What to know:

As someone who has been closely following the crypto market for quite some time now, I must say that today’s update is a rollercoaster ride of information! The S&P 500 and NASDAQ closing at record highs, coupled with the Latin American stock markets outperforming their US counterparts, it seems like we are in for an exciting week.

By Omkar Godbole (All times ET unless indicated otherwise)

The struggle between Bitcoin’s price increase and decrease persists, as the value climbed back up to over $97,000 from its dip at $94,200 on Monday. This slide was initiated by fears that Google’s newly developed quantum-computing chip, named Willow, might jeopardize Bitcoin’s security. However, these concerns were swiftly debunked by experts.

In my role as a researcher, I find myself in a position of patience today, as directional traders and I are left in limbo, waiting for market volatility to subside following Thursday’s inconclusive price action. For now, there seems to be no clear direction to take a stance on, so we patiently observe the market, eagerly awaiting the moment when prices break out of this current trading range and present us with an opportunity to make our next move.

As a researcher, I must admit that the market turbulence has been quite challenging. However, it seems there’s a method in this madness. The chaos appears to have sifted out speculative and overleveraged altcoin traders, as suggested by the adjustment of perpetual funding rates.

If these trends persist with decreasing rates, it might indicate an unwinding of excessive long positions on leverage, possibly leading to a more equitable market, according to analysts at Bitfinex. They further suggested that the $100,000 level may no longer be significant as a support or resistance point and instead, a new equilibrium is likely taking shape in the spot markets.

Moving forward to late 2024, an intriguing trend is emerging: Financial institutions are growing optimistic about the US dollar, a sentiment that typically isn’t favorable for investments tied to the American currency, such as Bitcoin (BTC) and other risky assets.

According to HSBC’s recent statement, the interplay of recurring economic cycles, government spending policies, and U.S. political factors is causing the US Dollar to regain strength. They have reinforced their bullish stance on the dollar, suggesting that a renewed growth in the dollar’s value could pose issues for numerous other currencies. Meanwhile, Citibank predicts that the dollar index (DXY) could surge up to 115, which represents an approximately 8% increase.

As a crypto investor, I always keep tabs on what’s happening in the Far East. The recent surge in Chinese stocks after Beijing’s pledge of additional stimulus might lead to a significant shift of capital away from other markets, potentially impacting the cryptocurrency sector as well.

Despite all the ongoing events, there is discussion about President-elect Trump potentially finding it challenging to fulfill his cryptocurrency-related promises. Peter Tschir, leader of macro strategy at Academy Securities, articulated this insightfully: “Trump may show loyalty towards those who supported his campaign financially, but I don’t foresee this relationship as long-lasting, particularly since he will likely face considerable pressure from the national security sector in Washington D.C. to exercise caution when it comes to supporting cryptocurrencies excessively.

After all, it’s one thing to promise big from Mar-a-Lago and a different ball game when delivering from the White House. Stay Alert!

What to Watch

- Crypto:

- Dec. 10, 11:30 a.m.: Microsoft’s annual shareholders meeting. The meeting will include MicroStrategy Executive Chairman Michael Saylor’s 44-slide presentation on investing in Bitcoin. Microsoft will then disclose the voting results. Livestream link.

- Dec. 13: The annual Nasdaq-100 reconstitution. Changes to the index, if any, are announced on this day. MicroStrategy (MSTR), the world’s largest corporate holder of bitcoin, is widely expected to be added to the index.

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Inflation Rate YoY Est. 2.7% vs Prev. 2.6%

- Core Inflation Rate YoY Est. 3.3% vs Prev. 3.3%

- Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Est. 3.25% vs Prev. 3.75%. A press conference starts at 10:30 a.m. Livestream link

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its latest monetary policy decision (three key interest rates) followed by a press conference at 8:45 am.

- Deposit facility interest rate Est. 3.0% vs Prev. 3.25%.

- Main refinancing operations interest rate Est. 3.15% vs Prev. 3.4%.

- Marginal lending facility interest rate Prev. 3.65%.

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

Token Events

- Governance votes & calls

- Horizen to hold community call discussing ZEN halving and future plans at 8 a.m.

- Token Launches

- Hacks

- The Clober Liquidity Vault has been hacked, resulting in a loss of 133 $ETH (worth ~$500K). The exploiter has already bridged the stolen funds from Base to Ethereum.

Token Talk

By Shaurya Malwa

Everything with “quantum” in the name is pumping!

Quantum computing-related components surged by over 100% within the last 24 hours following Google’s announcement of Willow, a quantum-processing chip. During testing, Willow managed to accomplish tasks in just 5 minutes that would take today’s supercomputers around 10 septillion years to complete.

As a crypto investor, I’ve witnessed a market downturn following the announcement that raised long-term concerns about bitcoin and other blockchains potentially being vulnerable to quantum computing attacks. However, while the overall market plummeted, tokens like Quantum Resistant Ledger (QRL), Quantum Network, and Quantum Swap, among others, surprisingly surged higher.

Items marked as “quantum” may seem like cutting-edge advancements in tech, but their practical significance or connection to quantum computation could be insignificant. Nonetheless, this misconception can fuel investments and offer an opportunity for speculation in the short-term stock market storyline.

Derivatives Positioning

- Perpetual funding rates in DINO coins have normalized as Monday’s price drop triggered a decent leverage washout.

- ETH’s implied volatility term structure remains in backwardation, pointing to higher near-term volatility.

- A notable BTC options trade included a long position in the $150,000 strike call expiring in March. Meanwhile, someone sold the ETH $5,000 call expiring at the end of March in large numbers, collecting nearly $1.8 million in premium.

Market Movements:

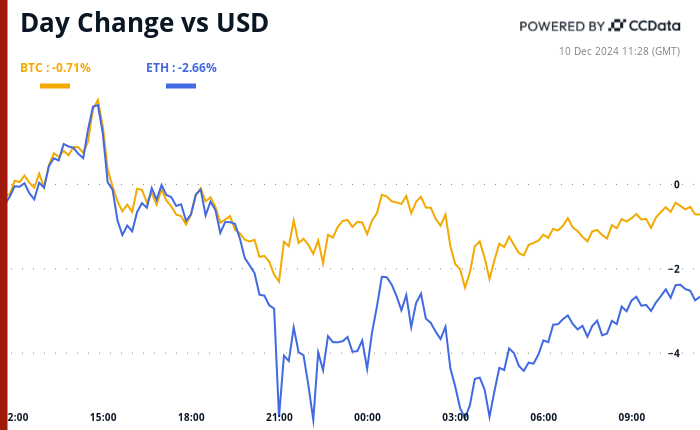

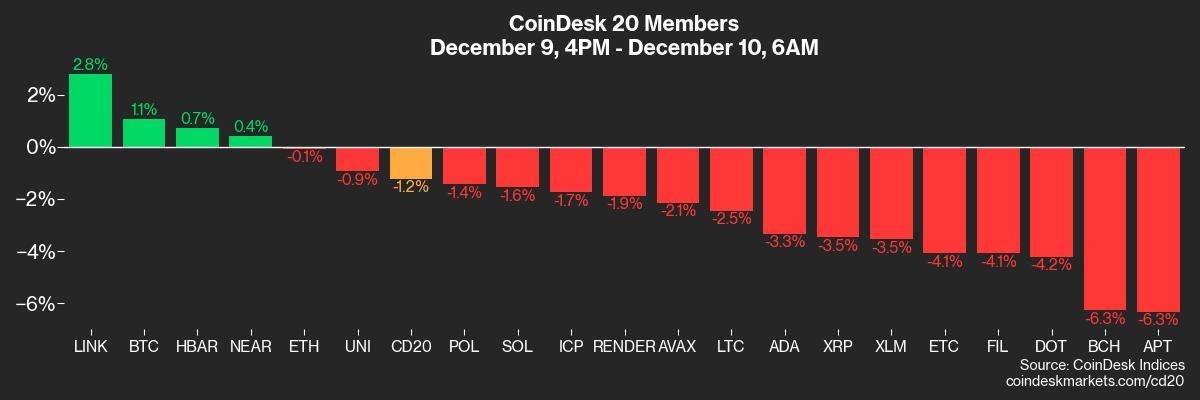

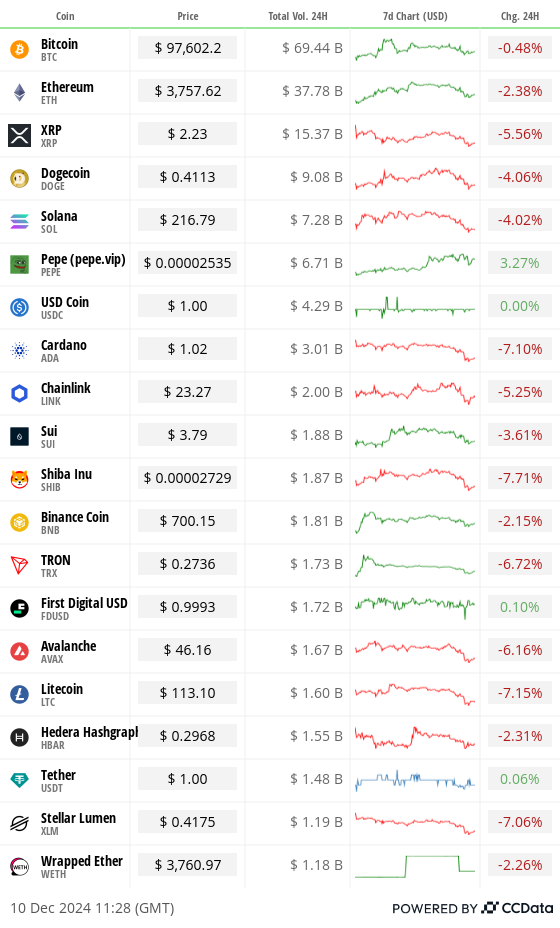

- BTC is up 0.76 % from 4 p.m. ET Monday to $97,763.77 (24hrs: -0.3%)

- ETH is up 1.66% at $3,765.44 (24hrs: -2.23%)

- CoinDesk 20 is up 1.78% to 3,954.73 (24hrs: -4.54%)

- Ether staking yield is up 15 bps to 3.2%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is up 0.23% at 106.39

- Gold is up 1.24% at $2,697.9/oz

- Silver is up 0.9% to $32.51/oz

- Nikkei 225 is up 0.53% unchanged at 39,367.58

- Hang Seng is down 0.5% at 20,311.28

- FTSE is down 0.63% at 8,299.38

- Euro Stoxx 50 is down 0.45% at 4962.94

- DJIA closed on Monday -0.54% to 44,401.93

- S&P 500 closed -0.61% at 6,052.85

- Nasdaq closed -0.62% at 19,736.69

- S&P/TSX Composite Index closed -0.26% at 25,625.40

- S&P 40 Latin America closed +1.15% at 2,356.64

- U.S. 10-year Treasury was unchanged at 4.23%

- E-mini S&P 500 futures are unchanged at 6,064.50

- E-mini Nasdaq-100 futures are unchanged at 21,488.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,455.00

Bitcoin Stats:

- BTC Dominance: 56.82% (-0.22%)

- Ethereum to bitcoin ratio: 0.03845 (0.76%)

- Hashrate (seven-day moving average): 773 EH/s

- Hashprice (spot): $61.93

- Total Fees: 15.97 BTC / $9.46M

- CME Futures Open Interest: 196K BTC

- BTC priced in gold: 36.7 oz

- BTC vs gold market cap: 10.46%

- Bitcoin sitting in over-the-counter desk balances: 432K BTC

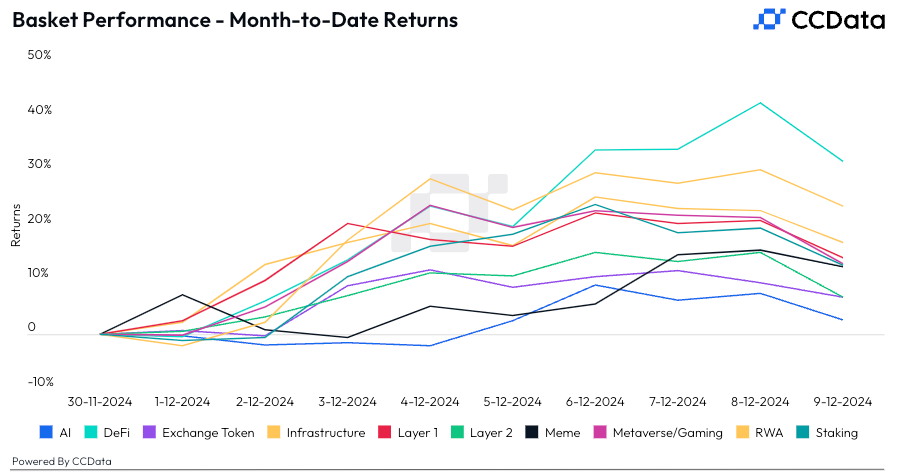

Basket Performance

Technical Analysis

- The chart shows the price of the Nasdaq-listed ProShares UltraShort Bitcoin ETF (SBIT) and its 14-day RSI, a momentum oscillator.

- The RSI has diverged bullishly, contradicting the lower lows in prices in a sign of waning downward momentum. In other words, the ETF could see some gains in the short-term.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $365.34 (-7.51%), up 2.72% at $375.49 in pre-market.

- Coinbase Global (COIN): closed at $310.52 (-9.63%), up 2.62% at $318.67 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.72 (-10.64%)

- MARA Holdings (MARA): closed at $23.86 (-9.72%), up 1.82% at $24.29 in pre-market.

- Riot Platforms (RIOT): closed at $11.21 (-13.44%), up 1.52% at $11.38 in pre-market.

- Core Scientific (CORZ): closed at $16.04 (-5.59%), up 0.31% at $16.09

in pre-market. - CleanSpark (CLSK): closed at $13.56 (-9.42%), up 3.61% at 14.05.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $28.58 (-7.63%).

- Semler Scientific (SMLR): closed at $62.12 (+0.6%).

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $479.1 million

- Cumulative net inflows: $33.88 billion

- Total BTC holdings ~ 1.108 million.

Spot ETH ETFs

- Daily net inflow: $149.8 million

- Cumulative net inflows: $1.56 billion

- Total ETH holdings ~ 3.287 million.

Overnight Flows

Chart of the Day

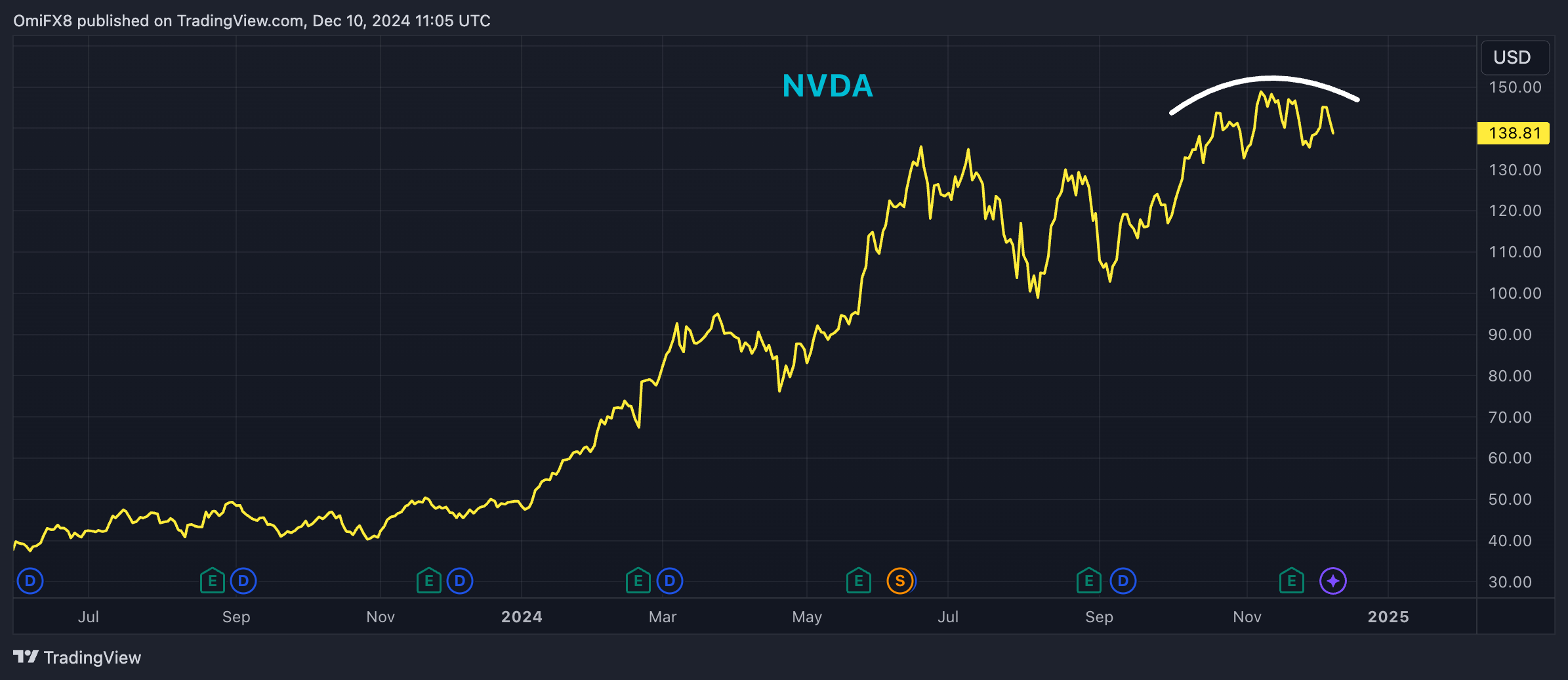

- The rally in Nvidia (NVDA), which has traditionally shown a positive correlation with bitcoin, appears to have lost momentum.

In the Ether

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-10 15:23