What to know:

As a seasoned investor and market analyst with over two decades of experience under my belt, I find myself constantly amazed by the dynamic nature of the cryptocurrency landscape. The growth of memecoins, in particular, is a testament to the power of social media and the allure of speculative investments.

By Omkar Godbole (All times ET unless indicated otherwise)

In simpler terms, as we wait for the Federal Reserve’s interest rate decision today, there’s a lot of talk about the possibility of another rate reduction. This could potentially encourage more investment risks in the economy and financial markets. In the crypto market specifically, investors seem to be taking fewer risks in anticipation.

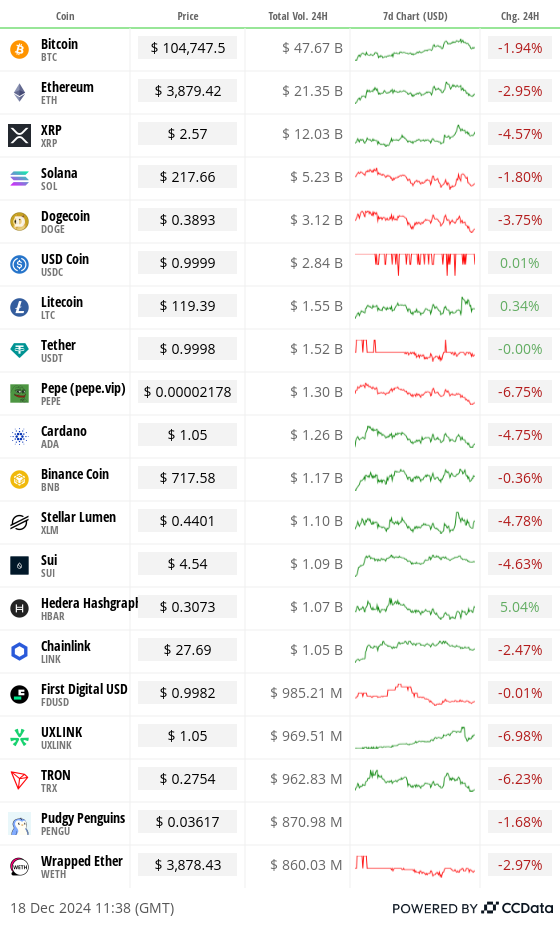

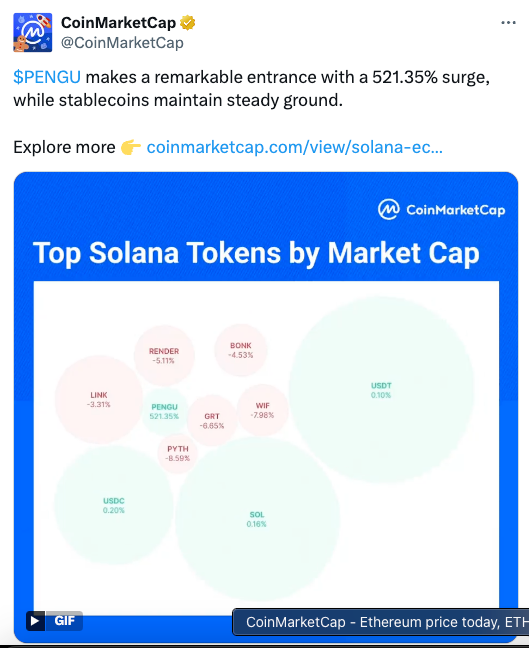

In this scenario, the central bank is predicted to announce three interest rate reductions instead of the four it initially forecasted for 2025, and also adjust its growth and inflation projections upward. Consequently, bitcoin, ether, and smaller digital tokens are seeing nearly a 2% drop in value, leading to larger losses among small-cap tokens such as Pudgy Penguins’ PENGU token, which has fallen more than 50% since its airdrop on Tuesday.

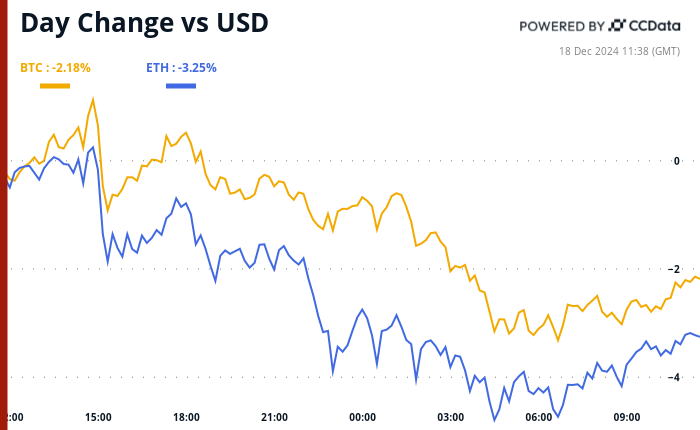

In both Bitcoin (BTC) and Ethereum (ETH), the prices for initial transactions have already decreased, indicating a sense of caution among traders. Similarly, traditional markets are preparing for potential interest rate increases.

In simpler terms, when everyone anticipates a particular outcome to such an extent, there’s often a chance for surprise or letdown. If the predicted interest rates remain unchanged, or if Chairman Jerome Powell addresses concerns about persistent inflation at his press conference while maintaining a flexible stance based on data, it could lead to a significant rise in risky investments like cryptocurrencies.

In the realm of cryptocurrencies, Virtual – the indigenous token of AI-based platform Virtuals Protocol – could potentially outperform, as it has increased by 11% during Asian trading hours. This intriguing trend in AI within crypto, particularly in social trading, is being hailed for its potential to leverage data-driven insights and automation to strengthen traders’ abilities, according to Neal Wen, the head of global business development at Kronos Research.

At the moment, the HYPE token from the prominent on-chain perpetuals platform HyperLiquid is seeing a 4% increase in trading value. The surge seems to be driven by buzz on social media regarding restricted exchange availability and the retention of tokens, which are potential triggers for this rally.

Keep in mind, avoid becoming complacent. Many experts believe that the decision for future interest rate reductions largely depends on the core PCE data released this Friday, which is the Federal Reserve’s primary gauge of inflation.

Valentin Fournier, a BRN analyst, stated: “Today, the Federal Reserve will announce a reduction of 0.25% in interest rates – this will be their final cut for the year. Any subsequent cuts might hinge significantly on the Core PCE report due out on Friday, which is projected to remain at 3.3% annual increase. Should there be any unexpected spikes in inflation, it could potentially unsettle financial markets, especially since bitcoin has been experiencing some bearish trends and lacks a strong upward trajectory.

Moreover, the decrease in returns on Chinese government bonds is causing concern among analysts at The Wall Street Journal, who warn that the second-largest global economy may be heading towards a depressive phase characterized by extended economic downturn and escalating joblessness.

These concerns could easily destabilize global markets, so it’s definitely a good time to stay alert.

Token Events

- Governance votes & calls

- Venus Protocol is officially expanding to Base. VIP-408 passed the governance vote and users can access Venus on Base on Dec. 19.

- Unlocks

- Metars Genesis to unlock 11.87% of MRS circulating supply, worth $11 million at current prices.

Token Talk

By Shaurya Malwa

Early PENGU buyers are learning the perils of low liquidity the hard way.

On Tuesday, the debut of the Pudgy Penguins ecosystem token was met with immense excitement. Its allure stemmed from its connection to an established NFT collection, causing a buying frenzy fueled by anticipation of rapid profits. However, the token had already accumulated sufficient liquidity at launch, resulting in early, eager buyers purchasing the token at a staggering $5 trillion market capitalization.

In simpler terms, liquidity refers to the ease with which you can purchase or sell an asset without affecting its value too much. Initially, for the cryptocurrency PENGU, the market had a limited number of buyers and sellers, resulting in a shallow pool that couldn’t maintain price stability effectively.

One unlucky trader lost big on the airdrop, turning $10,000 into less than $5 in seconds. Just before the official airdrop, they had swapped 45 wrapped Solana for PENGU but got only 78 tokens due to a glitch in Jupiter’s decentralized exchange. The trade was sent to a low-liquidity pool on Raydium, inflating the token’s price to an unrealistic $14 trillion market cap. This mishap was due to low liquidity, where even small trades can cause huge price swings.

The PENGU token was created weeks before its launch, leading to premature trading and significant losses for those who jumped in too early without checking the market cap.

Derivatives Positioning

- Positioning in BTC futures is heating up, with open interest approaching the November high of 663.71K BTC. Meanwhile, ETH open interest has hit a record of over 339K ETH.

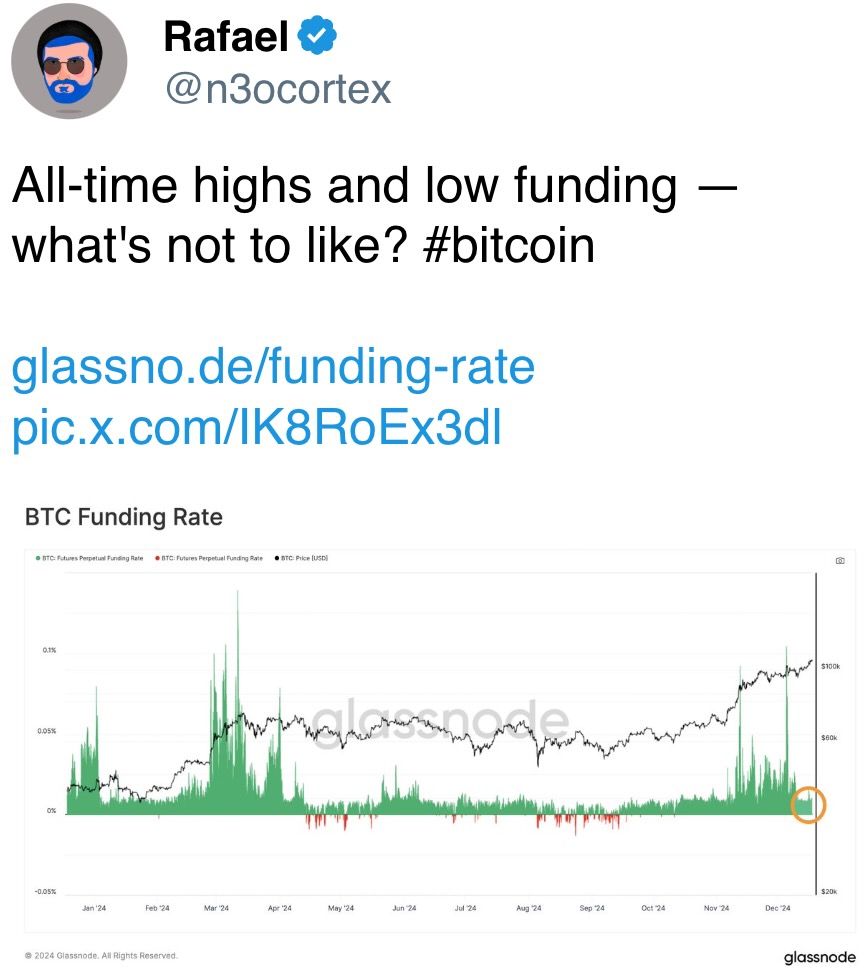

- Funding rates in perpetuals tied to major coins are holding steady at around an annualized 10%, bang in the middle of the -200% to 200% range, which marks the extremes for bearish and bullish sentiment.

- Front-end BTC and ETH puts are trading at a premium to calls, highlighting demand for downside protection ahead of the Fed’s interest-rate decision.

- Top BTC block trades include a bear call spread involving calls at strikes $104,000 and $105,000 and a standalone long position in the $95,000 put expiring on Jan. 3.

Market Movements:

- BTC is down 1.72% from 4 p.m. ET Tuesday to $104,593.98 (24hrs: -1.96%)

- ETH is down 1.44% at $3,876.29 (24hrs: -2.89%)

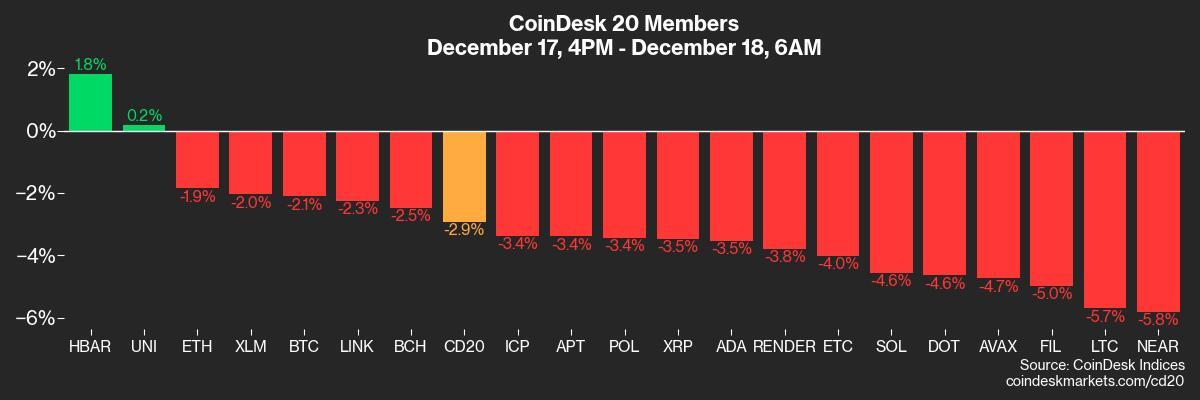

- CoinDesk 20 is down 3.03% to 3,830.21 (24hrs: +3.4%)

- Ether staking yield is up 2 bps to 3.18%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 106.90

- Gold is up 0.76% at $2,664.40/oz

- Silver is up 1.08% to $30.90/oz

- Nikkei 225 closed -0.72% at 39,081.71

- Hang Seng closed +0.83% at 19,864.55

- FTSE is up 0.23% at 8,214.42

- Euro Stoxx 50 is up 0.32% at 4,958.35

- DJIA closed on Tuesday -0.61% to 43,449.9

- S&P 500 closed -0.39% at 6,050.61

- Nasdaq closed -0.32% at 20,109.06

- S&P/TSX Composite Index closed -0.11% at 25,119.7

- S&P 40 Latin America closed +0.16% at 2,280.58

- U.S. 10-year Treasury was unchanged at 4.4%

- E-mini S&P 500 futures are up 0.25% to 6,069.00

- E-mini Nasdaq-100 futures are up 1.58% to 22,363.25

- E-mini Dow Jones Industrial Average Index futures are up 0.2% at 43,563.00

Bitcoin Stats:

- BTC Dominance: 57.78% (24hrs: -0.33%)

- Ethereum to bitcoin ratio: 0.037 (24hrs: +1.04%)

- Hashrate (seven-day moving average): 776 EH/s

- Hashprice (spot): $63.4

- Total Fees: $1.4M/ 12.7 BTC

- CME Futures Open Interest: 212,635 BTC

- BTC priced in gold: 39.4oz

- BTC vs gold market cap: 11.22%

- Bitcoin sitting in over-the-counter desk balances: 406,700 BTC

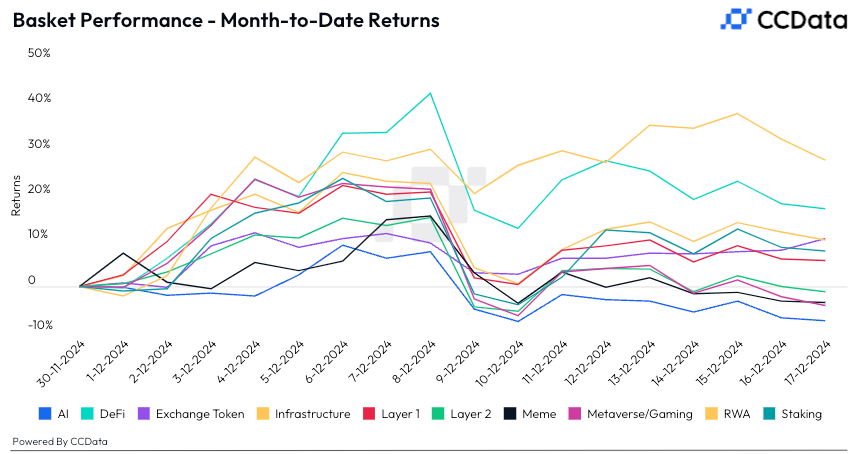

Basket Performance

Technical Analysis

- BTC’s dominance rate has bounced from 55% to nearly 58% in two weeks, retaking the year-to-date bullish trendline.

- It’s a sign of renewed investor preference for bitcoin over altcoins.

Crypto Equities

- MicroStrategy (MSTR): closed on Tuesday at $386.42 (-5.41%), up 0.45% at $388.15 in pre-market.

- Coinbase Global (COIN): closed at $311.64 (-1.16%), down 0.98% at $308.60 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.67 (-3.01%).

- MARA Holdings (MARA): closed at $24.60 (+0.16%), down 1.5% at $24.23 in pre-market.

- Riot Platforms (RIOT): closed at $13.97 (-0.43%), down 1.36% at $13.78 in pre-market.

- Core Scientific (CORZ): closed at $16.03 (-3.2%), down 1.19% at $15.84 in pre-market.

- CleanSpark (CLSK): closed at $12.36 (-0.96%), down 0.49% at $12.30 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.04 (-1.89%), down 0.48% at $28.90 in pre-market.

- Semler Scientific (SMLR): closed at $74.73 (+0.31%), up 2.97% at $76.93 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $493.9 million

- Cumulative net inflows: $36.70 billion

- Total BTC holdings ~ 1.136 million.

Spot ETH ETFs

- Daily net inflow: $144.7 million

- Cumulative net inflows: $2.46 billion

- Total ETH holdings ~ 3.530 million.

Overnight Flows

Chart of the Day

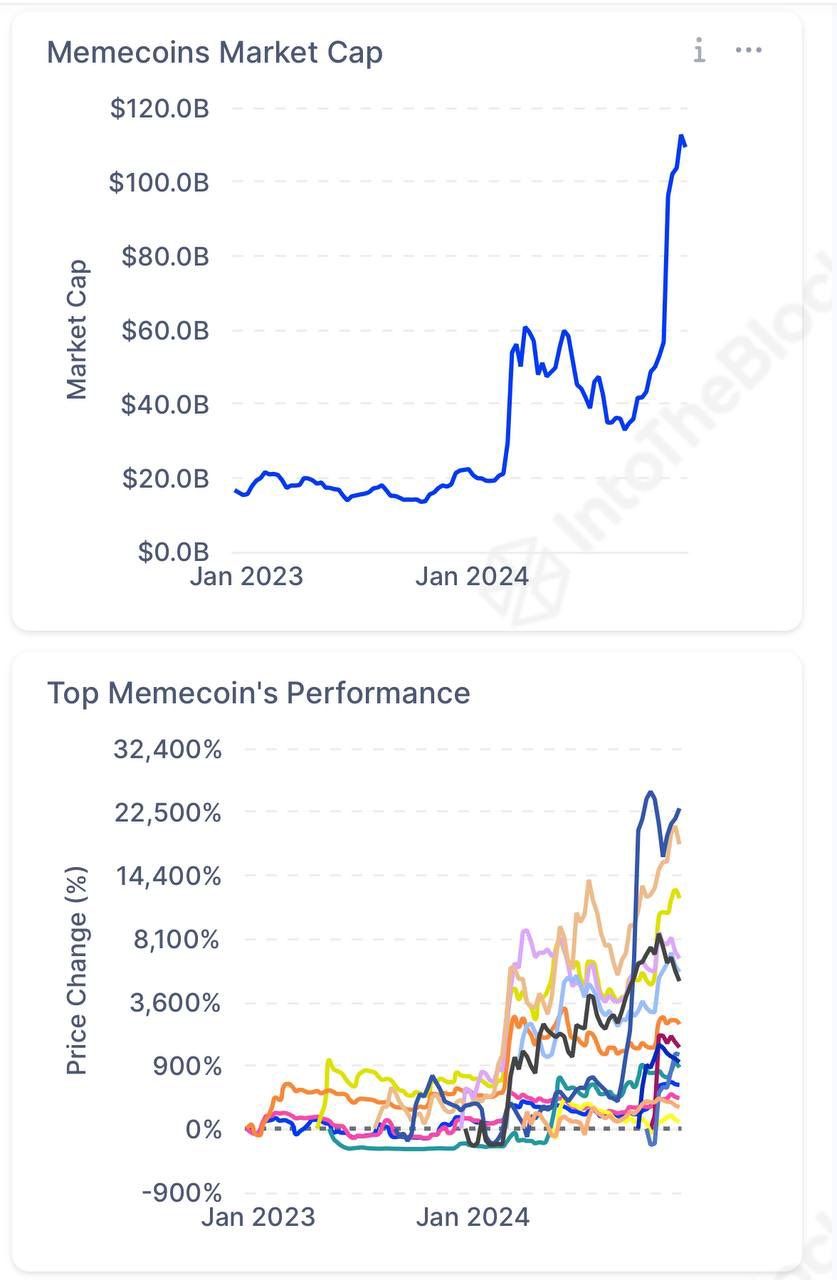

- The chart shows the explosive growth of the memecoin subsector, which has now surpassed $100 billion in market value.

- It’s evidence of how speculative allure and a successful social-media strategy can drive investors to take risk.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-18 15:16