As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and economic events that have shaped the trajectory of various assets. The recent interest rate cut by the U.S. Federal Reserve has once again proven to be a significant catalyst for the cryptocurrency market, particularly Bitcoin (BTC) and Ethereum (ETH).

After a wait of approximately four years, the cryptocurrency market experienced a much-anticipated resurgence when the U.S. Federal Reserve reduced interest rates on Wednesday for the first time.

The two largest digital assets went on a run, jumping by roughly 10% in the past few days.

BTC Price Rises Amid ETF Inflows

Bitcoin ETFs, which focus on the 11th spot, have garnered significant interest and investment since their launch in January. Their fluctuations in net flows – both positive and negative – have significantly impacted the asset’s price, causing Bitcoin to reach a new record high only two months later.

In much the same way as various markets adjust based on economic circumstances and updates, it proved intriguing to observe investor behavior during this specific week due to the Federal Reserve’s FOMC meeting held on Wednesday.

To put it simply, this is the initial reduction in interest rates in the U.S. since 2020, marking the first such cut after the launch of Bitcoin ETFs. In the days prior to the meeting, American investors collectively invested approximately $500 million into these financial instruments, but on Wednesday alone, they pulled out roughly $52.7 million.

Yesterday marked a shift in their stance for a second time – this change occurred on the first business trading day post the interest rate reduction. According to FarSide’s data, there was a total net inflow of approximately $158.3 million. ARK Invest’s ARKB took the lead with an inflow of around $81.1 million, closely followed by Fidelity’s FBTC with almost $50 million. There were no reported outflows, but BlackRock’s IBIT remained inactive.

Over the same period, the value of Bitcoin surged dramatically from approximately $59,000 (on the day of the rate cut) to more than $64,000 earlier today. However, it has since dipped slightly to around $63,400 at this moment.

Even ETH ETFs See Inflows

Unlike Bitcoin ETFs, Ethereum ETFs haven’t garnered much attention since their launch in late July, with only a few days showing net inflows. In the lead-up to the FOMC meeting, investors pulled out $9.4 million on Monday, $15.1 million on Tuesday, and another $9.8 million on Wednesday.

Yesterday, there was a shift in the trend for Ethereum ETFs, with a total of $5.2 million flowing in. Remarkably, all this money went to BlackRock’s ETHA fund, while the rest of the ETFs reported no significant inflows.

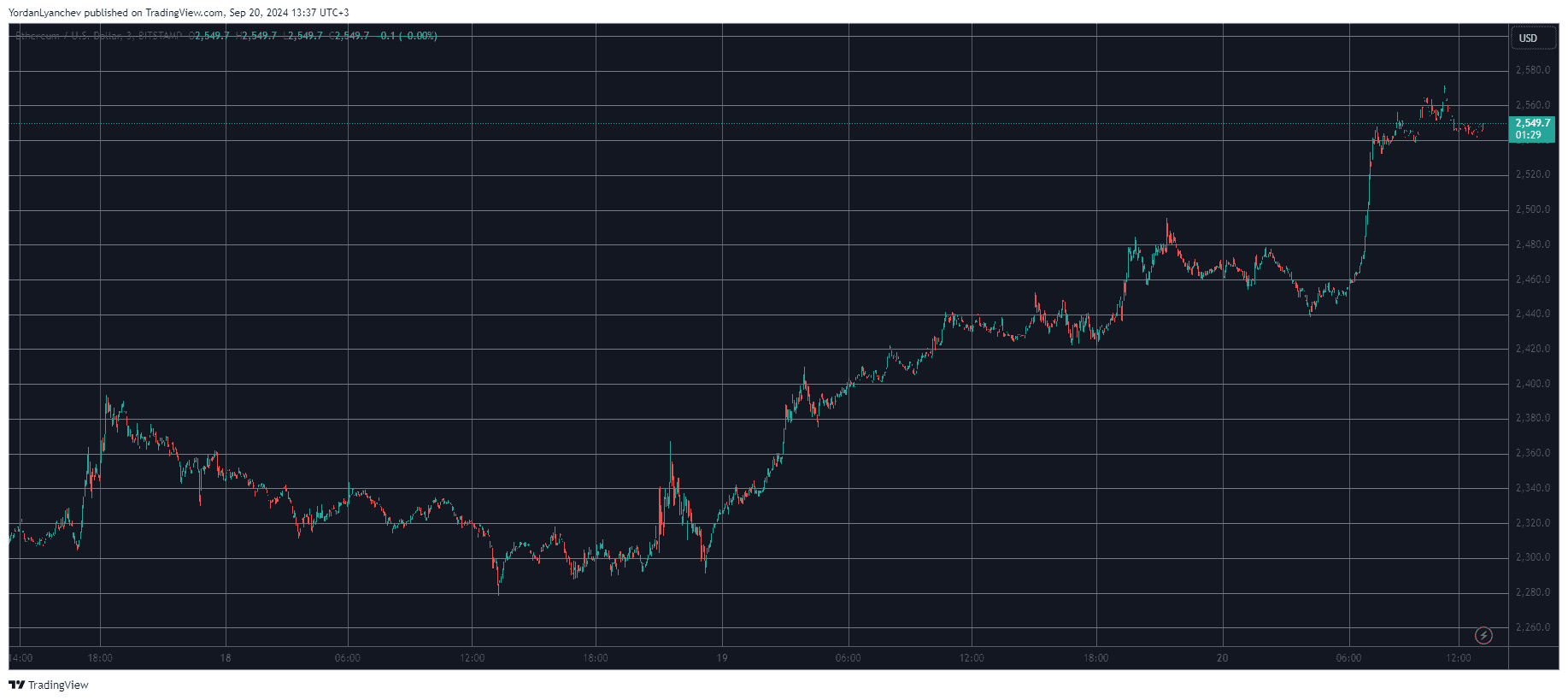

The cost of ETH increased in tandem with Bitcoin. Initially, it dropped to $2,300 during the FOMC meeting on Wednesday, but today it reached a high of $2,575, marking an increase of 12% for the first time since late August.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- BRISE PREDICTION. BRISE cryptocurrency

- GBP CAD PREDICTION

- WOO PREDICTION. WOO cryptocurrency

- WELT PREDICTION. WELT cryptocurrency

2024-09-20 13:50