As a seasoned analyst with extensive experience in the cryptocurrency market, I believe that Bitcoin’s current correction should not be taken as a bearish sign for the long-term bull market. The technical analysis shows that the price is testing important support levels on both the daily and 4-hour charts.

The price of Bitcoin hasn’t set a new record high recently and is experiencing a downturn. However, it’s possible that the bull market, which has driven its price upward, may continue.

Bitcoin Price Analysis: Technicals

By TradingRage

The Daily Chart

As an analyst, I’ve observed that Bitcoin’s price has been sliding downwards over the past few days after dipping below the $68,000 mark and breaking through the bullish trendline. At present, the cryptocurrency is encountering resistance at the $65,000 support zone. However, if the market recovers, a surge back up to $68,000 and potentially beyond could transpire in the near future.

If the price falls just short of the $65,000 threshold, it could trigger a continued decline towards the $60,000 support level. This downtrend might even reach the 200-day moving average, approximately at $57,000.

The 4-Hour Chart

On the 4-hour chart, the price has been shaping a falling wedge formation, which was lately probed near the $65,000 support area.

If this notable pattern is breached upward, it could trigger a surge in prices leading to new record highs. Conversely, a downward break could intensify the slide, potentially causing a sudden drop to around $60K.

On-Chain Analysis

By TradingRage

Miner Reserve

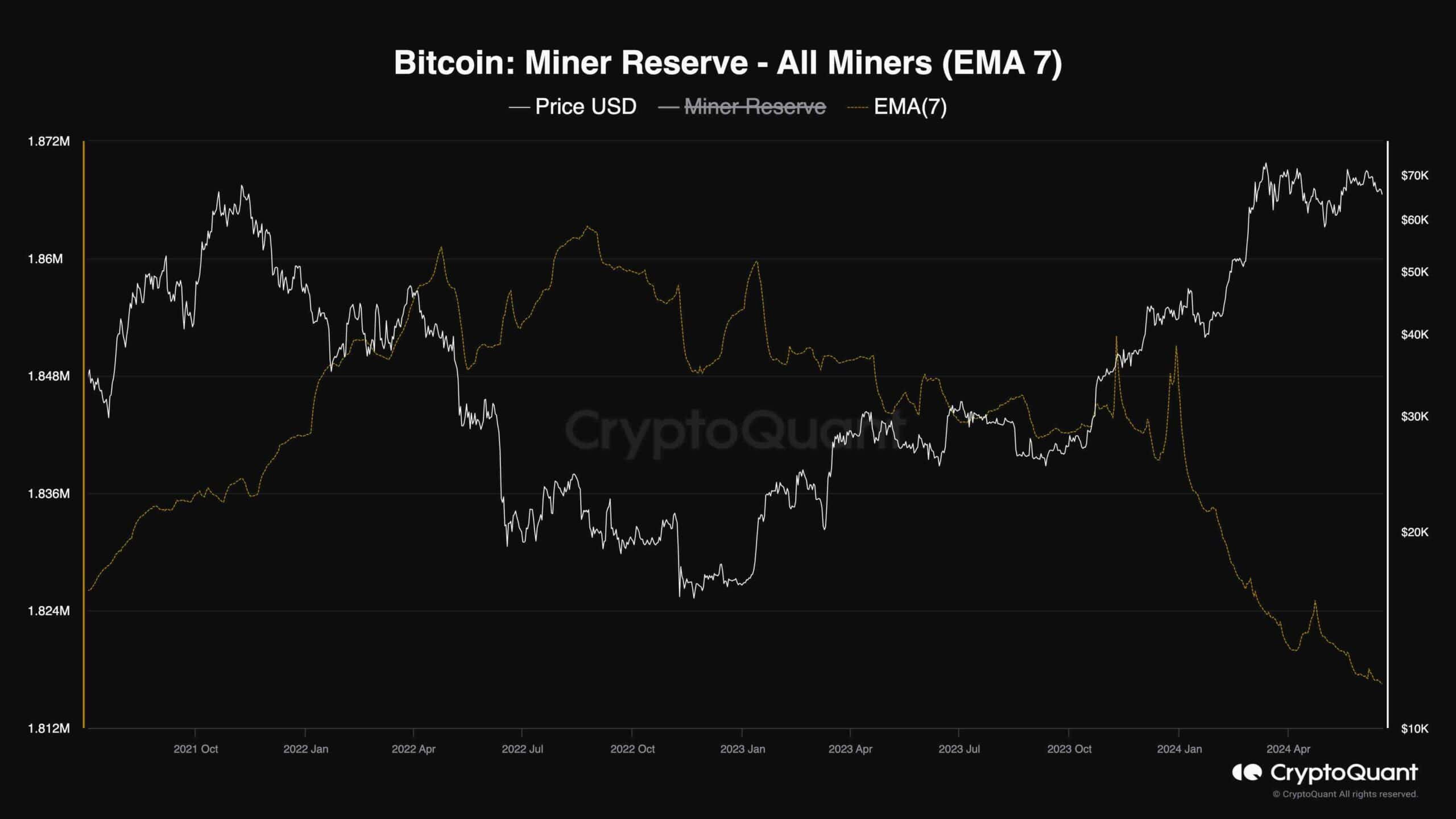

During the latest surge in Bitcoin’s price, miners have managed to make a good return on their investment. But since Bitcoin breached the $40,000 mark, there has been a noticeable rise in selling activity.

This graph illustrates the Bitcoin Miner Holdings indicator, representing the quantity of Bitcoins held by miners. An uptick in this figure suggests they are amassing more coins, while a decline indicates they are dispensing with their holdings.

As an analyst, I’ve noticed a significant decrease in the miner reserves holding Bitcoin lately. This could signify that these crucial BTC holders have swiftly cashed in their profits. While such actions are common during a bull market, they can result in an oversupply of Bitcoin and trigger a downtrend if the demand fails to keep pace.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- ORB PREDICTION. ORB cryptocurrency

- DESO PREDICTION. DESO cryptocurrency

- BORA PREDICTION. BORA cryptocurrency

- INR RUB PREDICTION

- SBR PREDICTION. SBR cryptocurrency

2024-06-18 15:08