As a crypto investor with some experience under my belt, I find the current state of Bitcoin’s price consolidation intriguing. The prolonged period of sideways movement following the new all-time high around $74K has left many investors on edge, but I remain optimistic.

For about three months, Bitcoin‘s price has remained relatively stable around its recent record-breaking peak of approximately $74,000.

Since then, the asset has failed to produce a new peak, but a new rally might begin soon.

Technical Analysis

By TradingRage

The Daily Chart

The price behavior of Bitcoin on a daily basis has been erratic, with the market observing a period of consolidation within a downward trendline. However, at present, the cryptocurrency is encountering resistance at both the descending channel’s upper boundary and the $68,000 mark.

As a researcher studying market trends, I’ve noticed that despite recent unsuccessful attempts to surpass previous highs, the overall momentum remains bullish. A breakout above current levels could occur suddenly, propelling the market toward the $75K all-time high and potentially setting a new record.

The 4-Hour Chart

The 4-hour chart clearly depicts the current consolidation period. The cryptocurrency’s price moves back and forth around the $68,000 mark, forming a symmetrical triangle pattern. Given the price behavior within this configuration and the market’s previous three touches of the triangle’s lower trendline, it appears likely that a bullish breakout will occur based on traditional price action principles.

Currently, the Relative Strength Index (RSI) remains close to the 50% mark without providing clear signals for an imminent trend reversal. Consequently, the upcoming price movement is highly dependent on the direction of a decisive breakout from the triangle formation.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Reserve

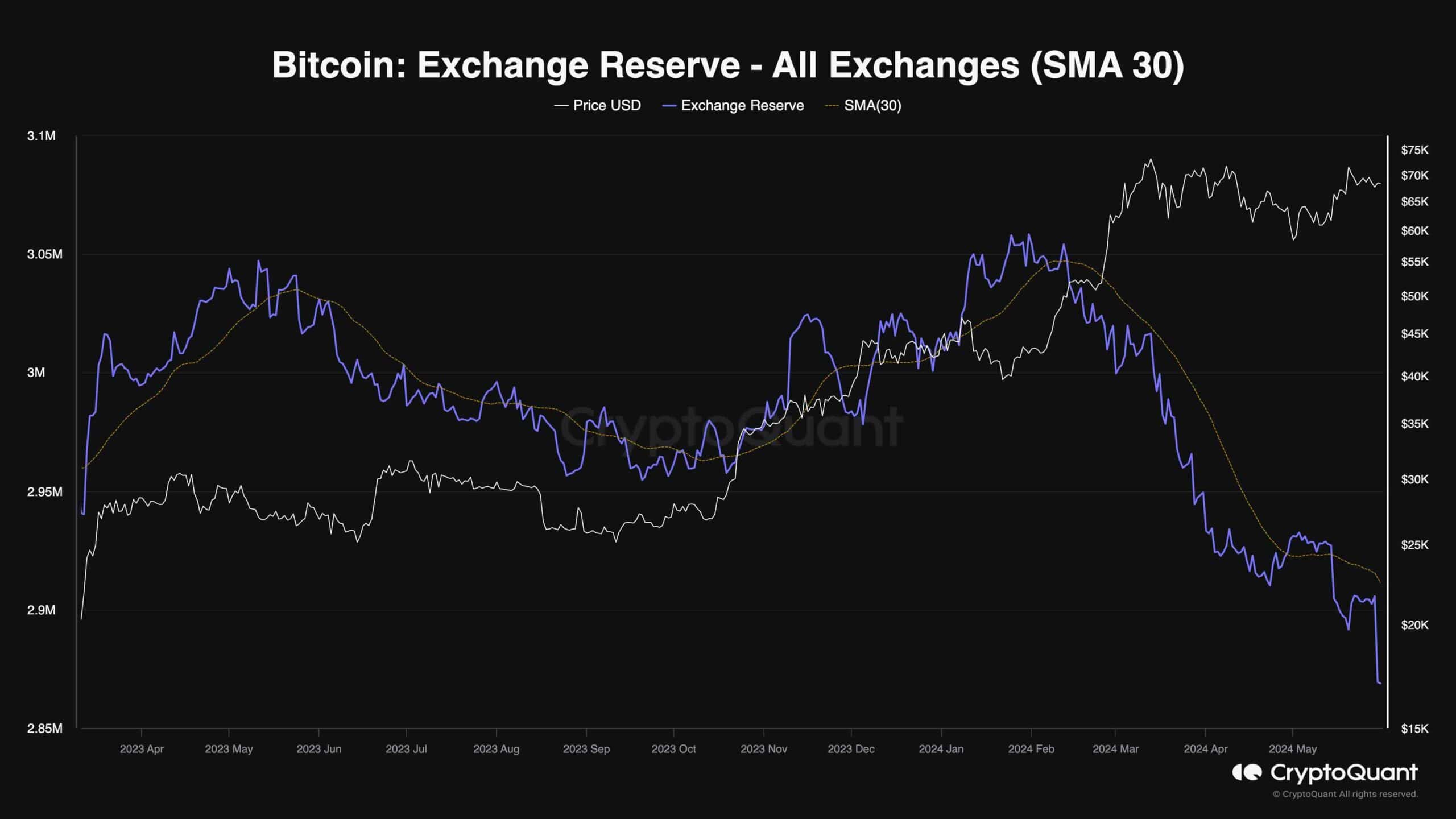

As a crypto investor, I’m keeping a close eye on Bitcoin’s price as it creeps closer to setting a new record high. The following chart illustrates the exchange reserve metric, which represents the total amount of Bitcoin held in wallets linked to exchanges. When this figure drops, it’s generally seen as a bullish sign because less Bitcoin is available for sale on the open market. Conversely, an increase in the exchange reserve suggests that more Bitcoin is ready to be sold, making it a bearish indicator.

As the chart demonstrates, the Bitcoin exchange reserve metric has declined steeply since February. This supply shrinkage was one of the contributing factors to the recent rally. The decline has even become sharper in the past few days, as investors expect a rally toward a new all-time high soon. This decrease in exchange reserve might be just what the market needs to do.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- W PREDICTION. W cryptocurrency

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Destiny 2: How Bungie’s Attrition Orbs Are Reshaping Weapon Builds

2024-05-31 15:42