Recently, Polkadot‘s price has been relatively calm and stable after a quick drop to around $6. Now, it’s at a significant point where a strong surge could indicate an uptrend or a further decline may ensue.

Polkadot Price Analysis: Technicals

By Shayan

The Daily Chart

Examining the day-to-day price action closely, there’s a stretch where the $6 level was supported, indicating a quiet market with neither side gaining clear advantage. This could be a sign of an upcoming major shift as the struggle between buyers and sellers becomes more pronounced.

Even with the present doubt, the Polkadot price stands firm due to a solid and clear-cut support system. This foundation is anchored by the substantial 200-day moving average, priced at $6.93, and the essential support mark of the 0.618 Fibonacci level, which is $6.7. The robust support area is fortified by strong buying interest and could halt any additional price declines, potentially pushing the cost upwards towards the significant resistance area around $9.

The 4-Hour Chart

Looking closely at the price action over the past 4 hours, we notice a steep decline toward the $6 mark, which faced strong buying pressure and caused a small rebound. Yet, during this period of sideways movement, there has been very little price fluctuation and no clear trend emerging.

Despite this, the price has been forming a triangular pattern on the chart, with a breach of its upper limit suggesting that the bullish momentum will persist.

At present, DOT hovers near the edge of surpassing its triangle chart pattern. Should it do so, Polkadot’s price trend is predicted to continue climbing upwards. Potential peak prices for DOT could be found between the 0.5 Fibonacci level ($7.4) and the 0.618 Fibonacci level ($7.8).

In simpler terms, if the price breaks down below the support line of the triangle chart pattern, it may indicate that the downtrend will resume and head towards the $6 level.

Sentiment Analysis

By Shayan

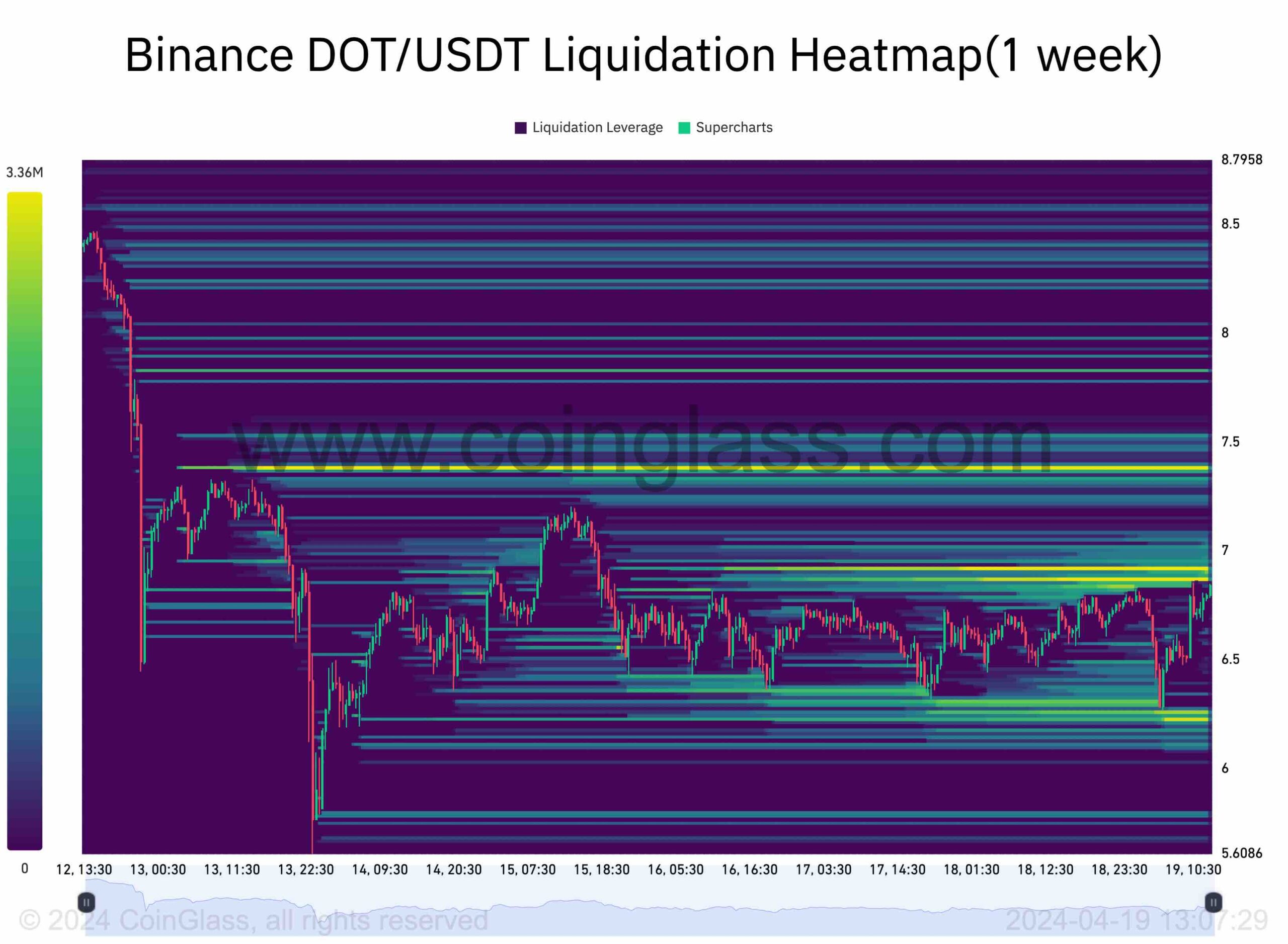

The influence of the continuous Polkadot futures market on its price fluctuations is substantial and should not be underestimated. Short-term price swings, especially those occurring after periods of stability, are frequently triggered by margin calls or liquidations in the futures market. Consequently, being aware of where most liquidity resides can provide useful information.

The Binance DOT/USDT chart featuring liquidation heatmap shows visual cues indicating probable massive liquidation occurrences at specific price points. Areas marked in yellow suggest an increased risk of successive liquidations.

In the chart, you can see that the areas around $7 and $6 have high trading activity (liquidity). If the price goes up toward $7, this could lead to a large number of sell orders being triggered at once, causing a big price drop and increased volatility. On the other hand, if the price falls near $6, many buyers might rush in to take advantage of the lower price, causing a quick price rise.

The current stages act as important benchmarks for the near future and could influence the market direction over the next few weeks.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-04-20 08:02