As a seasoned researcher with a decade of experience in the cryptocurrency market, I can confidently say that the current state of Bitcoin is a cause for concern. The repeated failure to surpass the 200-day moving average is a clear red flag, and if we don’t see a change soon, we might be looking at lower levels in the near future.

The current price of Bitcoin hasn’t managed to surpass its crucial 200-day moving average, suggesting a potential fall towards lower values if market conditions persist unchanged.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the day-to-day graph, the price has lately bounced back from the $60K support zone after falling beneath $64K and the 200-day moving average, which is approximately in the same region.

At the moment, these levels are acting as a barrier to any increase in price, as yesterday’s chart pattern clearly shows a strong sign of sellers rejecting further price rises.

As a researcher studying the cryptocurrency market, I anticipate that if this digital currency doesn’t surpass its 200-day moving average in the near future, it might experience a short-term drop towards the $56K mark.

The 4-Hour Chart

Looking at the 4-hour chart, things are seemingly turning in favor of the sellers.

Bitcoin (BTC) has been moving within an upward-sloping, constricted pattern known as an ascending channel. However, yesterday, it dropped beneath this channel’s boundaries. Given traditional price dynamics, a potential drop to around $60K – and possibly beyond – seems quite likely at present.

Even though the Relative Strength Index (RSI) remains near the 50% mark, there’s a possibility that the market might climb towards the $64K peak and surpass it. Nevertheless, such an outcome appears unlikely with minimal probability.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Miner Reserve

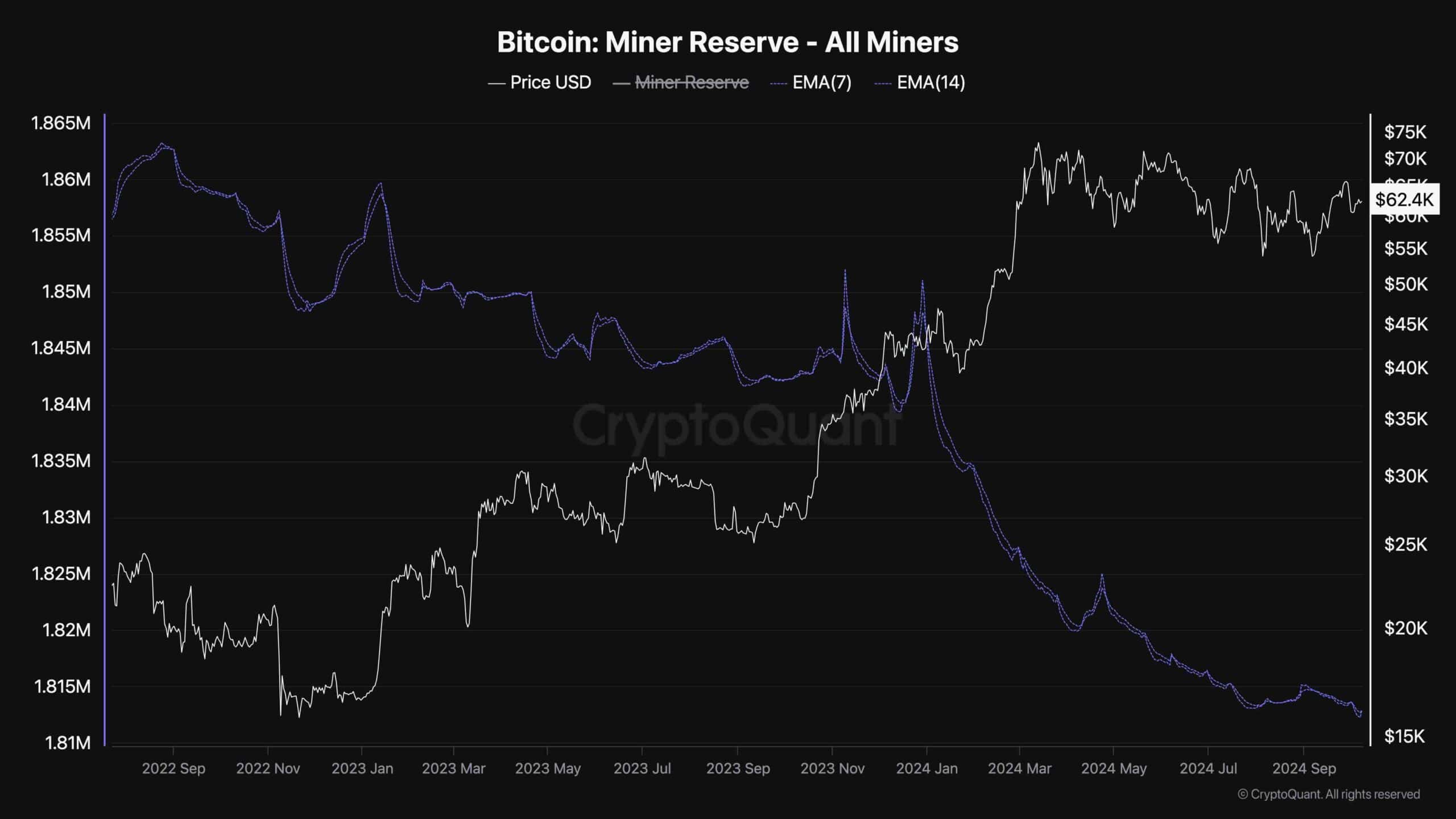

This chart demonstrates the Bitcoin miner reserve metric. It measures the amount of BTC held by miners and is an indicator for evaluating their behavior. Rising values show accumulation, while declines indicate distribution.

According to the graph, it appears that miners have been actively offloading their cryptocurrency when its value surpassed the $40K mark.

Despite the continuing decrease in available resources, these investors are offloading assets faster than they’re buying them up. If current trends persist, such selling could flood the market with an oversupply, potentially triggering a steeper decline in the next few months.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- COW PREDICTION. COW cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- DHT PREDICTION. DHT cryptocurrency

- FIDA PREDICTION. FIDA cryptocurrency

- PSP PREDICTION. PSP cryptocurrency

2024-10-08 20:02