What to know:

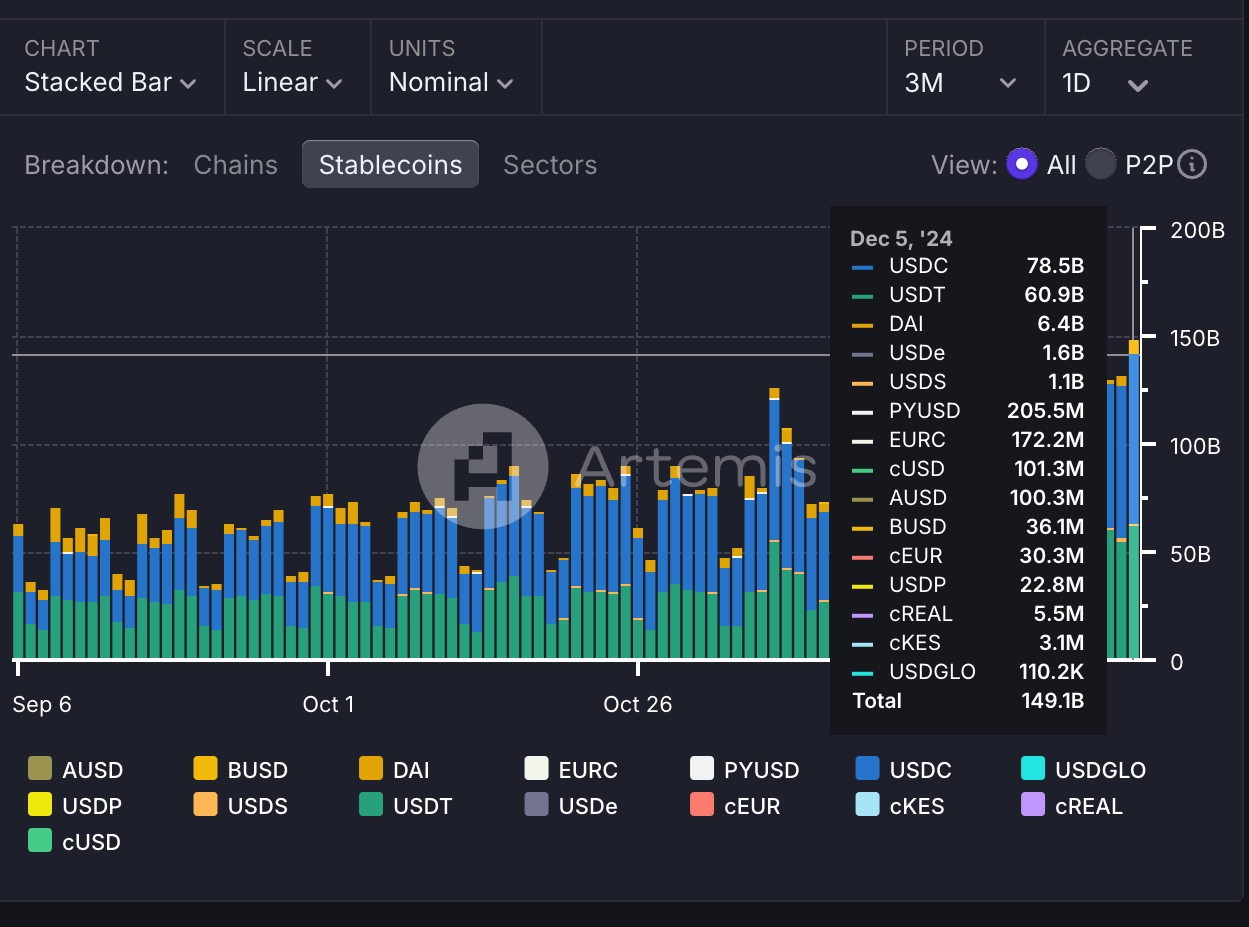

As a seasoned market analyst with over two decades of experience under my belt, I must say that the current state of the crypto market is nothing short of intriguing. The surge in stablecoin transfer volume to nearly $150 billion is reminiscent of the gold rush days, but instead of panning for gold, we’re now mining digital assets.

By Omkar Godbole (All times ET unless indicated otherwise)

You may recognize the sensation of observing a game where each team manages to score, resulting in a tie. That’s exactly what the bitcoin market is experiencing at the moment – a situation reminiscent of a tie game.

Initially, the bulls managed to drive prices above $103,000 on Thursday, but then the bears took over, causing prices to plummet to $91,000. Currently, we’re seeing a stable trading range near $98,000. This market is clearly showing signs of indecision…

The crash caused approximately $1 billion in leveraged bets on crypto futures to be shaken out, restoring a sense of balance to an overheated market. This might have been a hidden advantage, as if Bitcoin had reached $120,000, the subsequent shakeout due to leverage would have been even more intense and could have potentially undermined investor trust.

From my analyst’s viewpoint, I find it fascinating that Bitcoin Spot ETFs were able to attract a substantial inflow of approximately $766 million amidst market turmoil, demonstrating a ‘glass-half-full’ outlook on investor sentiment towards this digital asset class.

From my perspective as an analyst, it’s important to acknowledge the counterpoint: The ProShares Ultra Short Bitcoin ETF, which mirrors twice the daily performance drop of bitcoin, surprisingly saw a net inflow and record trading volume. Although the $7 million added may seem insignificant relative to long spot ETFs, it underscores that bearish investors are gearing up, preparing to assert their influence in the market.

As an analyst, I find myself in a position where the current situation seems somewhat unstable. Further developments may bring about volatility, especially if the U.S. nonfarm payrolls data suggests a robust labor market and persistent wage pressures. This could lead to a reassessment of Federal Reserve rate-cut expectations, which might negatively impact crypto prices. On the flip side, weak data could potentially trigger a price surge; however, navigating trades during such an indecisive phase might prove challenging.

In more recent updates, the selection of David Sacks as Crypto and AI Advisor by President-elect Donald Trump is generating optimism for the potential ETF approval of Solana. This is due to Sacks’ past involvement with crypto hedge fund Multicoin, one of Solana’s initial investors. While it may appear contradictory considering crypto’s decentralization ideals, it’s a common theme in a thriving market, often referred to as a bull-market storyline.

In terms of the overall market, the HYPE token of Hyperliquid is rapidly approaching a market worth comparable to Arbitrum’s ARB token, suggesting that application-focused layer 2 solutions like Hyperliquid are emerging as the primary means for DeFi applications to generate significant value. This perspective comes from Gautham Santosh, founder of Polynomial Protocol.

Gautham pointed out on X that developing on widespread layer 2 platforms might result in creating another’s protective barrier, essentially turning your success into the value of their token. He highlights an interesting contrast: Although Arbitrum’s perpetual protocol, GMX, generates 54% more income than Hyperliquid, its market capitalization is only $376 million, which equates to just 8% of Hyperliquid’s total value.

That’s a lot to take in for today. So, as trader Alex Kruger said on X, “If you’re not a full-time trader, focus on portfolio construction.” Stay alert out there!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 200K vs Prev. 12K.

- Unemployment Rate Est. 4.2% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Est. 3.9% vs Prev. 4.0%.

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate YoY Prev. 2.6%

- Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Prev. 3.75%.

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its latest monetary policy decision (three key interest rates).

- Deposit facility interest rate Prev. 3.25%.

- Main refinancing operations interest rate Prev. 3.4%.

- Marginal lending facility interest rate Prev. 3.65%.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

Token Events

- Governance votes & calls

- TK

- Unlocks

- Token Launches

Token Talk

On Friday, Ethereum and memecoin MOG experienced a 40% increase each, reaching new highs. This surge was fueled by MOG’s listing on Coinbase’s spot market, making it the second largest cat-themed token after POPCAT from Solana.

The meme-based cryptocurrency is recognized by its unique branding featuring a cat laughing with tears (commonly symbolized by the “joycat” emoji 😹), wearing Pit Viper sunglasses. Unlike other tokens, it doesn’t have any inherent functionality. Instead, it thrives on its community-focused philosophy and the widespread popularity of meme culture within the digital currency market.

meme-based cryptocurrencies frequently thrive on popular excitement, and the MOG coin has managed to seize a moment in time by using humor and culturally relevant marketing that boosts its popularity.

The community associated with this cryptocurrency frequently seems to ‘outdo’ other digital currency groups in social media posts or comments on platform X, which has turned into a meme and contributes to the token’s rising popularity.

Derivatives Positioning

- BTC and ETH perpetual funding rates have normalized from previously overheated levels, with the ETH rate remaining elevated compared with BTC, suggesting a bullish bias for the ETH/BTC ratio. The positioning in SOL perpetuals is even more bullish.

- The open interest-normalized cumulative volume delta has declined for most major tokens in the past 24 hours, indicating that the sell-off primarily resulted from the unwinding of long positions rather than fresh shorts.

- Despite BTC’s quick retrace to sub-$100K levels, calls continue to trade at a premium to puts, although the spread is narrower than it was early Thursday. A similar dynamic is observed in ETH options.

- A large bull call spread crossed the tape on Deribit, involving a long position in the $106,000 strike call and shorting the $110,000 strike call, both expiring on Dec. 27, according to data source Amberdata.

Market Movements:

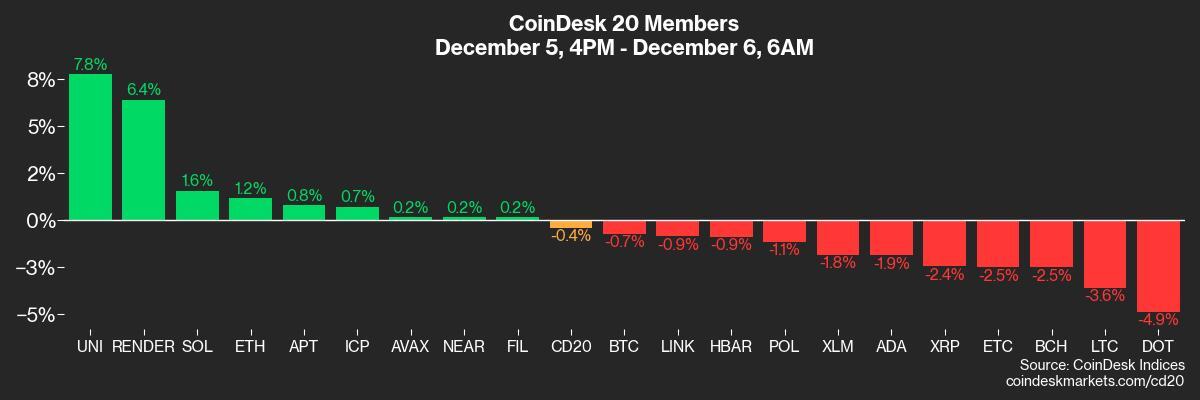

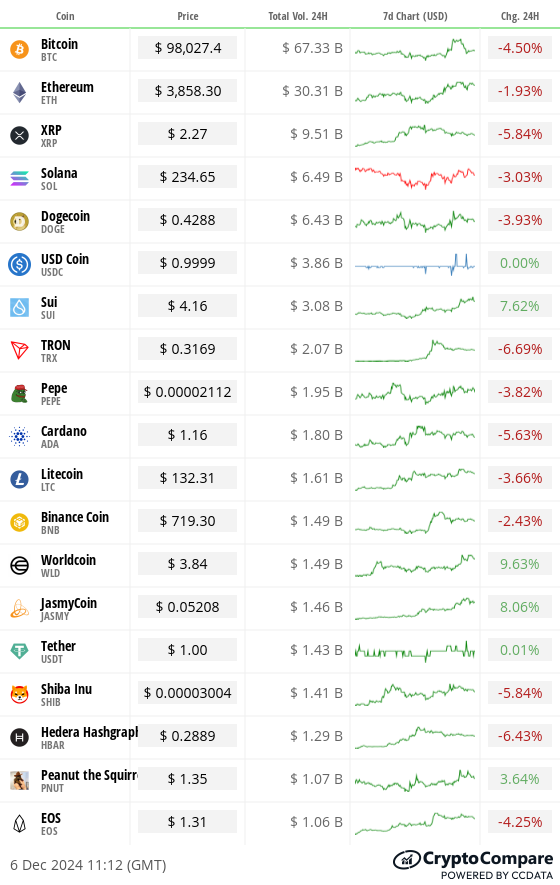

- BTC is down 0.82% from 4 p.m. ET Thursday to $98,196.16 (24hrs: -4.05%)

- ETH is up 0.27% at $3,870.06 (24hrs: -1.93%)

- CoinDesk 20 is down 0.29% to 3,954.73 (24hrs: -3.32%)

- Ether staking yield is down 5 bps to 3.22%

- BTC funding rate is at 0.0165% (18.05% annualized) on Binance

- DXY is unchanged at 105.80

- Gold is up 1.12% at $2656.00/oz

- Silver is up 1.73% to $31.67/oz

- Nikkei 225 closed -0.77% at 39,091.17

- Hang Seng closed +1.56% at 19,865.85

- FTSE is unchanged at 8,354.46

- Euro Stoxx 50 is up 0.56% at 4,979.24

- DJIA closed on Thursday -0.55% to 44,765.71

- S&P 500 closed -0.19% at 6,075.11

- Nasdaq closed -0.18% at 19,700.26

- S&P/TSX Composite Index closed +0.15% at 25,635.73

- S&P 40 Latin America closed +1.37% at 2,368.14

- U.S. 10-year Treasury was unchanged at 4.18%

- E-mini S&P 500 futures are unchanged at 6,083.50

- E-mini Nasdaq-100 futures are unchanged at 21,465.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,846.00

Bitcoin Stats:

- BTC Dominance: 55.76% (0.10%)

- Ethereum to bitcoin ratio: 0.03937 (1.08%)

- Hashrate (seven-day moving average): 800 EH/s

- Hashprice (spot): $63.02

- Total Fees: 14.28 BTC/ $1.4M

- CME Futures Open Interest: 518K BTC

- BTC priced in gold: 37.3 oz

- BTC vs gold market cap: 10.62%

- Bitcoin sitting in over-the-counter desk balances: 423.84k

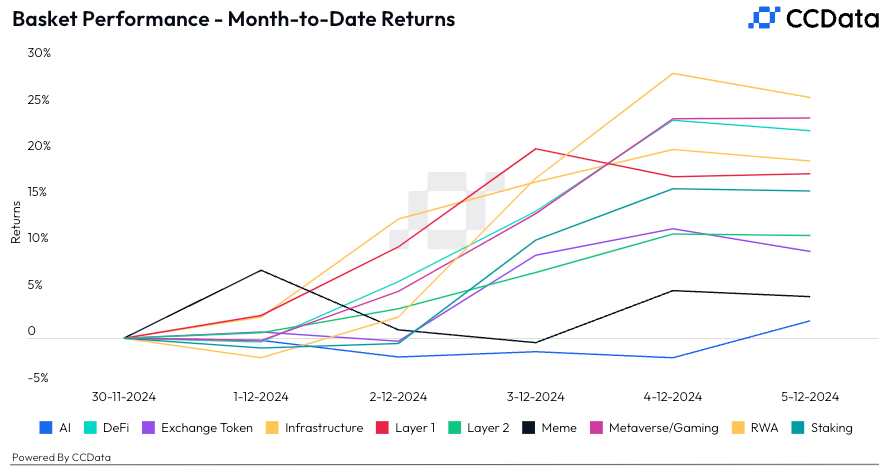

Basket Performance

Technical Analysis

- The chart shows the dollar index (DXY), which tracks the U.S. currency’s value against major peers, has dived out of a trendline, characterizing the steep rally from late September lows.

- Renewed losses in DXY will likely ease financial conditions further, supporting more risk-taking in financial markets.

TradFi Assets

- MicroStrategy (MSTR): closed on Tuesday at $386.4 (-4.83%), up 0.47% at $388.23 in pre-market.

- Coinbase Global (COIN): closed at $320.57 (-3.13%), up 0.83% at $323.24 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.65 (-0.22%)

- MARA Holdings (MARA): closed at $24.79 (-4.51%), down 0.69% at $24.96 in pre-market.

- Riot Platforms (RIOT): closed at $12.32 (-4.86%), up 0.16% at $12.34 in pre-market.

- Core Scientific (CORZ): closed at $16.94 (-3.03%), down 1% at $16.77 in pre-market.

- CleanSpark (CLSK): closed at $13.93 (-5.11%), up 0.5% at $14.00 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $28.91 (-2.07%), up 0.83% at $29.15 in pre-market.

- Semler Scientific (SMLR): closed at $58.55 (-7.65%), up 1.95% at $59.69 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $766.7 million

- Cumulative net inflows: $33.03 billion

- Total BTC holdings ~ 1.092 million.

Spot ETH ETFs

- Daily net inflow: $428.5 million

- Cumulative net inflows: $1.32 billion

- Total ETH holdings ~ 3.158 million.

Overnight Flows

Chart of the Day

- The daily stablecoin transfer volume has surged to nearly $150 billion, the most since May.

- Stablecoins are widely used to fund cryptocurrency purchases, derivatives trading and to move capital across borders.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-06 15:07