As a seasoned crypto investor with a decade-long journey through the digital asset market, I can’t help but feel a sense of deja vu when observing the recent developments in the Bitcoin market. The current downturn, with BTC dumping to monthly lows, is a stark reminder of the rollercoaster ride that characterizes this industry.

Remember 2017 and the infamous bitcoin bubble? I was there, watching in disbelief as the price soared to unimaginable heights only to crash spectacularly soon after. It seems history may be repeating itself, albeit at a slower pace this time around.

The ongoing negative trend following MicroStrategy’s acquisition streak is a curious case. While it’s commendable that the firm continues to invest in Bitcoin, I can’t help but wonder if their Monday announcements are causing more harm than good. Each purchase seems to be followed by immediate corrections, creating a pattern that makes me question the timing of these moves.

I find myself at a crossroads, torn between my belief in the long-term potential of Bitcoin and the short-term volatility that comes with it. But as they say, every downturn brings new opportunities, and I’m keeping a close eye on the market for any signs of reversal.

In the end, I can’t help but chuckle at the irony. Here I am, an old-timer in the crypto world, still learning to navigate the ups and downs of this ever-changing landscape. As they say, “The more things change, the more they stay the same.” Guess that’s just part of being a crypto investor!

As a researcher studying the cryptocurrency market, I find myself confronted with a concerning situation. The bull market we’ve been experiencing seems to be at risk, given that Bitcoin’s price has plunged more than $16,000 from its all-time high, which was reached on December 17.

It’s worth noting that since MicroStrategy’s recent buying spree, a downward pattern seems to be emerging. The company consistently announces new acquisitions every Monday.

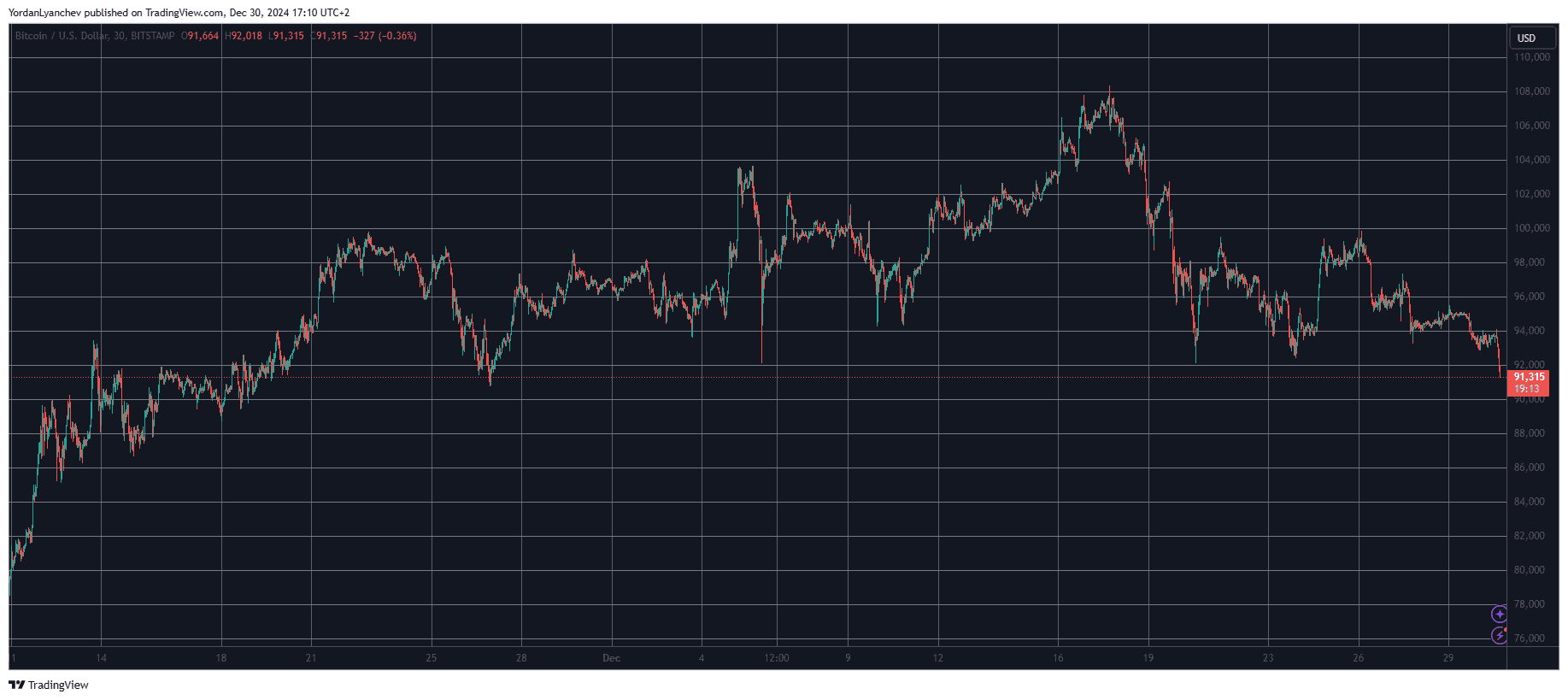

BTC Dumps to Monthly Lows

Just over two weeks ago, the environment surrounding the main cryptocurrency was extremely optimistic. It consistently set new record highs, with the most recent one reaching $108,000 on December 17. This marked a significant increase of around $50,000 since the US presidential elections on November 5.

Yet, it was at the end of the final Federal Reserve FOMC meeting for the year that the anticipated interest rate reduction occurred. Nevertheless, hawkish remarks from Chair Jerome Powell caused a significant market flip-flop.

Initially, Bitcoin saw a significant decrease in value and fell to approximately $92,000 within three days. However, it briefly recovered during the following week and even attempted to reach $100,000 on a few occasions. Unfortunately, these attempts were unsuccessful, leading to repeated setbacks that pushed its value downward.

Today, Bitcoin experienced another downturn, causing its value to drop significantly to around $91,330 on Bitstamp. This is the lowest price it’s held since November 27. In tandem, other cryptocurrencies like XRP and ADA have also seen a decline of over 6%, while many meme coins have suffered even more severe losses.

MicroStrategy to Blame?

As an analyst, I find myself reflecting on today’s dip in prices, which occurred mere hours following MicroStrategy’s latest Bitcoin acquisition announcement – a move they’ve consistently made public every Monday for the past eight weeks, as a Nasdaq-listed business intelligence software leader.

While it might appear that removing Bitcoin from circulation is a positive sign, history shows that every time Saylor Corporation bought Bitcoin, the market saw an immediate downturn. For instance, on November 25, when Bitcoin was valued at over $99,000, it swiftly dropped to less than $91,000 shortly after the purchase.

On December 2nd, bitcoin peaked at $98,000 but dipped to $93,000 following MicroStrategy’s announcement. The following Monday, BTC surpassed $101,000 before experiencing another drop that took it down to $94,000. On December 16th, the value of bitcoin exceeded $106,000 only to retreat back to $103,500 on the same day. In its final movement before Christmas, it traded at $96,200, but yet another correction pushed it down by $3,000.

currently, the price decrease has led to a new low not seen in several weeks. However, Bitcoin might plummet even more if it falls below the $90,000 support. Some experts predict that if this level is breached, the value could drop down to and potentially fall below $80,000.

Read More

- SUI PREDICTION. SUI cryptocurrency

- „People who loved Dishonored and Prey are going to feel very at home.” Arkane veteran sparks appetite for new, untitled RPG

- LDO PREDICTION. LDO cryptocurrency

- Destiny 2: A Closer Look at the Proposed In-Game Mailbox System

- Clash Royale Deck Discussion: Strategies and Sentiments from the Community

- Jennifer Love Hewitt Made a Christmas Movie to Help Process Her Grief

- ICP PREDICTION. ICP cryptocurrency

- Naughty Dog’s Intergalactic Was Inspired By Akira And Cowboy Bebop

- Critics Share Concerns Over Suicide Squad’s DLC Choices: Joker, Lawless, and Mrs. Freeze

- EUR IDR PREDICTION

2024-12-30 18:22