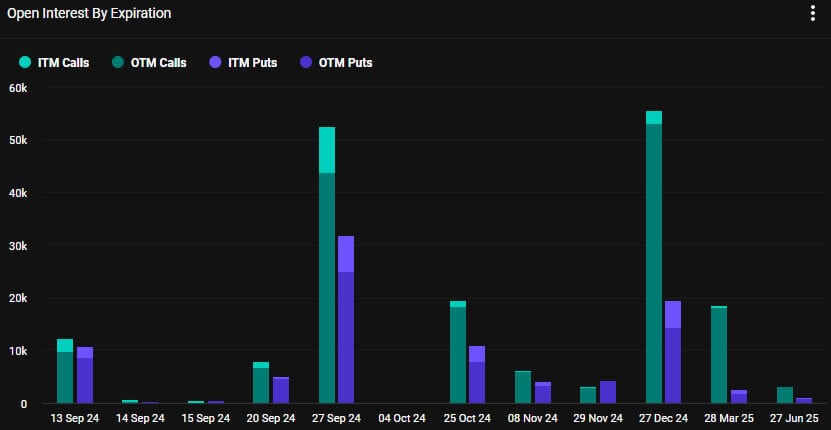

As a seasoned analyst with over two decades of experience in the financial markets, I find myself closely monitoring this week’s Bitcoin options expiry. With a notional value of $1.34 billion and a put/call ratio of 0.87, it’s clear that the market is anticipating some significant price movements. The high open interest at strike prices of $70,000, $75,000, $90,000, and $100,000 suggests a bullish sentiment, but we must remember that options are derived from spot prices, so their expiration can potentially impact the crypto spot markets.

Approximately 23,000 Bitcoin option agreements will expire this coming Friday, September 13th. The total worth of these financial instruments is estimated to be roughly $1.34 billion.

Today’s expiration of options is approximately twice as large as the one from last week, which means the potential influence on cryptocurrency spot markets could be more substantial.

Bitcoin Options Expiry

This week’s set of Bitcoin options is leaning slightly towards more long positions (calls) expiring compared to short ones (puts), but the difference isn’t substantial.

The value of ongoing contracts that haven’t yet expired is still substantial for strike prices set at $70,000 and $75,000, with approximately $627 million and $638 million in open interest respectively, as reported by Deribit.

Furthermore, approximately $751 million and about $930 million are tied up in Options Instrument (OI) for the strike prices of $90,000 and $100,000 respectively.

According to Greeks Live, the week is wrapping up smoothly since the U.S. presidential debate and key economic indicators like CPI have not caused much market turbulence.

The expectation for a 25-basis-point interest rate reduction by the Federal Reserve next week is growing more uniform, as indicated by the CME Fed Watch tool. Specifically, there’s an 87% likelihood of a 25 basis point cut, while the possibility of a 50 basis point cut stands at 13%.

In the meantime, the data on options suggests a substantial drop in implied volatilities (IVs) across all primary periods. This indicates that the market’s anticipation of volatility is decreasing, while the overall theme for September continues to fluctuate.

On September 13th, approximately 23,000 Bitcoin (BTC) option contracts are set to expire. The Put-Call ratio for these options is 0.87, indicating that there are more put (bearish) contracts than call (bullish) contracts. The maximum potential loss, or Maxpain point, is estimated at around $58,000 per option contract. The total notional value of these expiring options is approximately $1.34 billion.

— Greeks.live (@GreeksLive) September 13, 2024

Apart from the Bitcoin options maturing this week, approximately 126,700 Ethereum options with a total value of around $299 million will also be settled. These derivative contracts have a put/call ratio of 0.73, which is quite similar to the ratio we saw during last week’s expiration.

The Bitcoin Fear and Greed Index remains at “fear” (32) as market sentiment is still battered.

Crypto Market Outlook

Total market capitalization has been flat over the past 24 hours at $2.13 trillion.

Bitcoin’s price fluctuated significantly today, moving from a low of approximately $57,300 to around $58,400. Despite this movement, it hasn’t been able to push past the resistance level here. Interestingly, after reaching a low of below $54,000 on September 7th, Bitcoin has since recovered and is currently moving within a narrow range.

Ethereum is currently confined within a narrow range, hovering between approximately $2,320 and $2,360 for much of this week. Meanwhile, most altcoins are experiencing losses, with exceptions being Ripple and Toncoin (TON), which have seen gains of about 3%.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- W PREDICTION. W cryptocurrency

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

2024-09-13 09:39