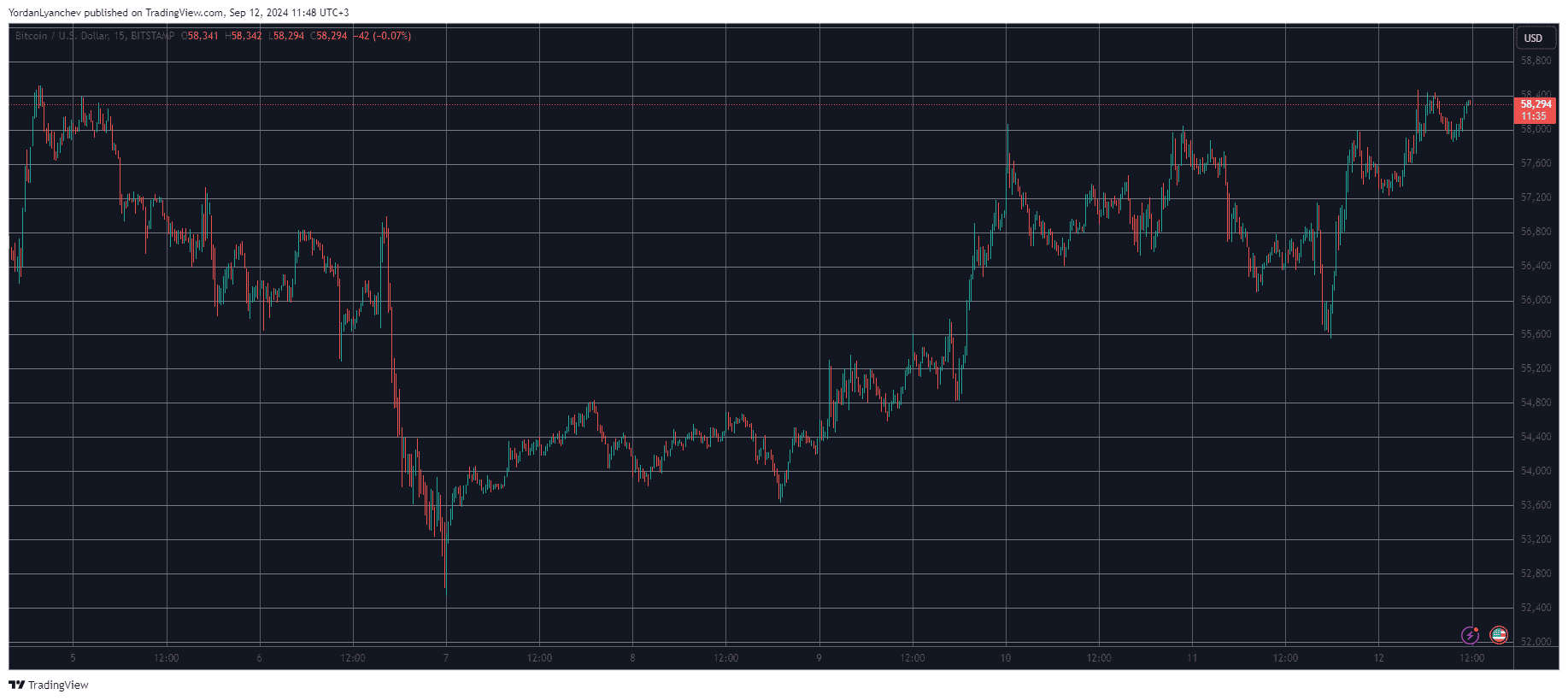

As a seasoned analyst with over a decade of experience in the dynamic world of cryptocurrencies, I can confidently say that the current market scenario is nothing short of exhilarating. The past few days have been a rollercoaster ride for Bitcoin, with its price touching new heights above $58,000 and then dipping after the latest CPI data from the US. However, the resilience of BTC has been evident as it quickly bounced back, showcasing its potential to weather market volatility.

The cost of Bitcoin saw increased fluctuations following the recent Consumer Price Index (CPI) figures released in the U.S., yet it has still recorded remarkable increases, currently surpassing $58,000.

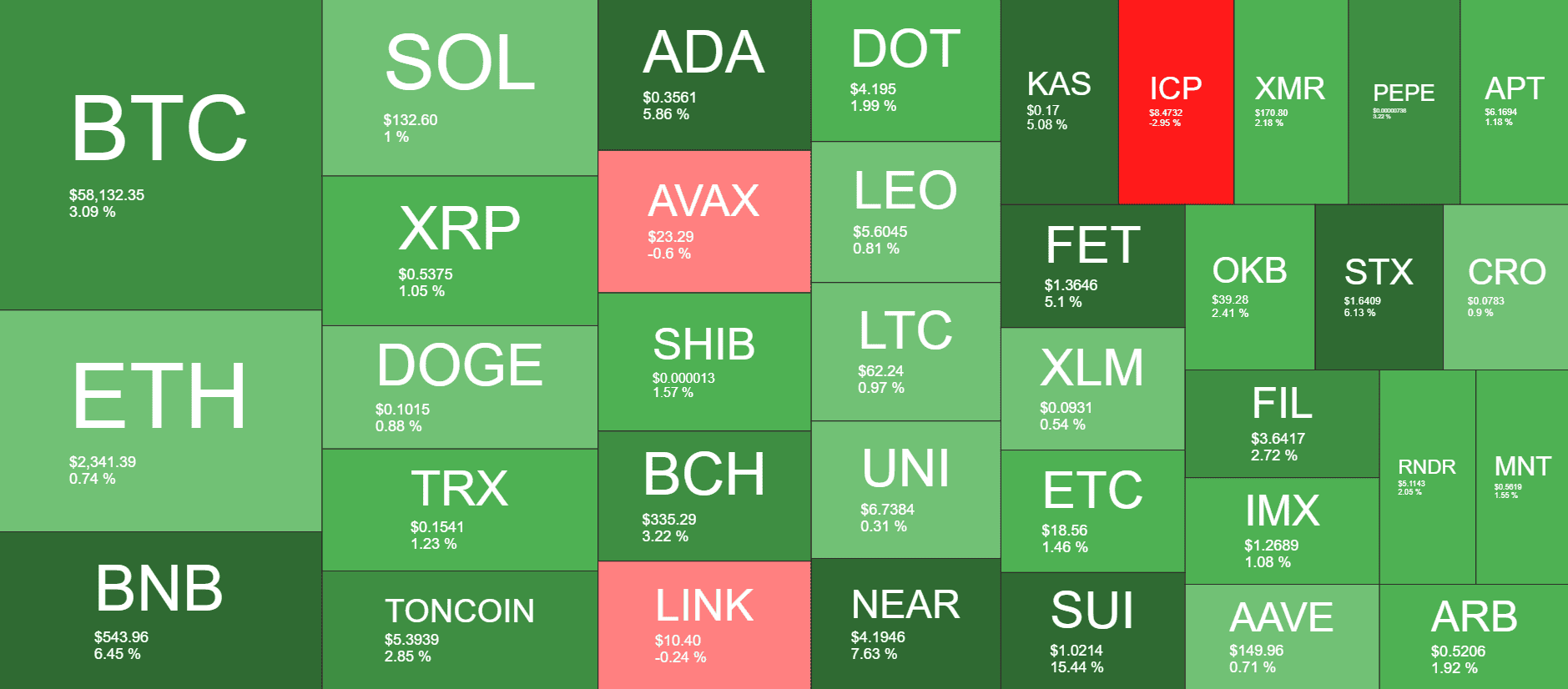

Almost all alternative cryptocurrencies have mimicked this trend, as Binance Coin (BNB) and Cardano (ADA) have seen daily gains of around 5-6%, pushing their prices up to approximately $540 and $0.35 each.

BTC North of $58K

Over the weekend, Bitcoin’s performance was relatively subdued. On Friday, its value dipped below $53,000, but it mostly hovered above $54,000 on both Saturday and Sunday. The start of the new trading week saw a slight uptick towards $55,000, followed by a significant surge that pushed its price beyond $58,000 later in the week.

After two unsuccessful attempts to surpass that level by Wednesday, I experienced a significant drop in price to $55,500 following the release of US CPI data. This figure holds great importance for investors because the next FOMC meeting is scheduled for the upcoming week, and it’s widely anticipated that the Fed will reduce interest rates by 25 basis points at this gathering.

Initially, Bitcoin showed a negative response to the news, causing its price to drop from approximately $57,000 down to around $55,500. Later on, the bullish investors rallied and instigated a significant surge in the subsequent hours that propelled Bitcoin nearly up to an 8-day high of about $58,500 today.

Despite failing to conquer that level yet, BTC is still more than 3% up on the day. Its market cap has jumped to $1.150 trillion, while its dominance over the alts is up to 53.9% on CG.

BNB, ADA on a Roll

Today, I’m observing a positive trend across the altcoin market. Notably, Ethereum (ETH), Solana (SOL), Ripple (XRP), Dogecoin (DOGE), Tron (TRX), and Shiba Inu (SHIB) have experienced minor growth. However, it’s Cardano’s (ADA) and Binance Coin’s (BNB) impressive 6% surge that has truly caught my attention. As a result, the price of Cardano’s native token has climbed to approximately $0.35, while Binance Coin is hovering just under $545.

As an analyst, I’d rephrase it like this: Among the larger-cap alternatives, I noticed significant gains in NEAR (up by 7.5%), KAS (5%), FET (5%), and STX (6%). However, the standout performer was SUI, which skyrocketed more than 15%, pushing its current trading price above $1.

The total crypto market cap has added over $35 billion since yesterday and is now close to $2.140.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

- Is Granblue Fantasy’s Online Multiplayer Mode Actually Dead? Unpacking the Community Sentiment

2024-09-12 11:56