What to know:

- One in 10 members of the next U.S. Congress were boosted by campaign ads paid for by the crypto industry.

- The Fairshake PAC and its affiliates spent $139 million to reshape Congress, and the vast majority of their picks won.

As a seasoned political observer with a keen interest in technology and finance, I find the rise of crypto-focused political action committees (PACs) like Fairshake quite fascinating. Having spent years watching lobbying efforts in Washington, it’s clear that this new breed of PAC is leveraging their unique resources to influence elections in a way we haven’t seen before.

Here begins an exploration of the crypto world’s political journey in 2024, delving into their significant involvement in campaigns.

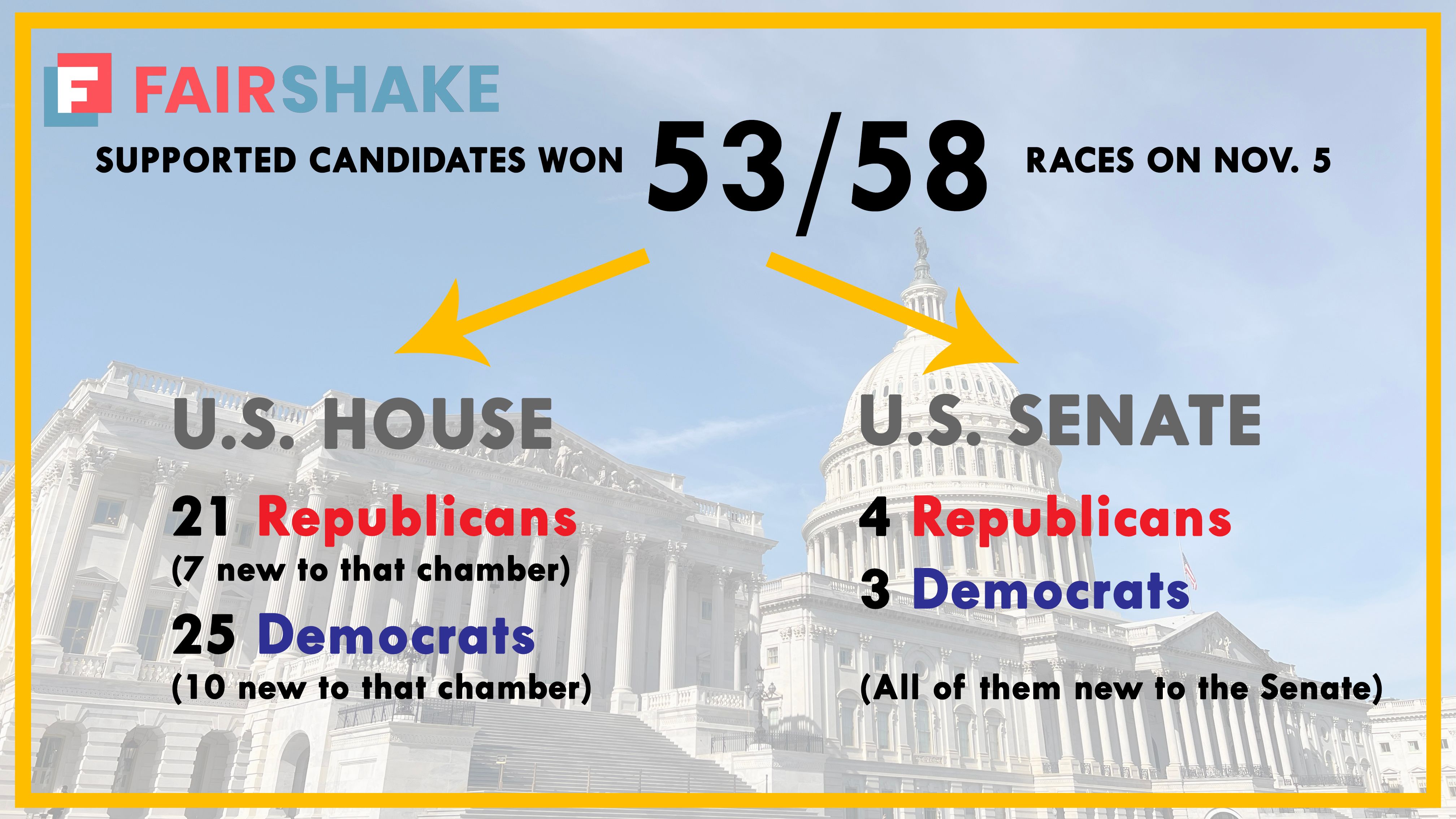

After the recent congressional elections have been officially decided, it appears that the cryptocurrency industry’s attempts to influence policy through financial contributions have yielded positive results, with a remarkable 91% success rate in supporting their preferred candidates during U.S. election contests.

53 out of the 58 political candidates that Fairshake’s political action committee and its allies supported during the last month’s elections were victorious. This means a substantial part of the Senate and House of Representatives will owe their wins to the industry, as they received considerable financial backing from it – funding that may have even influenced the outcome in certain cases.

In January, they will go to Capitol Hill, where a substantial number of crypto advocates have already established themselves – partly due to the 2022 congressional elections, during which GMI PAC Inc., a forerunner to Fairshake, employed a similar approach, albeit on a much smaller scale.

It’s well known that Congress can be challenging when it comes to passing intricate laws like the regulation package desired by the U.S. cryptocurrency industry. However, having many congress members who may have ties to the industry could help move these crypto bills forward. Furthermore, President-elect Donald Trump has expressed his intention for his administration to support financial advancements, potentially creating a united front between the two branches in 2025.

What series of events led us to this point in the industry? Large, unparalleled political donations and a politically advantageous approach, where the passion for cryptocurrency wasn’t always overtly expressed.

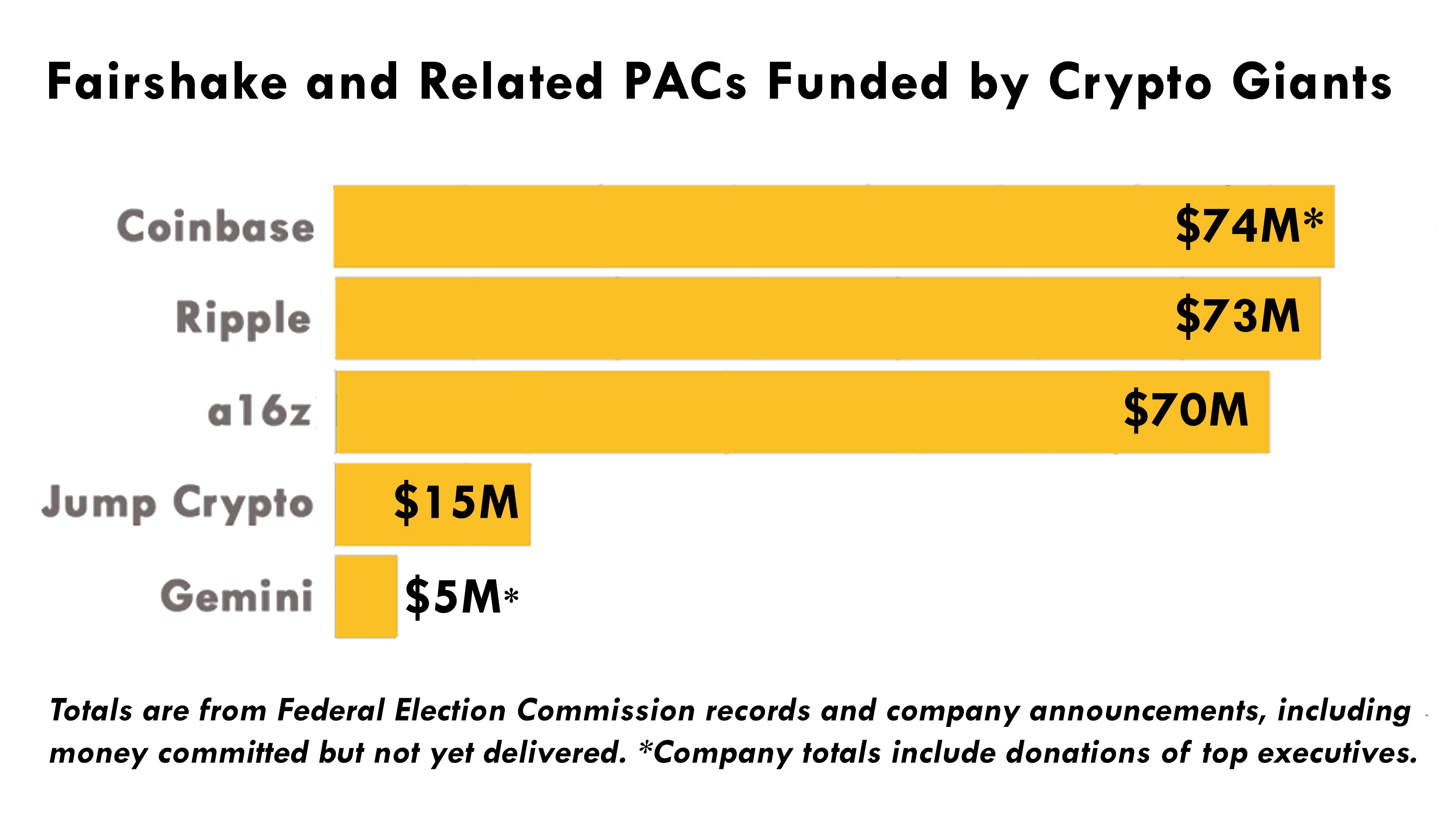

In the contemporary U.S. electoral landscape, corporations are permitted to freely invest substantial amounts in campaign ads for their preferred candidates. Consequently, significant financial resources have been amassed by three prominent industry players – Coinbase Inc. (COIN), Ripple Labs, and investment firm Andreessen Horowitz (a16z) – for the 2024 elections. This substantial fund, amounting to $169 million, was primarily gathered by these three companies, with additional millions contributed by other firms and individuals.

This action signified the most daring corporate intervention into election financing since the Citizens United Supreme Court decision allowed businesses to purchase unlimited, independent ads supporting or opposing candidates, provided these activities aren’t directly linked to the campaigns. The Fairshake super PAC and its allies, Protect Progress for Democratic beneficiaries and Defend American Jobs for Republican expenditures, limited their influence solely to congressional races, excluding presidential contests.

For crypto, the top priority in Washington is the passage of new laws to regulate the space and eliminate questions in the minds of hesitant potential investors. Though that was the case, the industry’s anonymously monikered super PACs refrained from mentioning crypto in the ads they bought to boost or block candidates. The long game wasn’t about winning crypto support in the field, but getting people into Washington who would eventually be on the industry’s side.

In a conversation with CoinDesk, Josh Vlasto, spokesman for Fairshake PAC, commented on their political operation. He stated, “Fairshake was running a highly intelligent and effective political campaign within the industry.” This strategy not only influenced the composition of the new Congress, boasting around 300 pro-crypto members as of November 5th, but it also demonstrated its efficacy for future cycles.

As an analyst, I’d rephrase it like this: In the aftermath of the election last month, it was evident that the industry had gained numerous new allies in Congress. However, it wasn’t until weeks later that all the races were officially decided. The closest contest took place in California’s 45th Congressional District, where Michelle Steel, a proponent of cryptocurrency and Republican candidate, lost to Democratic nominee Derek Tran by just a few hundred votes. This district saw over 300,000 votes cast.

In the role of a researcher, I would rephrase it this way: As a researcher, I noted that in November, Representative Lori Chavez-DeRemer, a Republican hailing from Oregon, received Donald Trump’s endorsement to lead the Department of Labor in the future.

However, the two major competitions took place at the start and finish of the electoral process. Fairshake aggressively entered the California Senate primary, investing approximately $10 million to suppress the campaign of Representative Katie Porter, a Democrat who was associated with Senator Elizabeth Warren, a figure widely disliked in the industry. As a result, her campaign was largely overshadowed by the opposition’s efforts.

In a more recent development, Fairshake announced hostilities in Ohio, with over $40 million being invested against the re-election bid of Senator Sherrod Brown, a Democrat who serves as the chairman of the Senate Banking Committee and has been instrumental in resisting crypto legislation. This substantial amount of funds, which represented the largest spending in the state, was used to back Bernie Moreno, a businessman specializing in blockchain technology. Moreno won the seat by over 200,000 votes, contributing to the shift of the Senate towards a Republican majority.

Fairshake’s most memorable moments were its dramatic plays, yet it’s potential for lasting triumph might stem from the multitude of lesser-known contests in primaries that it focused on. Frequently, this Political Action Committee (PAC) would identify a supporter of cryptocurrency, regardless of party affiliation, in districts where the candidate’s party held significant power (indicating the primary election would essentially decide the outcome). In these instances, Fairshake or its allies would typically invest over $1 million into these races to outspend competitors and pave the way for the chosen candidate’s journey towards the general election.

In one Arizona district, the Political Action Committee (PAC) invested approximately $1.4 million to support Yassamin Ansari, a former vice mayor of Phoenix. Remarkably, Ansari secured her primary victory by a margin of only 42 votes. Interestingly, the crypto-backed campaign finance effort spent around $0.71 per vote in the primary, but Ansari eventually triumphed in the general election with nearly 71% of the votes.

Four candidates who received funding from Fairshake lost during the primaries, while a large number of winners going into this month’s general election felt optimistic due to their advantageous party ties for district victories. However, in certain regions, Fairshake backed crypto-supporters as underdogs in tougher races, and five of these candidates suffered defeats.

1) The effectiveness of its strategies was clearly demonstrated by its impressive track record, as it managed to turn around a previously damaged image in Washington. Despite facing significant adversity, the cryptocurrency sector bounced back from the 2022 catastrophe where some major players faltered and numerous investors suffered substantial losses.

Fairshake’s endeavors this time around seem to have drawn inspiration from earlier attempts by the industry to win over lawmakers, but they were significantly more concentrated in their approach. In the previous term, when Sam Bankman-Fried of FTX was at his peak before the collapse, he and his team donated funds to nearly one-third of Congress members (though these contributions were relatively modest and direct). This time, the strategy shifted towards utilizing its virtually limitless spending capacity in strategic contests where it believed that the investment could tip the scales.

In previous election cycles, it was apparent that Fairshake’s associated businesses found the performance of cryptocurrencies to be “unsuccessful.” According to Vlasto, they lacked proper organization, professionalism, careful consideration, balance, and focus.

He serves as the representative for the super PAC, as it keeps its strategists hidden from the media and the companies supporting it refuse to discuss how the organization receives instructions or maintains relationships with donors. Two of GMI’s organizers returned after two years to manage Fairshake, although the PAC doesn’t reveal its internal operations. Additionally, Vlasto shares his spokesperson role with a more clandestine group focused on promoting cryptocurrencies, the Cedar Innovation Foundation, which has targeted the sector’s main political adversaries but remains silent about its benefactors.

After the election concludes, crypto advocacy groups in Washington D.C., including Stand With Crypto, aim to capitalize on the momentum from the Fairshake movement and work diligently to ensure that congressional representatives uphold their promises regarding cryptocurrencies.

According to Vlasto, there are other entities and groups specifically designed for interacting with members directly, as it isn’t Fairshake’s role. He added that this supportive network of organizations will persist in carrying out their tasks, which is expected to remain the case during the upcoming Congress.

Read More

- SUI PREDICTION. SUI cryptocurrency

- COW PREDICTION. COW cryptocurrency

- KSM PREDICTION. KSM cryptocurrency

- Exploring the Humor and Community Spirit in Deep Rock Galactic: A Reddit Analysis

- WLD PREDICTION. WLD cryptocurrency

- W PREDICTION. W cryptocurrency

- ADA EUR PREDICTION. ADA cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

2024-12-03 17:46