There are approximately 21,800 Bitcoin options contracts due to expire on Friday, April 19.

The derivatives we’re looking at are worth approximately $1.33 billion based on their notional value. This is slightly less than the previous week’s expiration value.

Additionally, the value of cryptocurrencies has significantly dropped over the past week, and Bitcoin may soon fall below its psychologically significant mark of $60,000.

Bitcoin Options Expiry

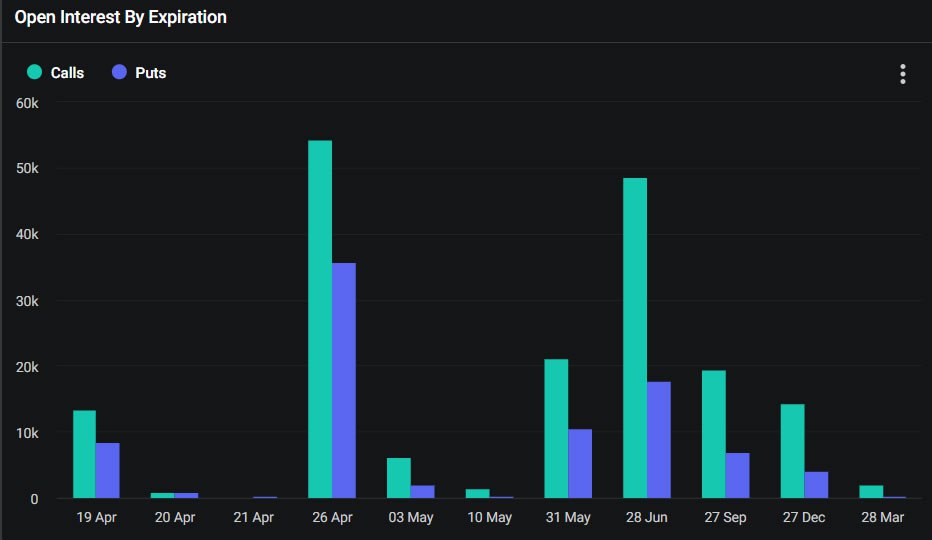

In simple terms, for the Bitcoin contracts set to expire today, there are about two times more call contracts, representing a bullish bet, than put contracts, signifying a bearish one. The put-call ratio stands at 0.63.

At Deribit, the bulls continue to hold significant ground in derivatives markets. The highest open interest is recorded at the $80,000 strike price, amounting to approximately $881 million in long contracts. Moreover, there are over $700 million worth of open interests for both the $70,000 and $75,000 strike prices.

Approximately 453 million dollars’ worth of options contracts are situated near the price of 60,000 dollars, which is not far from the level of highest perceived loss and the current market value.

Despite the market turmoil this week, causing Bitcoin to drop by $60,000 and Ethereum to lose $3,000, the significant decrease in major option contracts’ implied volatility, as noted by crypto derivatives provider Greeks Live, may indicate a calming effect.

IV, or implied volatility, is an estimation of upcoming market turbulence based on data from options contracts about to expire.

“Adding to this, the bullish outlook for Bitcoin remains strong with the upcoming halving on Saturday. For the bulls to take charge in May, Bitcoin must continue to spearhead the market.”

Today, Bitcoin options with an expiry date reach their maturity, in addition to this, Ethereum options contracts numbering 297,000 will also conclude. With a combined value of approximately $960 million, the put (downside bet) contracts account for just 42% of the total, implying that long positions (bets on price increase) outnumber short positions significantly.

In simpler terms, Greeks Living asserted that the longer end of Ethereum’s price movement is weaker and less capable of setting market trends.

Crypto Market Outlook

The total capitalization has stayed at $2.37 trillion today, yet markets have begun to slide once more during the early trading hours in Asia.

Bitcoin experienced a significant drop to $60,000 after ongoing correction, but then rebounded to reach $62,000 within the hour, finding support at the lower price.

Ethereum experienced a significant decline, dropping to $2,876 prior to recovering. However, it hadn’t managed to surpass the symbolic $3,000 mark at the point of this report and was instead priced at $2,989.

Most altcoins experienced losses to different extents that day, with the exception of Toncoin (TON), which saw a gain of 9%.

Read More

- Finding Resources in Palworld: Tips from the Community

- UFO PREDICTION. UFO cryptocurrency

- Skull and Bones: Navigating the Quest for Extra Teeth in the Game

- AAVE PREDICTION. AAVE cryptocurrency

- Uncovering the Mystery of Red King Players in Clash Royale – What Reddit Users Have to Say

- BONE PREDICTION. BONE cryptocurrency

- The Last Epoch Dilemma: Confronting the Gold Dupe Crisis

- Discovering the Infinite Power: The Abiotic Factor that Could Change Everything

- Unveiling the Mystery of Palworld IVs: What Redditors Have to Say

- Gaming News: Like a Dragon: Infinite Wealth’s Dondoko Island Takes Expansion to New Heights

2024-04-19 10:06