As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility. However, the recent price dump in bitcoin and the wider crypto markets has left me feeling uneasy.

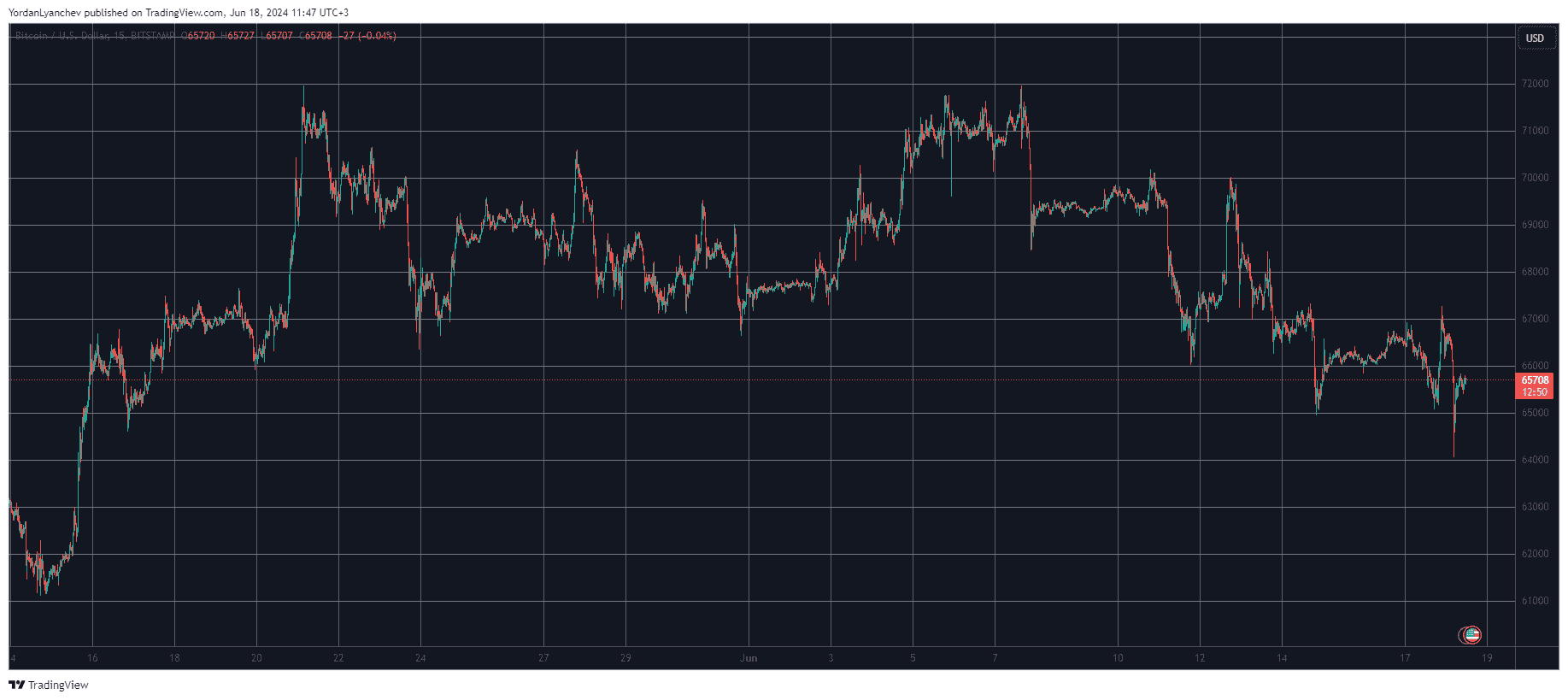

Over the tranquil weekend, Bitcoin‘s value took a sharp turn downward within the last dozen hours or so, reaching a monthly minimum of $64,000 due to increasing withdrawals from the spot Exchange-Traded Funds (ETFs).

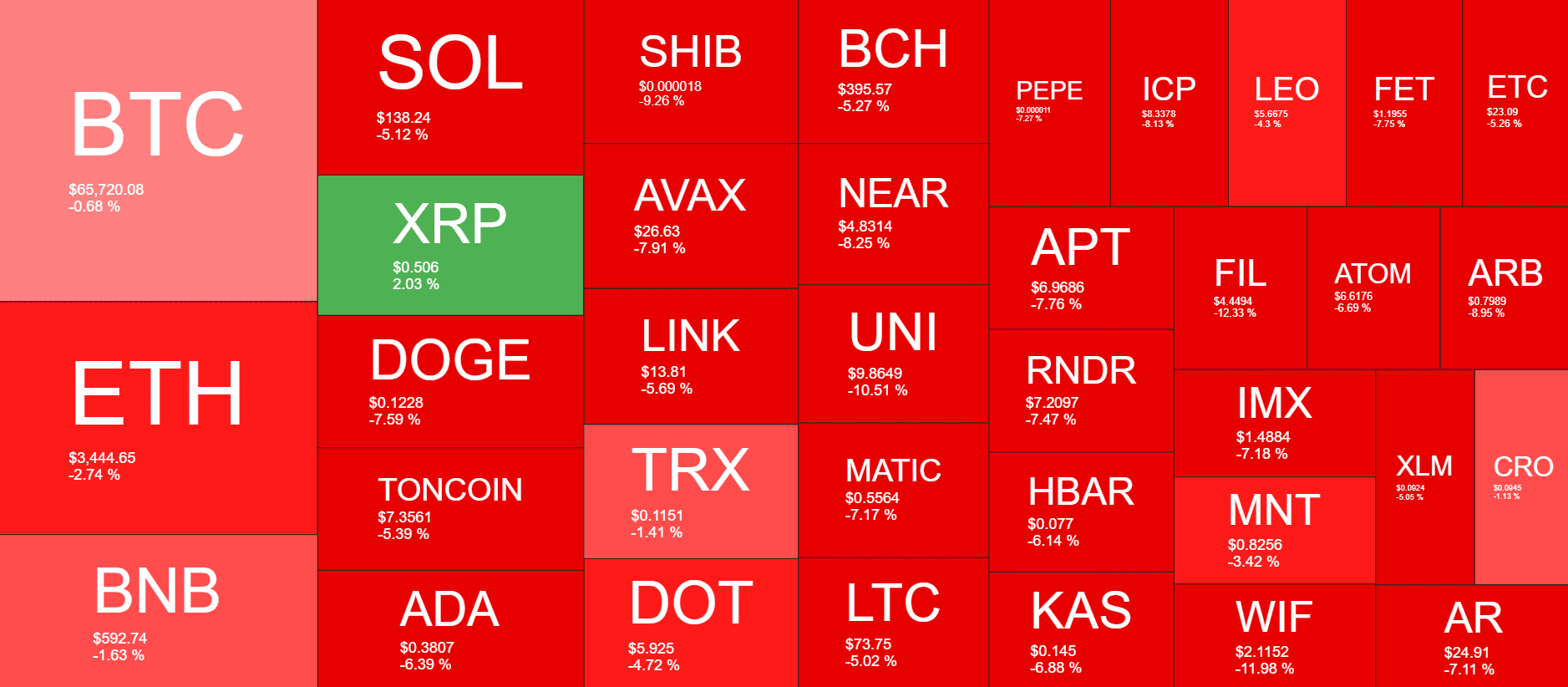

At one point, over $100 billion disappeared from the crypto markets in a flash, with most alternative coins experiencing significant price drops.

BTC Goes Low

Last week, Bitcoin made several attempts to surpass the $70,000 mark, but was unsuccessful each time. The most recent effort occurred following the release of positive US Consumer Price Index (CPI) data on Wednesday, which caused Bitcoin’s price to rapidly climb from around $67,000 to hit $70,000 almost instantly.

As an analyst, I’d rephrase that as follows: The bears pounced on the market when the US Federal Reserve announced no plans for interest rate cuts, causing a dramatic sell-off in Bitcoin. By the end of Friday, the cryptocurrency had plummeted by $5,000 and was trading at around $65,000.

Over the weekend, Bitcoin’s price remained more stable and serene, hovering above $66,000. The tranquility continued into Monday’s trading, but the bulls’ efforts to push the price up to $67,000 didn’t gain much ground. Consequently, a rejection ensued, causing Bitcoin to plunge to a monthly low of $64,000, resulting in approximately $500 million worth of liquidations.

Price reductions occurred simultaneously with the withdrawal of $145.9 million from exchange-traded funds (ETFs) in a recent round of investment shifts.

The market value of Bitcoin (BTC) has dropped beneath $1.3 trillion, whereas its control over the alternatives has increased by 0.7% to reach a commanding 52.1%.

Alts See Nothing but Red

As a crypto investor, I’ve noticed that Bitcoin’s recent correction hasn’t spared alternative cryptocurrencies either. For instance, Shiba Inu (SHIB), Uniswap (UNI), and Dogecoin (WIF) have all seen declines of approximately 10%. This indicates a stronger dominance of Bitcoin in the market during these turbulent times.

These cryptocurrencies – Solana, Dogecoin, Toncoin, Cardano, Avalanche, and Chainlink – are currently experiencing significant losses. DOT is hovering just above the $6 mark, on the verge of dropping further. Ethereum (ETH) and Binance Coin (BNB) are also in the red.

Among larger-alternative cryptocurrencies, XRP stands alone with its recent price surge. The native token of Ripple has ascended above $0.5, bucks the general downtrend in the crypto market.

In simpler terms, the overall value of all cryptocurrencies has dropped below $2.5 trillion in the last 24 hours, representing a loss of approximately $100 billion compared to yesterday’s highest point.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- GBP CAD PREDICTION

- WOO PREDICTION. WOO cryptocurrency

- INR RUB PREDICTION

- USD PLN PREDICTION

2024-06-18 12:07