As an experienced analyst, I have closely followed the cryptocurrency market, including Ethereum (ETH), for several years. Based on my analysis of the given information and considering my past experiences with similar situations, I believe that Ethereum’s price movement remains uncertain.

TL;DR

- Ethereum (ETH) surged over 20% this week, nearing $4,000, driven by hopes of SEC approval for spot ETH ETFs. Nonetheless, the official green light led to significant market volatility and a price drop.

Analysts are divided on ETH’s future, with some predicting a major price increase and others expecting short-term corrections. Key indicators hint at a potential incoming rally.

ETH’s Next Potential Move

Ethereum (ETH) has been one of the top-performing cryptocurrencies in the last week, experiencing a significant surge of more than 20% and approaching the $4,000 threshold. This price increase was largely driven by renewed optimism regarding the SEC’s potential decision on Ethereum ETF applications.

Several hours ago, the approval status for the greenlight was officially announced. Instead of causing a further price surge as anticipated, this development sparked significant volatility throughout the cryptocurrency market. Ethereum, in particular, slipped into the red zone.

As an analyst, I’d like to point out that the market responded in a remarkably similar fashion to the announcement made by the American securities regulator in January of this year, giving its approval for spot Bitcoin ETFs.

Multiple analysts weighed in on the heated issue, many of them viewing it as a significant positive development for the crypto sector. Notably, Anthony Pompliano, a well-known investor and businessman, holds this perspective.

The cryptocurrency analyst CryptoYoddha also contributed to the discussion, stating that Ethereum’s stance on ETF approvals is irrelevant. Regarding the asset’s value projection, a chart was presented suggesting Ethereum could exceed $13,000 by next year, potentially reaching this milestone during the peak of the bull market cycle.

Despite Ali Martinez’s cautionary stance, not all investors share his pessimism. Just before the SEC’s approval, he pointed out the TD Sequential indicator suggests a sell signal on Ethereum’s daily chart. Consequently, he expects a potential correction of one to four daily candlesticks for ETH.

The TD Sequential indicator, created by Tom DeMark, is a valuable tool for identifying possible trend exhaustion and potential reversal points in financial and cryptocurrency markets. This indicator operates based on the consecutive closure of bars at higher or lower levels.

What Are Other Metrics Signaling?

As a researcher studying the Ethereum (ETH) market, I would like to highlight an important factor that could provide insight into ETH’s potential price movement: open interest. Open interest represents the total number of unfilled derivative contracts, such as futures or options, for Ethereum that have yet to be settled. By examining this indicator, we can assess the market sentiment towards Ethereum and potentially anticipate its future price trends.

Lately, the metric has reached a new record peak, implying potential large price fluctuations in the future.

Another indicator worth observing is Ethereum’s exchange netflow, which has been negative in the past two days. Such a shift from centralized platforms to self-custody methods is considered bullish since it reduces the immediate selling pressure.

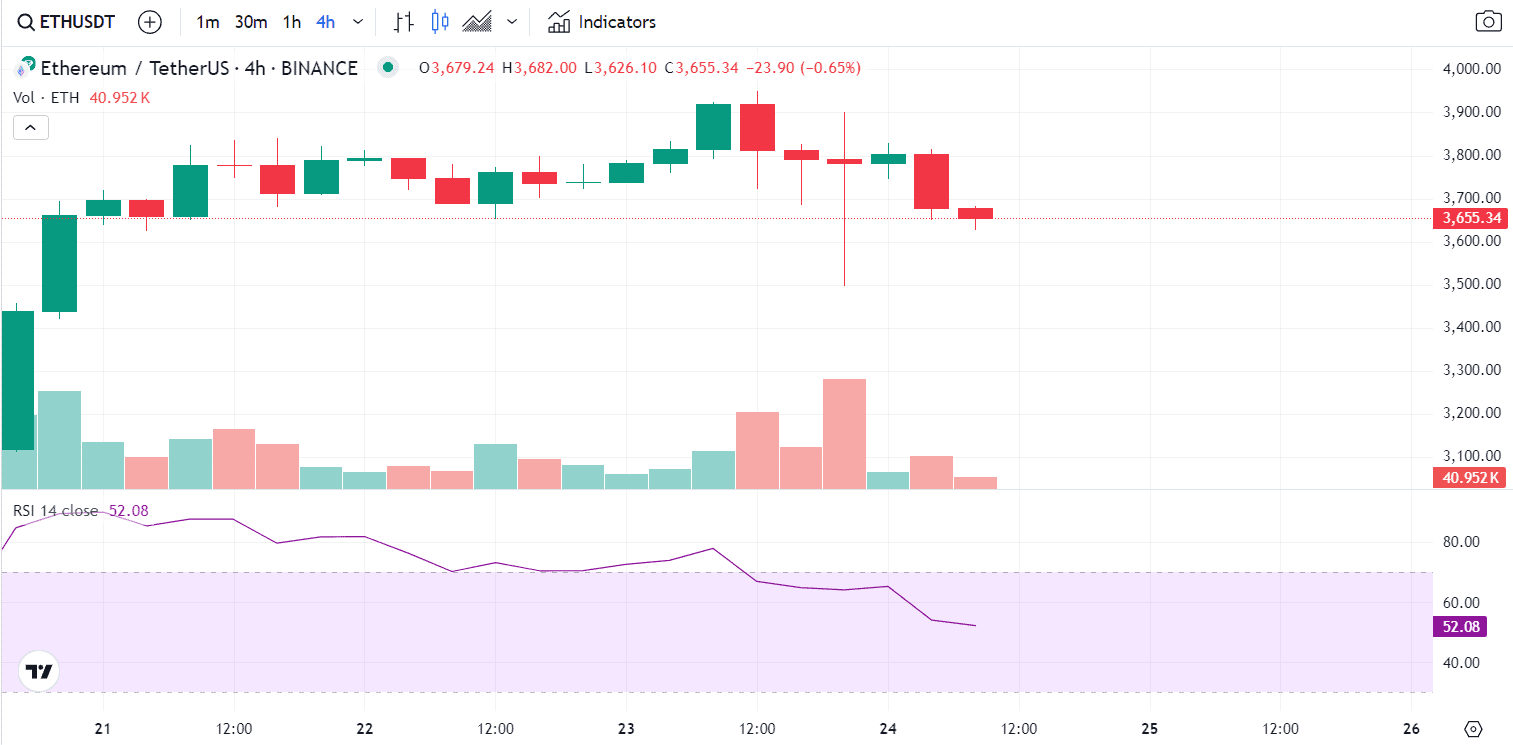

As an analyst, I’d like to add some insights about the Relative Strength Index (RSI) of Ethereum (ETH). This indicator measures the rate and magnitude of price changes and is presented on a scale from 0 to 100. When the RSI value surpasses 70, it suggests that the asset may be overbought and could potentially experience a correction. Currently, based on the most recent data, Ethereum’s RSI hovers around 52.

Read More

- ACT PREDICTION. ACT cryptocurrency

- W PREDICTION. W cryptocurrency

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- PENDLE PREDICTION. PENDLE cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

2024-05-24 17:07