What to know:

As a seasoned investor and blockchain enthusiast with over two decades of experience under my belt, I must say that today’s newsletter is a veritable smorgasbord of intriguing developments in the crypto realm.

By Omkar Godbole (All times ET unless indicated otherwise)

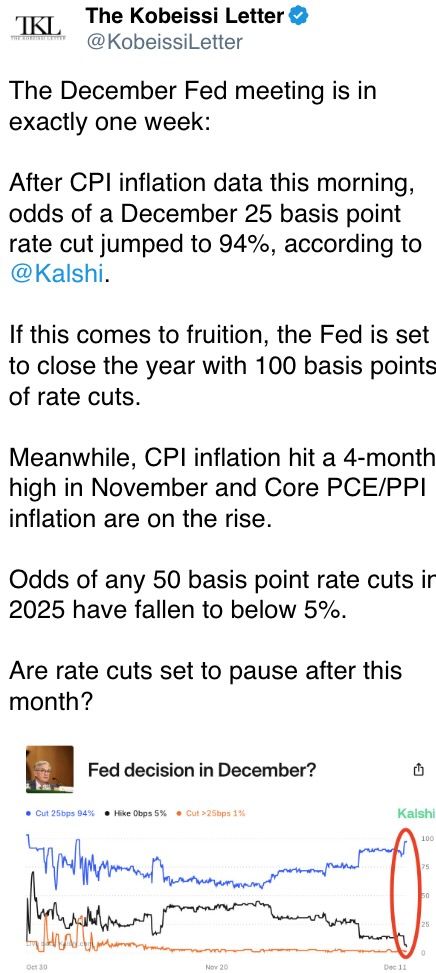

The cryptocurrency market aims to sustain the positive trend sparked by Wednesday’s U.S. Consumer Price Index (CPI) report, as it aligned with expectations and paved the way for a possible Federal Reserve interest rate reduction in the coming week.

1) Bitcoin surpassed the $100,000 mark again, while Ether is aiming for $4,000. Several tokens such as AAVE and LINK are experiencing a 10% increase in value due to accumulation by wallets connected to World Liberty Financial, a project backed by the Trump family.

Is it possible that Bitcoin’s surge will persist for a while? It might, considering Bitcoin’s persistent price advantage on Coinbase relative to international exchanges and more robust margin conditions across the market as a whole. However, potential upward momentum could be limited if the Producer Price Index indicates higher inflation rates ahead.

According to ING, any unexpectedly good news might have a slight positive impact on the US dollar when the core Personal Consumption Expenditures (PCE) deflator is released next Friday.

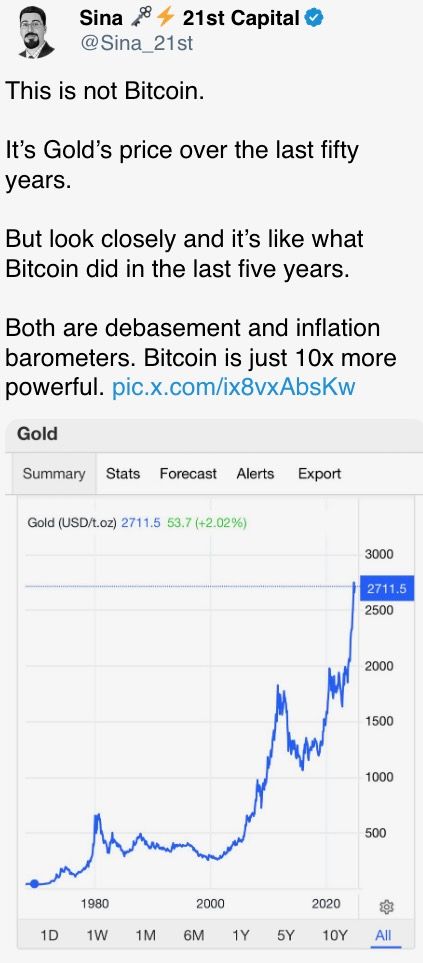

For cues on whether $100K is a major top, my advice is simple: when in doubt, zoom out.

On significant cryptocurrency exchanges, the three-month Bitcoin futures basis remains close to 15% annually, significantly lower than the 30% or more observed during the peak of the 2021 bull market. This suggests that the price increase is primarily due to genuine purchases in the spot market, which tends to be more sustained compared to speculative rises fueled by leveraged trading.

Enlarging the view also includes bringing the latter part of 2021 into focus. This was the time when high school students all around the globe started trading tokens such as DOT, SOL, ETH, and others, without fully understanding their purpose.

It’s also when the bull market topped.

Moving on to the present, the bustle on Main Street about cryptocurrency has died down significantly. As Leonardo DiCaprio stated in The Wolf of Wall Street, “If you read about it in The Wall Street Journal, it’s probably too late.

In addition, reaching the $100,000 milestone is accompanied by an increase in institutional involvement and intense advocacy efforts by the crypto community for positive regulatory conditions.

Regarding the prolongation of a bull market, it appears that Ether could potentially surge beyond $5,000. This prediction is based on the observation that increasing on-chain activity is causing more tokens to be destroyed, thereby decreasing the token’s supply in the market, as suggested by CryptoQuant.

As a crypto investor, I’ve learned that the highest potential selling price for my ETH, based on the realized price or the average price at which holders acquired their ETH, is hovering around the $5.2k mark, as shared with CoinDesk by the firm.

The bullish outlook for ether is generally seen as good news for other altcoins too, although, according to Delphi Digital, the token supply is “too damn high,” thanks to projects like pump.fun. The resulting demand-supply imbalance makes finding the alpha that much more challenging in the altcoin sector. Stay alert!

What to Watch

- Crypto:

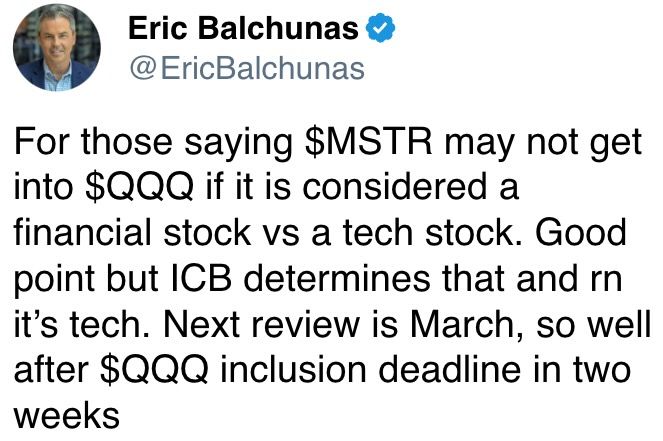

- Dec. 13: Nasdaq announces its annual changes to the Nasdaq-100 index. MicroStrategy (MSTR), the world’s largest corporate holder of bitcoin, is widely expected to be added.

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its monetary policy decision (three key interest rates), followed by a press conference at 8:45 a.m.

- Deposit facility interest rate Est. 3.0% vs Prev. 3.25%.

- Main refinancing operations interest rate Est. 3.15% vs Prev. 3.4%.

- Marginal lending facility interest rate Prev. 3.65%.

- Dec. 12, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Dec. 7. Initial Jobless Claims Est. 220K vs Prev. 224K.

- Dec. 16, 9:45 a.m.: December’s S&P Global Flash US PMI data is released. Composite PMI Prev. 54.9.

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its monetary policy decision (three key interest rates), followed by a press conference at 8:45 a.m.

Token Events

- Governance votes & calls

- EigenLayer to deploy Rewards v2 upgrade on Holesky testnet following governance vote. Stakers and operators can collect multiple rewards at once, saving on transaction costs.

- Moonriver’s MR64 proposal meets quorum and would upgrade tokenomics by redirecting 80% of token inflation to the treasury to fund ecosystem growth and operations.

- Synapse puts up SIP-41 for voting, and proposes a $3.5 million buyback of SYN tokens over three months. Voting is currently live.

- Unlocks

- Axie Infinity to unlock 815,000 AXS, worth $6 million at current prices, at 8:10 a.m.

Token Talk

An artificial intelligence-based entity modeled after venture firm a16z has surpassed the market leader, GOAT (GOAT), to hold the highest valuation within its specific industry.

16z Fund, a venture focused on artificial intelligence trading signals, has surpassed $850 million in market value, surpassing GOAT’s position. This significant milestone was first reached by AI16Z back in October, marking the start of the AI agents sector. Owners of 16z tokens propose concepts to “AI Marc,” an AI model mimicking Andreessen Horowitz partner Marc Andreessen, who then provides guidance and potential investment advice based on these ideas.

The fund boasts more than $10 million, contributed by approximately 30,000 distinct supporters, an accomplishment made possible within a short span of just over a month following its launch.

The AI16Z price has surged 77% in the past seven days and more than tripled in the past 14 days, CoinGecko data shows. That’s more than GOAT and other AI agent tokens that function solely as memes or online chatbots.

The demonstration reveals a shift in the market’s taste towards projects that blend enjoyment with practical use, with technically-oriented projects disguised as memes potentially garnering increased interest in the forthcoming months.

In a recent post, crypto trader Defi0xJeff stated that “$ai16z flipping $goat” serves as a significant indication for the advancement of AI agents. This rapid progress of the new generation of agents surpasses the traditional ones, indicating a positive outlook not only for “$ai16z” but also for the broader ecosystem as a whole.

Derivatives Positioning

- BTC and ETH implied volatility term structures have steepened alongside price rises.

- Calls have become pricier than puts as BTC’s move back above $100,000 has reduced fears of a protracted pullback.

- A market participant bought a large calendar spread by buying the $110K strike call expiring Jan. 3 while selling the $100K call expiring Dec. 27. The strategy aims to profit from the price decay in the Jan. 27 expiry while being protected from an upside volatility explosion.

- In ETH, the notable trade was a bull call spread at $4,300 and $4,500 strikes.

Market Movements:

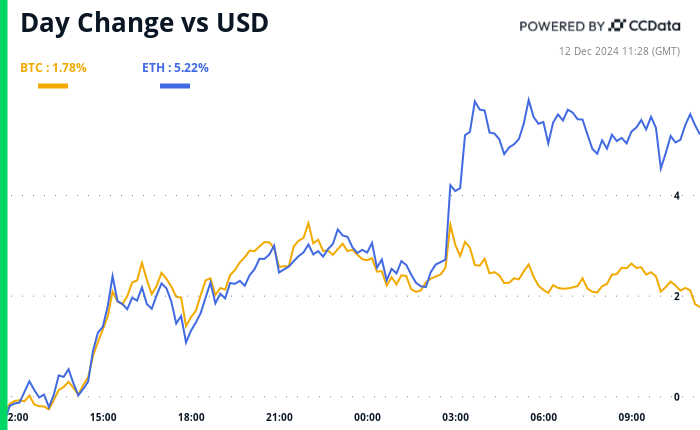

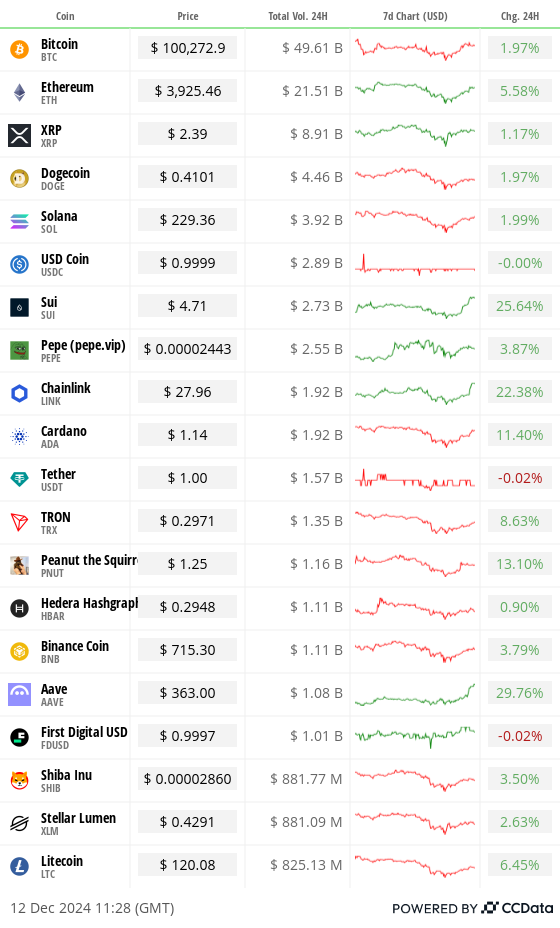

- BTC is up 3.64% from 4 p.m. ET Wednesday to $100,599 (24hrs: +2.05%)

- ETH is up 6.9% at $3,921.91 (24hrs: +5.41%)

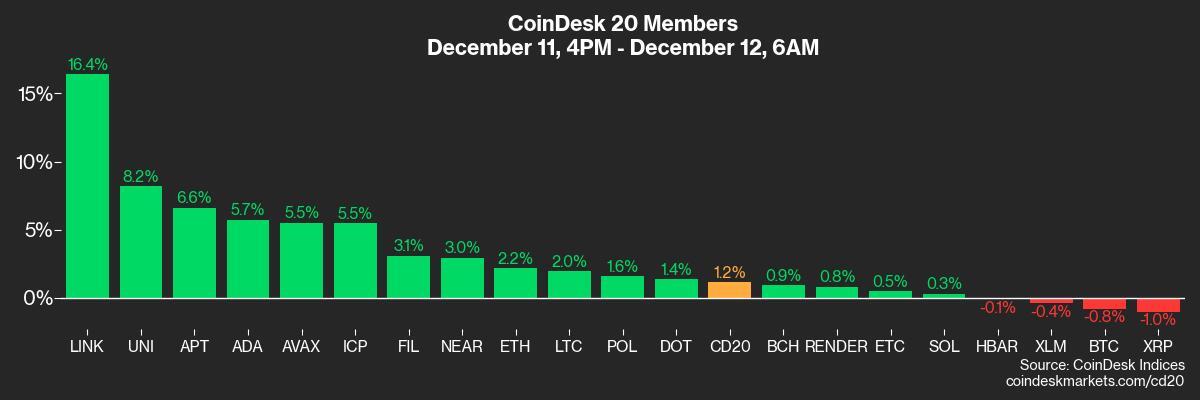

- CoinDesk 20 is up 2.14% to 3,905.81 (24hrs: +5.52%)

- Ether staking yield is down 30 bps to 3.17%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 106.63

- Gold is up 0.49% at $2,747.10/oz

- Silver is up 1.47% to $33.04/oz

- Nikkei 225 closed +1.21% at 39,849.14

- Hang Seng closed +1.2% at 20,397.05

- FTSE is up 0.25% at 8,322.22

- Euro Stoxx 50 is unchanged at 4,962.71

- DJIA closed on Wednesday -0.22% at 44,148.56

- S&P 500 closed +0.82% at 6,084.19

- Nasdaq closed +1.77% at 20,034.89

- S&P/TSX Composite Index closed +0.6% at 25,657.70

- S&P 40 Latin America closed +1.55% at 2,398.16

- U.S. 10-year Treasury is unchanged at 4.3%

- E-mini S&P 500 futures are down 0.16% to 6,082.75

- E-mini Nasdaq-100 futures are down 0.24% to 21,741.50

- E-mini Dow Jones Industrial Average Index futures are down 0.19% at 44,139.00

Bitcoin Stats:

- BTC Dominance: 56.18% (24hrs: -1.20%)

- Ethereum to bitcoin ratio: 0.03878 (24hrs: -0.83%)

- Hashrate (seven-day moving average): 770 EH/s

- Hashprice (spot): $61.8

- Total Fees: 18.9 BTC/ $1.9M

- CME Futures Open Interest: 194,740 BTC

- BTC priced in gold: 37.2 oz

- BTC vs gold market cap: 10.60%

- Bitcoin sitting in over-the-counter desk balances: 431,000 BTC

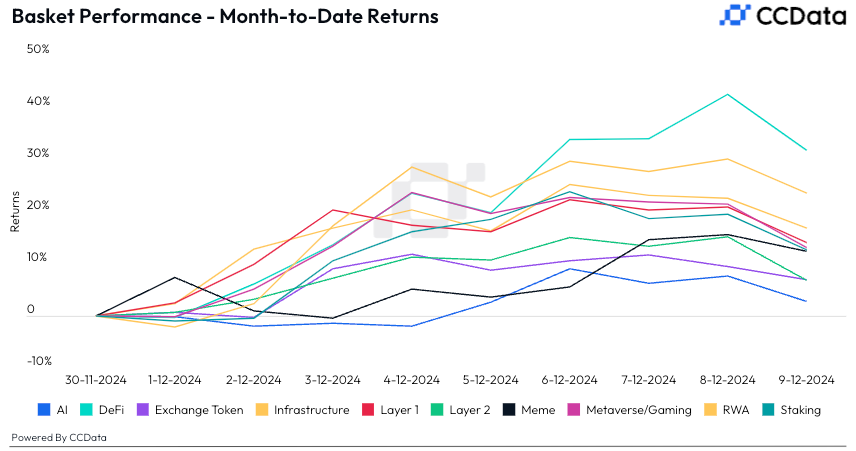

Basket Performance

Technical Analysis

- The ETH/BTC ratio has already scaled the 50-day SMA and is now looking to establish a foothold above the 100-day average.

- That would give traders more confidence that the pair has bottomed out and open the door for a test of the 200-day average at 0.044.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $411.4 (+9.03%), down 0.75% at $408.11 in pre-market.

- Coinbase Global (COIN): closed at $313.81 (+3.77%), up 0.63% at $315.80 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.29 (+5.04%)

- MARA Holdings (MARA): closed at $23.27 (+2.02%), up 0.13% at $23.30 in pre-market.

- Riot Platforms (RIOT): closed at $11.77 (+6.04%), down 0.59% at $11.70 in pre-market.

- Core Scientific (CORZ): closed at $15.86 (+0.51%), up 0.19% at $15.89 in pre-market.

- CleanSpark (CLSK): closed at $12.83 (-0.85%), up 0.39% at $12.88 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.89 (+2.8%), up 3.08% at $28.75 in pre-market.

- Semler Scientific (SMLR): closed at $64.53 (+7.86%), down 0.22% at $64.39 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $223.1 million

- Cumulative net inflows: $34.55 billion

- Total BTC holdings ~ 1.119 million.

Spot ETH ETFs

- Daily net inflow: $102 million

- Cumulative net inflows: $1.97 billion

- Total ETH holdings ~ 3.417 million.

Overnight Flows

Chart of the Day

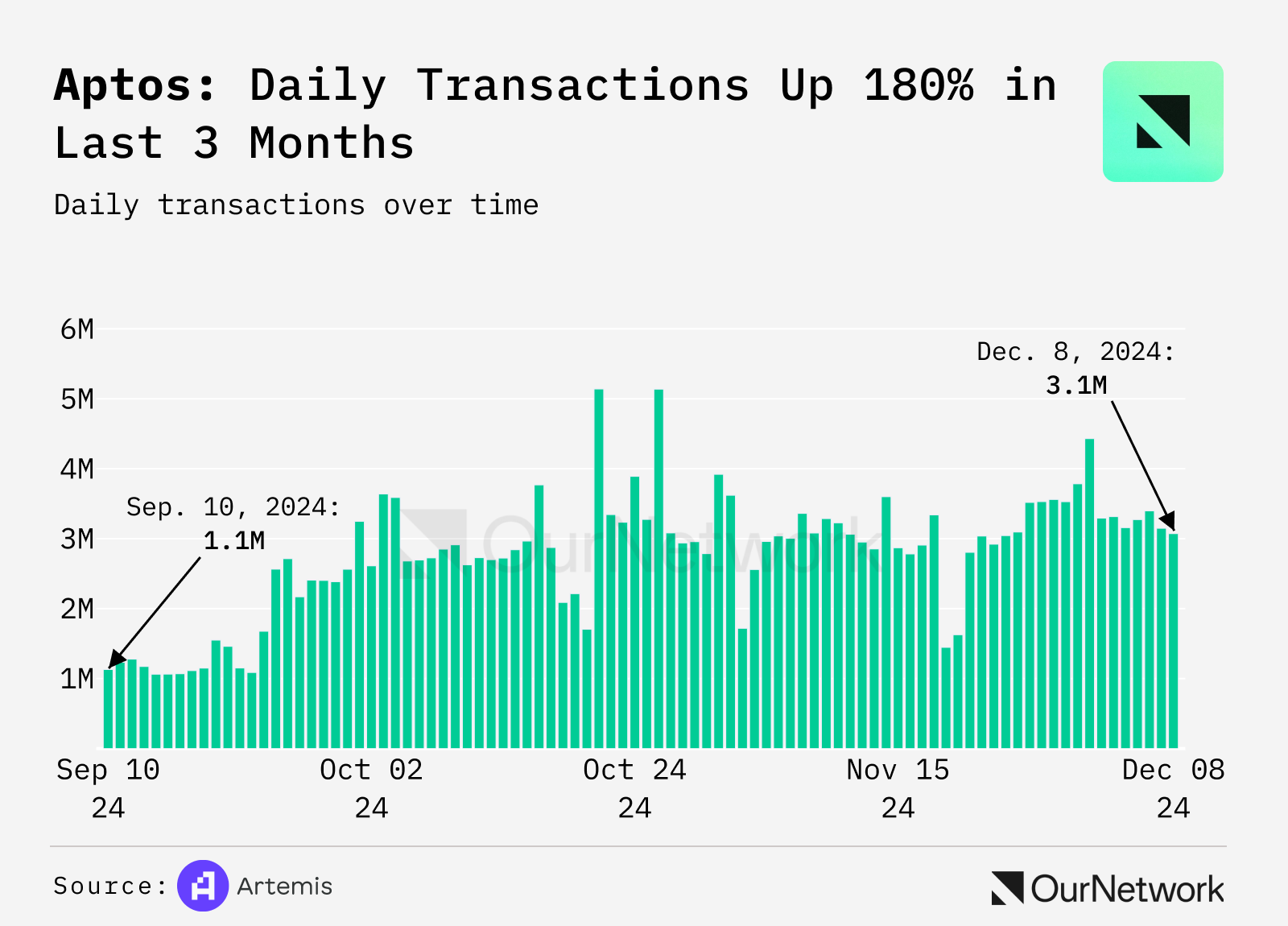

- The number of daily transactions on Aptos, a layer-1 blockchain focused on safety and scalability, has almost tripled to 3.1 million in three months.

- The increased network usage supports the bull case in the APT token, which has increased 46% this year.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-12 15:12