As an experienced analyst, I’ve closely monitored Bitcoin’s price movements last week. The volatility was palpable, especially before and after the US Fed’s FOMC meeting. Bitcoin dipped to a multi-month low of $56,500 on Wednesday but swiftly recovered, soaring past $62,000 within minutes on Friday. It even touched $64,000 on several occasions but couldn’t sustain those gains.

Last week, Bitcoin‘s value went through significant fluctuations, with particularly noticeable movements leading up to and following the latest Federal Open Market Committee (FOMC) meeting by the US Fed. However, Bitcoin regained some losses during the current FOMC meeting.

Last Wednesday saw the major cryptocurrency reach a low point of $56,500, marking a several-month low. Following this announcement from the US Federal Reserve that they would not be increasing interest rates, the currency experienced significant volatility. However, by Friday, it started to bounce back from its decline.

During the given time frame, Bitcoin experienced a remarkable surge, jumping from approximately $59,000 to $62,000 within mere minutes. The price continued escalating throughout the weekend, reaching as high as $64,000 on several occasions. Despite these efforts, it was unable to surpass this level by Sunday. However, on Monday, Bitcoin broke through the resistance and peaked at an impressive $65,500, marking a new 12-day record.

Despite the bears’ persistent presence, preventing any additional gains, bitcoin experienced a sudden and significant price decrease below $61,000 on Thursday. Since then, BTC has rebounded, regaining over $2,000 and currently trades around $63,000. This recovery took place despite the notable reduction in the Bitcoin network’s mining difficulty.

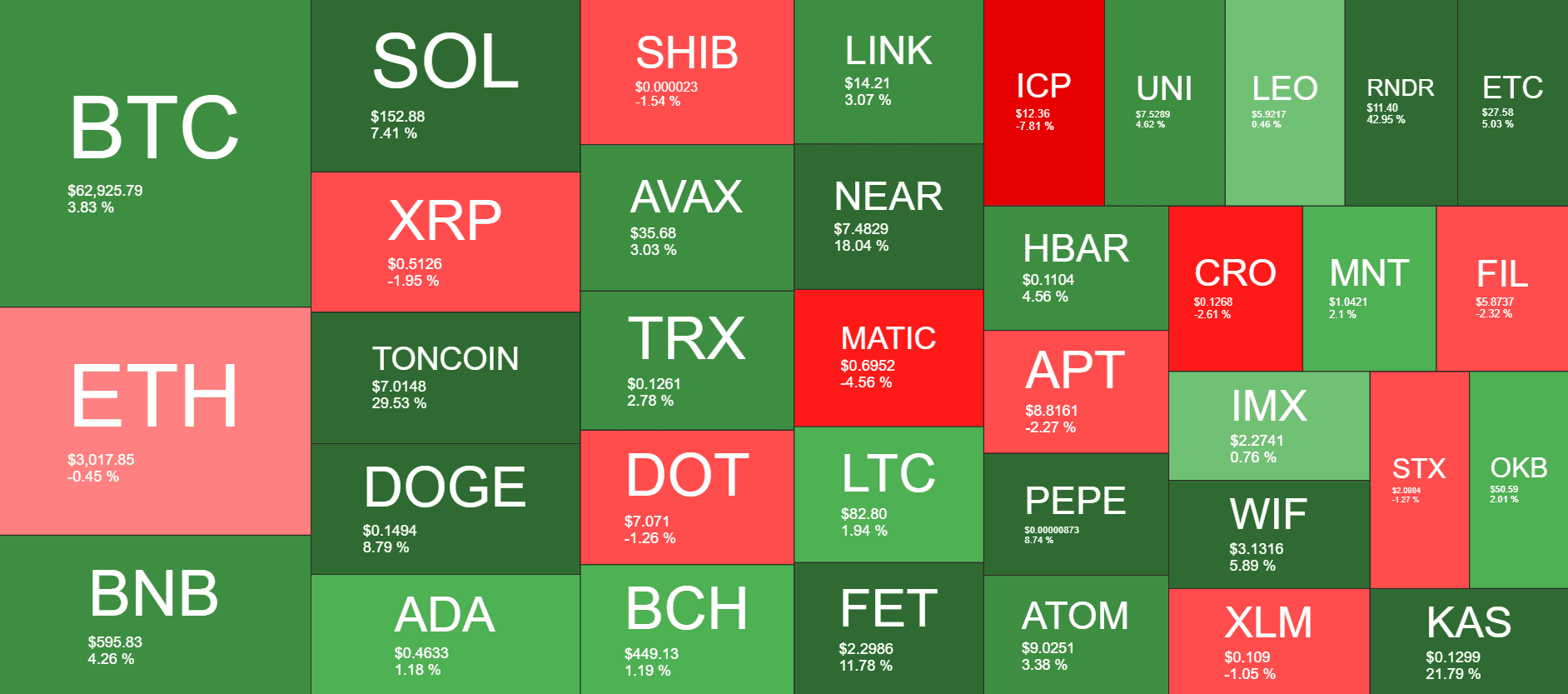

Among the mid-capacity altcoins, Toncoin has distinguished itself with an impressive 30% price increase each week. Notably, NEAR, FET, and RNDR have also shown significant gains.

Binance has once more found itself at the center of non-price related headlines. The Nigerian government’s ongoing dispute with the platform is one issue, while another involves the Canadian regulatory authorities imposing a penalty due to Binance’s supposed inadequate anti-money laundering measures.

Market Data

Market Cap: $2.451T | 24H Vol: $74B | BTC Dominance: 50.6%

BTC: $62,717 (+1.6%) | ETH: $3,011 (-1.75%) | BNB: $594 (+3%)

This Week’s Crypto Headlines You Can’t Miss

Top Polkadot (DOT) Wallets in 2024: A Detailed Comparison

As a dedicated researcher in the field of blockchain technology, I’ve noticed an intriguing surge in activity on the Solana network over the past year and a half. With thousands of projects flourishing and on-chain trading reaching new heights, I believe it’s essential to identify the leading decentralized exchanges (DEXs) on Solana that are worth keeping an eye on in 2024. Here are my top picks:

Donald Trump, who was formerly critical of Bitcoin, has shifted his stance and announced plans to allow cryptocurrency donations for his political campaign.

As an analyst, I’m excited to report that Bitcoin’s network reached an impressive achievement despite recent price fluctuations. With one billion transactions now processed on the blockchain, Bitcoin continues to demonstrate its robustness and efficiency as a digital currency.

I’ve analyzed the Bitcoin market and noticed that we’re currently experiencing an extended phase of consolidation. This means Bitcoin’s price has been fluctuating within a narrow range for some time. Interestingly, miner behavior adds to this trend – they have held their positions steadily for the longest duration since Bitcoin was priced at approximately $16K.

The Biden administration is reportedly planning to thwart a legislative proposal allowing U.S. banks to hold cryptocurrencies as custodians.

Charts

This week, I’d like to share an examination of Ethereum, Ripple, Cardano, Shiba Inu, and Polkadot through chart analysis. For a comprehensive look at their current pricing trends, please follow this link.

Read More

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- Valorant Survey Insights: What Players Really Think

2024-05-10 17:21