As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a sense of deja vu looking at Bitcoin’s current trajectory. The daily chart break above $64K and the 200-day moving average is reminiscent of the euphoria that preceded the last all-time high. However, I am cautiously optimistic this time around.

Bitcoin‘s price has just surpassed a crucial threshold and appears to be aiming for a fresh record high in the near future.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the day-to-day graph, the price has successfully surpassed the $64K threshold and the 200-day moving average, both roughly at this level.

Given the robustly bullish trend indicated by the Relative Strength Index (RSI), it’s expected that the cryptocurrency could proceed on an upward trajectory, potentially reaching the resistance level of around $68K over the near future.

If there’s a need for adjustment, it’s expected that the 200-day moving average will continue to support the price and potentially drive the market upwards.

The 4-Hour Chart

On a 4-hour scale, the price has been forming successive higher peaks and troughs following its bounce back from the $52K support point.

The positive momentum in the market has resulted in a distinct upward trend, acting as a steady support for Bitcoin over several weeks. If this trajectory persists, it’s just a question of time until we see the market hitting the $68K mark.

If the trendline is broken going downwards, there’s a likely possibility that the price might retreat to around $60,000.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Short-Term Holder SOPR

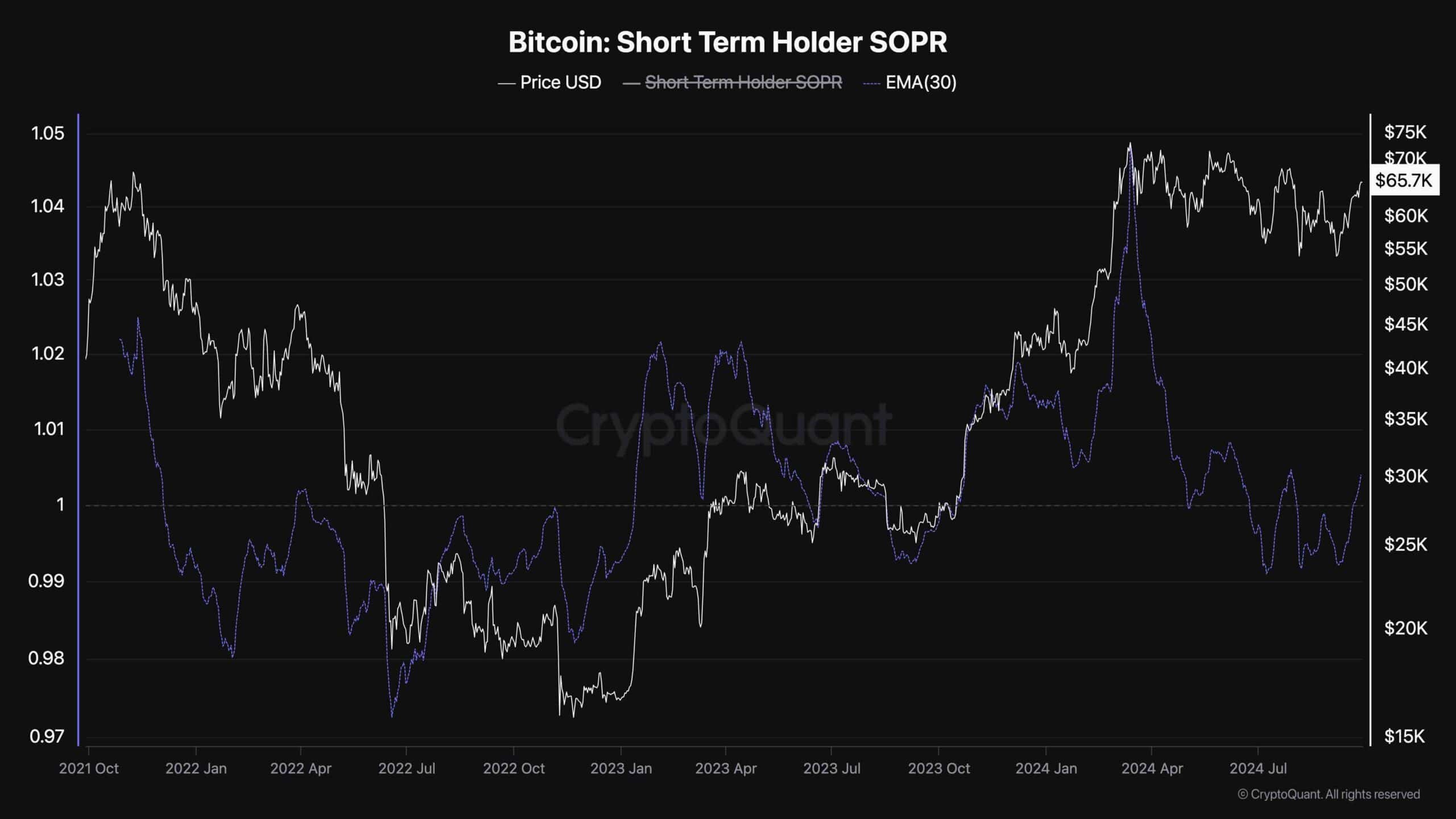

During the latest period of Bitcoin’s price stabilization and minor correction, numerous short-term investors, some who hadn’t yet made a profit, became anxious and offloaded their coins. The provided chart demonstrates the Short-Term Holder SOPR, a metric that calculates the proportion of profits/losses reaped by brief-term Bitcoin investors.

According to the graph, the Short-Term Holder SOPR reached a new peak when Bitcoin’s price touched $70K initially, but it has since significantly decreased over the last few months. In fact, short-term holders have been incurring losses since July, as the metric has fallen below 1. However, with the recent surge in Bitcoin’s price, these investors are now seeing profits once more.

As an analyst, I’ve observed that during bull markets, investors often take profits. If the demand to buy these sold assets doesn’t match the supply (selling pressure), the price may dip lower once more.

Read More

- PENDLE PREDICTION. PENDLE cryptocurrency

- Skull and Bones Players Report Nerve-Wracking Bug With Reaper of the Lost

- SOLO PREDICTION. SOLO cryptocurrency

- W PREDICTION. W cryptocurrency

- NBA 2K25 Review: NBA 2K25 review: A small step forward but not a slam dunk

- Why has the smartschoolboy9 Reddit been banned?

- Understanding Shinjiro: The Persona 3 Character Debate

- Unlocking Destiny 2: The Hidden Potential of Grand Overture and The Queenbreaker

- Mastering Destiny 2: Tips for Speedy Grandmaster Challenges

- Rainbow Six Siege directory: Quick links to our tips & guides

2024-09-28 18:32