As a researcher with extensive experience in cryptocurrency market analysis, I’ve closely followed Bitcoin’s recent price action and have formed an opinion based on both technical and on-chain analysis.

As a researcher studying the Bitcoin market, I’ve noticed that the price has held steady above the $60,000 mark for several months. However, recently, we’ve seen a significant drop below this level. This unexpected price movement has left many investors feeling uneasy and questioning whether the bull market has come to an end.

Technical Analysis

By TradingRage

The Daily Chart

As a crypto investor, I’ve noticed that the daily chart of my cryptocurrency investment has been following a large descending channel pattern since March. However, recently, the price has managed to break below this channel, signaling a potential trend reversal. Consequently, I’m bracing myself for further downward movements as the market tests the $52K support level.

The moving average of Bitcoin’s price over the past 200 days hovers near the $50,000 threshold and may serve as a critical support level should the market experience a more significant downturn. Conversely, a slide below this point could trigger increased selling pressure.

The 4-Hour Chart

On the 4-hour chart, the price attempted to break above the middle trendline several days ago but was unsuccessful. Since then, it has formed lower peak and trough points, and more recently, it has fallen below this line.

As an analyst, I’ve noticed that although the market trends appear bearish at present, the Relative Strength Index (RSI) has dipped into the oversold territory. Consequently, it’s likely that we might experience a short-term rebound leading to a pullback around $60,000. Following this brief recovery, there’s a possibility of another decline toward the $52,000 mark.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Whale Ratio

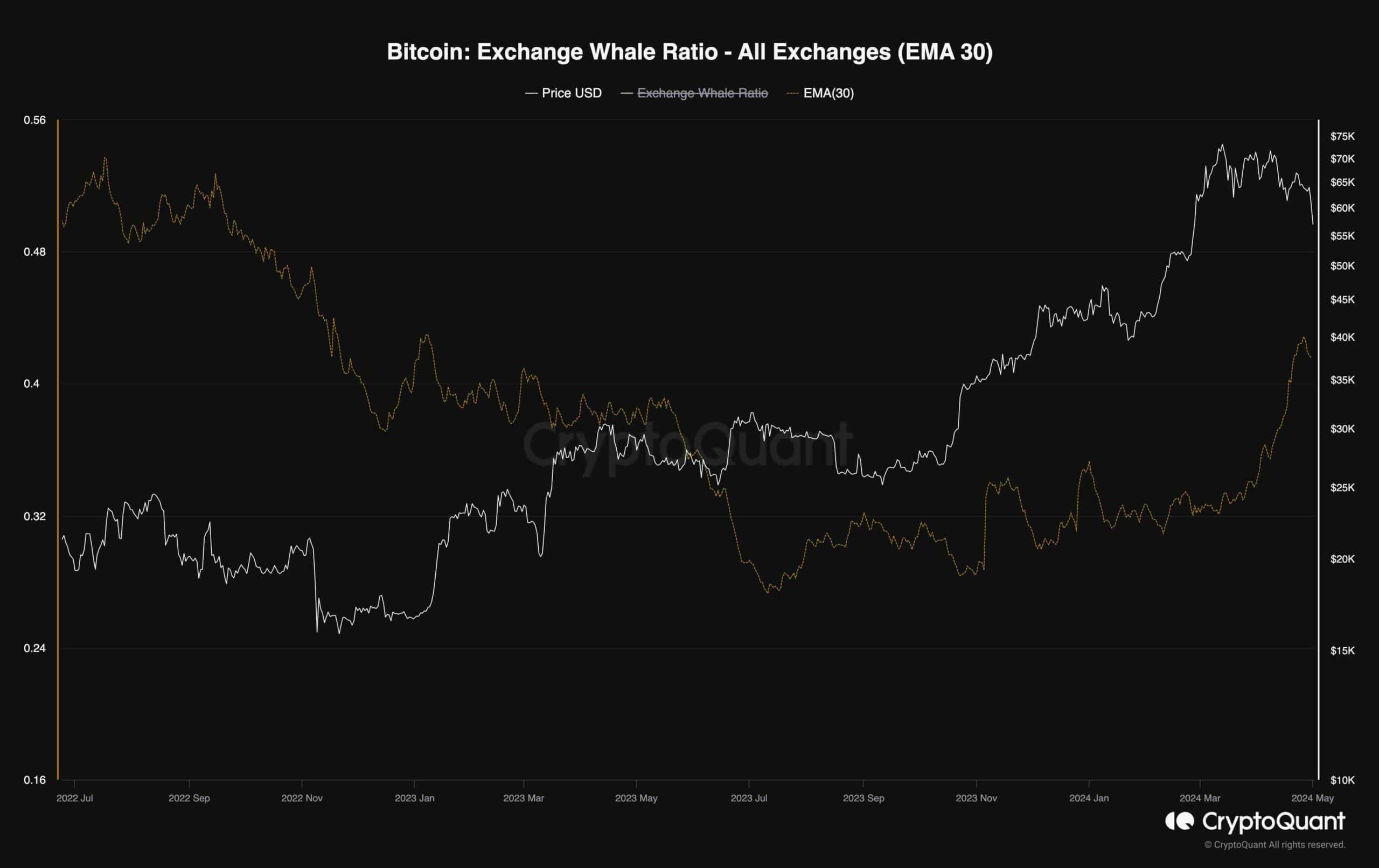

The value of Bitcoin has been decreasing ever since it failed to surpass the $75,000 mark. Some investors are pondering over when and if the market will bounce back. This diagram may hold some clues.

The Exchange Whale Ratio represents the comparison of deposit amounts by large investors, or whales, to the total deposits over a 30-day period, calculated using an exponential moving average.

Based on the data presented in the graph, it appears that the metric has experienced a substantial rise in value lately. This indicates that whales have been actively transferring their coins to exchanges with the intention of selling. The ensuing market pressure is believed to be one of the primary factors behind the recent price correction. Consequently, if the ratio of whale transactions decreases again, it may signal an end to the correction.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- Brawl Stars: Exploring the Chaos of Infinite Respawn Glitches

- Is Granblue Fantasy’s Online Multiplayer Mode Actually Dead? Unpacking the Community Sentiment

2024-05-01 22:52