ)?

- Early Life, Family, Education

- CZ’s Introduction to Bitcoin and His First Crypto Roles

- History of Binance

- Expansive Product Ecosystem

- Launch of Binance Coin

- CZ and FTX in 2022

- FTX’s Downfall

- Post-Exit Risk Management

- Legal Challenges and Criminal Charges

- The Next Chapter for CZ

Who Is Changpeng Zhao (CZ)?

Changpeng Zhao (commonly known as CZ) is the co-creator and ex-leader of Binance, a platform he launched in 2017. Alongside him in this venture was Yi He, a prominent Chinese businesswoman who plays a significant role in the cryptocurrency sector.

Under CZ’s leadership, Binance became the largest cryptocurrency exchange globally.

Today, Binance maintains its position as a leading exchange, consistently transacting between 5 and 15 billion dollars daily. In fact, it shattered records in 2022 by processing over 70 billion dollars in a single day. This marked a substantial rise from the platform’s previous highs, which were $56 billion in 2021, $35 billion in 2020, and $15 billion in 2019.

Early Life, Family, Education

1977 saw the birth of Zhao in China’s Jiangsu province. His parents, educators by profession, nurtured an intellectually enriching upbringing for him. Yet, political turmoil disturbed their family life. In response, they moved to Vancouver, Canada at age 12, seeking tranquility amidst China’s evolving political landscape.

For Zhao, adjusting to life in a new country proved challenging due to his busy schedule during his teenage years. He held down several part-time jobs such as working at McDonald’s and a gas station, all while providing for his family.

A pivotal moment in Zhao’s life occurred when his father purchased a 286 DOS computer. This purchase, made years ago, would later play a crucial role in shaping Zhao’s adult life. While still a teenager at McGill University in Montreal, Zhao delved into programming, a passion that served as the foundation for his future accomplishments.

Initially majoring in computer science, this individual later chose a professional path that merged his passion for technology with finance – working at the Tokyo Stock Exchange. His responsibilities primarily involved designing and implementing software to match trade orders, marking one of his initial ventures in finance. Subsequently, he relocated to New York and joined Bloomberg Tradebook, where he spent four years specializing in the creation of futures trading software. This tenure provided him with a wealth of knowledge about high-speed financial systems.

2005 marked the year when Zhao grew weary of perpetual promotions and leading teams in cities like London, New York, and Tokyo. This was the time he determined to establish his first venture, Fusion Systems, situated in Shanghai. This innovative company specialized in constructing high-frequency trading platforms for brokers.

CZ’s Introduction to Bitcoin and His First Crypto Roles

For those well-versed in the world of cryptocurrency, it’s likely no secret that CZ is a strong proponent of Bitcoin. Notably, his wealth has grown substantially through his BTC investments, with predictions estimating his net worth to be between $40-$60 billion by September 2024.

But how CZ got into Bitcoin is way wilder than it sounds. To give an idea, if you think that selling or mortgaging your house to buy BTC is a funny, recurring joke in the crypto community, well, it wasn’t for CZ. This man embodied the meaning of degeneracy once he discovered Bitcoin.

Back in 2013, during a poker game, my interest in cryptocurrency was sparked by Bobby Lee, not the comedian, but the founder of BTCC, China’s pioneering crypto exchange. He introduced me to Bitcoin and suggested I invest 10% of my funds into this digital currency.

Contemplate how CZ might respond upon discovering Bitcoin and blockchain tech. Intrigued, he chose to sell his apartment in Shanghai, utilizing the earnings along with all his savings, to invest in Bitcoin. This decision likely stirred up some anxiety among his family members, showcasing his unwavering commitment.

As a passionate crypto investor, I didn’t limit my focus to just Bitcoin. Instead, my fascination with blockchain technology led me to immerse myself in numerous projects related to cryptocurrencies. During this journey, I had the privilege of serving as the head of development at Blockchain.com (previously known as Blockchain.info). It was here that I crossed paths with many influential figures in the crypto space—founders and advocates alike.

In the year 2014, I was fortunate enough to be recruited by Yi He, who had co-founded OKCoin earlier that year, and eventually took on the role of Chief Technology Officer (CTO) within the company.

Previously, OKCoin ranked among the world’s top cryptocurrency exchanges; however, its co-founder Changpeng Zhao (CZ) and He departed in 2015 because they held divergent views and values compared to other leaders within the company.

Approximately two years after their initial partnership, CZ and He established Binance together. From there, events unfolded that we’ll delve into more detail within the Binance segment of our discussion.

History of Binance

In just eight short months following its debut, Binance had risen to become the global leader in cryptocurrency trading volume. Such swift success is truly remarkable, but what sets Binance apart from other well-established crypto companies?

Indeed, the significant growth of this exchange within the crypto sector can be largely credited to a combination of factors such as groundbreaking technology and strategic international development.

Right from its inception, Binance has focused on incorporating cutting-edge tech and ensuring a smooth user interface. The founder, CZ, leveraged his knowledge gained from high-frequency trading during his tenure at Fusion Systems to construct a system that can process numerous transactions every second.

Just like a chameleon adapting to its surroundings, Binance seamlessly adjusts to shifts in the market, keeping itself fresh and competitive. From introducing novel trading options, such as leveraged tokens, to diving into the NFT scene, this exchange’s agility in responding to burgeoning trends has allowed it to claim a significant portion of the crypto market across various niches.

Expansive Product Ecosystem

Swiftly expanding from a simple trading platform, Binance transformed into a comprehensive crypto solution offering services like spot trading, futures, options, and peer-to-peer trading. This versatile platform accommodates various investing styles, ranging from cautious and risk-averse traders to aggressive memecoin traders seeking over 20 times leverage.

Currently, Binance provides numerous services and goods, ranging from trading options to educational resources like Binance Academy. Additionally, they have a Launchpad, an incubator that’s part of Binance Labs, the exchange’s venture capital arm which Yi He has successfully led in one instance. The list continues with more offerings from Binance.

Launching Binance Smart Chain (originally known as BSC but now also referred to as BNB Chain in 2020) broadened its influence into the Decentralized Finance (DeFi) sector, enabling developers to construct various types of decentralized applications (dApps) by utilizing a diverse set of resources and development tools.

Through an expansive range of crypto-related services, Binance has become a multifaceted centerpoint in the cryptocurrency world. Now, the BNB Chain ranks among the most substantial crypto ecosystems, boasting over $4 billion in total value locked (TVL). At its zenith in April 2021, the BNB Chain amassed more than $20 billion in cumulative deposits; however, Ethereum retained the lead with a TVL of $70 billion.

Launch of Binance Coin

As a researcher delving into the world of cryptocurrencies, I’ve found that the advent of Binance Coin (BNB) has been instrumental in drawing more participants to Binance. Beyond this, it has provided significant advantages for CZ and the team associated with its development.

BNB was created as a means to finance growth and extend the reach of the Binance platform beyond just trading. It debuted during an Initial Coin Offering (ICO) in July 2017, amassing $15 million for the development of the Binance exchange.

During the ICO, a total of 200M BNB tokens were issued, with the following allocation:

- 50% (100 million BNB) for public sale

40% (80 million BNB) for the Binance team

10% (20 million BNB) for angel investors

This token is exceptionally useful due to its substantial market fluidity, but what truly sets it apart is that it offers traders a 25% reduction in trading fees if they own the coin.

BNB, while not the first currency tied to a crypto exchange, offered some unique perks that other exchanges lacked, mostly due to BNB’s multi-faceted utility within the ecosystem. Moreover, BNB, which was originally an ERC-20 coin, came two years before the Binance Chain, was founded, which means BNB ultimately migrated to the BEP2 standard, which is still used today in the BNB Chain ecosystem.

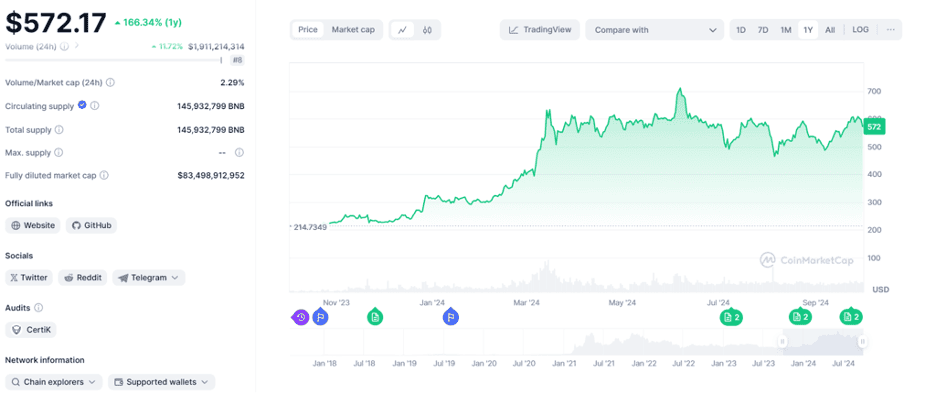

As per CoinMarketCap, Binance Coin (BNB) is one of the major cryptocurrencies currently available. Typically, it holds either the fourth or fifth position among the top assets based on market capitalization. In June 2024, BNB reached a record high of $720.6.

Every three months, Binance sets aside 20% of its earnings to purchase and destroy BNB tokens. This process progressively decreases the number of BNB tokens in circulation. The goal is to lower the total BNB supply from 200 million to just 100 million. In April 2024, Binance executed its 27th quarterly burn, removing approximately 1.94 million BNB worth around $670.78 million.

CZ and FTX in 2022

The collapse of FTX, which turned out to be a significant scandal, is likely considered one of the most important events in cryptocurrency history, occurring in November 2022.

Established by Sam Bankman-Fried (SBF) in 2017, FTX soon became a significant player within the cryptocurrency exchange market. The sister company to FTX, Alameda Research – also founded by SBF along with his former partner Caroline Ellison – had strong ties with FTX, frequently employing the native token, FTT, as security for its trading activities. This tight bond between the two entities implied that their financial stability was significantly tied to FTT.

It seems highly problematic, and it’s unfortunate that such a detailed expose on the companies’ questionable financial dealings has indeed surfaced.

On November 2nd, 2022, CoinDesk shared a finding in their report indicating that a significant proportion of Alameda Research’s holdings were made up of FTT tokens.

Of course, alarm bells began to sound, sparking worries about the company’s solidity, as it showed a heavy dependence on an internal token instead of safer resources. Notably, Alameda had a significant portion of $3.6 billion worth of FTT tokens that were not locked, making up approximately 25% of its total assets valued at $14.6 billion.

Post-Exit Risk Management

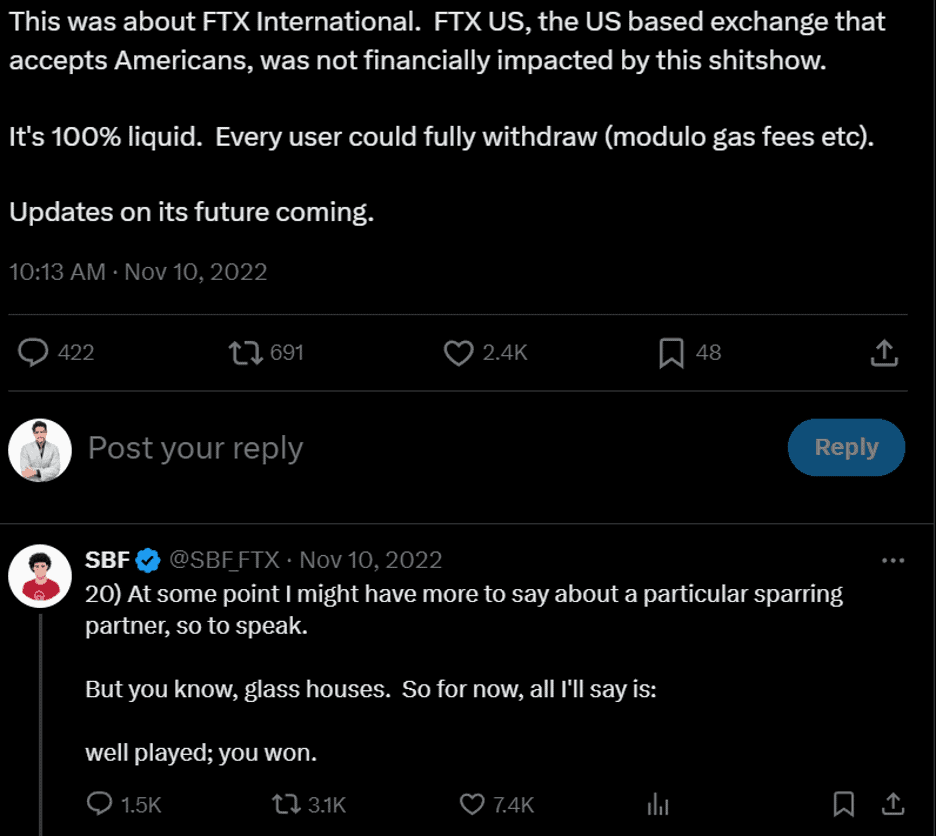

In an attempt to rescue FTX, SBF negotiated a preliminary deal with Binance on November 8, whereby Binance would take over FTX’s international operations, excluding the United States. But after thoroughly reviewing FTX’s financial management, Binance decided to back out from the agreement on November 9, raising questions about FTX’s business practices which ultimately led to FTX’s downfall.

At first, I had contemplated the prospect of CZ acquiring FTX, but upon scrutinizing their financial statements, I found myself utterly bewildered. To put it bluntly, I stumbled upon a gaping $8 billion hole in their accounts, which was quite unexpected. To make matters worse, it appeared that the founder had been using clients’ funds to finance various ventures such as political campaigns and other activities.

It’s worth pointing out that Binance and FTX, initially collaborative entities, began to view each other as rivals as FTX grew into a formidable competitor. Leaked conversations suggest that Bankman-Fried harbored a poor opinion of Zhao, often using disparaging language towards him, which suggests an increasing tension between the two parties.

The action taken by CZ (Changpeng Zhao) to shut down FTT (Futures Token) can be viewed from several perspectives – it could have been a defensive measure for Binance or a tactical move against a rising competitor, or maybe a combination of both. There’s no clear agreement on this matter, but what is certain is that Binance’s open actions have heightened concerns and exposed potential weaknesses in FTX’s system, especially the heavy dependence on tokens such as FTT.

Due to its significant use of Funding-Based Token Trading (FTT), Alameda Research incurred considerable losses. Additionally, it was accused of employing funds from FTX’s customers to cover up its trading losses.

When Binance revealed they would sell off their FTT shares, SBF sought to allay concerns by stating that FTX possessed sufficient assets to meet creditor demands, all the while hinting that Binance’s decision was driven by a desire to undermine a rival in the market.

Legal Challenges and Criminal Charges

In late 2022, a sequence of examinations initiated by American regulatory entities started causing troubles for Zhao. These investigations escalated over time, with allegations that he didn’t establish sufficient anti-money laundering safeguards at Binance. As a result, the Department of Justice (DOJ) and other regulatory bodies have been delving deeply into these matters, which has prolonged their investigation.

In the chilly month of November 2023, I found myself standing before a court, confessing to charges related to money laundering infractions. This confession came after it was revealed that Binance, the platform I lead, had handled more than 100,000 transactions that raised red flags due to their association with illicit activities, including ties to notorious entities such as al-Qaeda and ISIS.

Zhao lived in Dubai, but due to the judge’s decision, they were now required to remain in the U.S. instead.

In accordance with his settlement arrangement, Zhao resigned from his position as CEO and was ordered to personally pay a fine of $50 million. On April 30, 2024, he was handed a four-month prison sentence—a term that attracted significant attention on the prediction marketplace Polymarket—which was shorter than the three years initially proposed by prosecutors, thanks to his assistance to law enforcement and favorable character testimonials.

In a turn of events, Binance itself was subjected to significant legal hurdles, reaching an agreement to pay one of the most substantial fines ever recorded: a staggering $4.3 billion, as part of settlements for multiple inquiries concerning compliance and sanctions. Consequently, some services and products had to be temporarily halted or discontinued entirely.

Some of the consequences included:

- Operational Restrictions: Binance now faces increased regulatory scrutiny worldwide, resulting in operational challenges and reduced willingness from financial institutions to engage with the exchange. This has led to compliance difficulties and limited market access.

- Declining Investor Confidence: The legal issues have shaken investor trust, prompting many users to withdraw funds from Binance amid concerns about its stability and potential future legal repercussions. This exodus has triggered worries about Binance’s liquidity and operational efficiency.

- Shift Toward Compliance: In response to these challenges, Binance has prioritized enhancing its compliance systems to meet regulatory requirements. This marks a significant departure from its previous rapid expansion approach, which often lacked stringent oversight.

- Leadership Changes: With CZ stepping down, Binance has entered a new phase under the leadership of Richard Teng, who has taken over as CEO. Teng’s primary task is to guide Binance through ongoing legal hurdles while ensuring that it maintains operational integrity.

After his release in September 2024, Zhao was prohibited from participating in any Binance-related activities, as stipulated by the conditions of his plea deal.

The Next Chapter for CZ

After considering everything that’s been discussed, what does the future hold for CZ? The entrepreneur mentioned on X that he continues to be a keen investor, yet he desires a break to unwind and ponder over his previous choices.

It appears that the Giggle Academy is thriving quite nicely. This venture might just be CZ’s crowning achievement so far, given its integration of game-based learning concepts and adaptive education techniques facilitated by blockchain technology.

And Binance?

Indeed, though prohibited from all company matters, his impact remains substantial due to his 90% ownership stake. This closing note carries a touch of humor, irony, and satire that’s fitting for the chapter’s conclusion.

Read More

- W PREDICTION. W cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- REF PREDICTION. REF cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- USD NZD PREDICTION

- LAZIO PREDICTION. LAZIO cryptocurrency

- CTC PREDICTION. CTC cryptocurrency

2024-10-08 11:14