As a seasoned analyst with decades of experience in the financial markets under my belt, I’ve witnessed countless market cycles and trends that have shaped the global economy. However, the meteoric rise of Bitcoin (BTC) over the past few months has left me both astounded and intrigued.

As a crypto investor, I’ve noticed an interesting trend: The unpredictable nature of the cryptocurrency market seems to have been influenced by the increasing odds of Donald Trump winning the U.S. presidency. This shift has been marked by significant surges in the value of most digital assets.

After reaching an all-time high of $73,737 in March, Bitcoin surpassed that mark and reached over $75,000, setting a new record. At the same time, its market capitalization also experienced significant growth, reaching a staggering $1.5 trillion at one point.

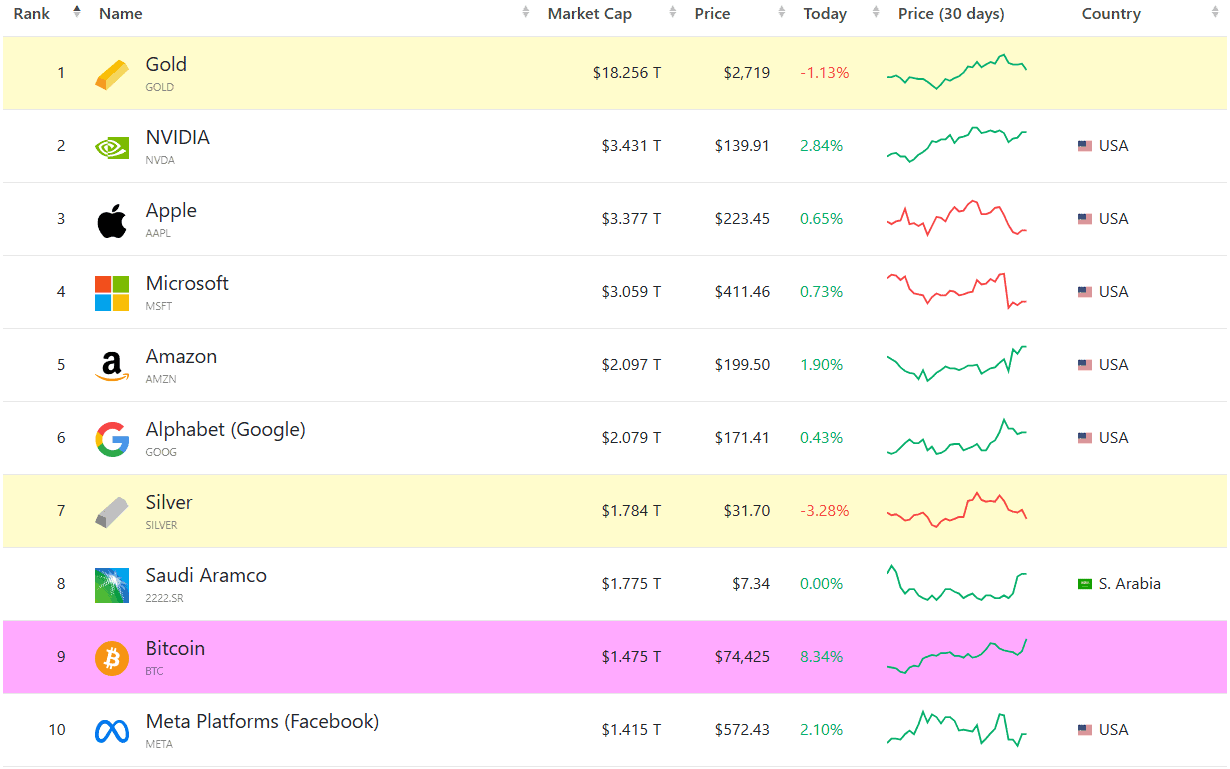

Despite a minor dip since that time, with Bitcoin’s current price at around $74,500, its performance has nevertheless allowed it to reclaim a spot among the world’s top 10 most valuable assets by market capitalization.

At the moment, Bitcoin holds a position of $1.475 trillion in value, placing it as the 9th largest entity, surpassing heavyweights such as Meta Platforms, Berkshire Hathaway, Tesla, and Walmart, which rank 10th, 12th, 14th, and 16th respectively.

Gold currently holds the top spot, boasting a market capitalization exceeding $18 trillion, despite a 1.1% dip in its price today. NVIDIA comes in second with a market cap of approximately $3.4 trillion. The list continues with Apple ($3.377 trillion), Microsoft ($3.06 trillion), Amazon ($2.1 trillion), and Alphabet ($2.08 trillion).

Bitcoin could potentially aim for market valuations similar to those of Saudi Aramco ($1.775 trillion) or even silver ($1.784 trillion), given its current trajectory. Interestingly, silver has experienced a dip of over 3% today.

In simple terms, Ethereum (ETH), the second-largest cryptocurrency, has seen a 7% increase in value over the past day. This surge brings its price close to $2,600, giving it a market capitalization of more than $310 billion. This substantial value ranks Ethereum at number 34 among other significant entities such as Bank of America, Netflix, and Johnson & Johnson.

Among the top 100 largest assets, as ranked by CompaniesMarketCap, those are the mere two cryptocurrencies listed.

Read More

- Hades Tier List: Fans Weigh In on the Best Characters and Their Unconventional Love Lives

- Smash or Pass: Analyzing the Hades Character Tier List Fun

- Why Final Fantasy Fans Crave the Return of Overworlds: A Dive into Nostalgia

- Sim Racing Setup Showcase: Community Reactions and Insights

- Understanding Movement Speed in Valorant: Knife vs. Abilities

- Why Destiny 2 Players Find the Pale Heart Lost Sectors Unenjoyable: A Deep Dive

- How to Handle Smurfs in Valorant: A Guide from the Community

- Honkai: Star Rail’s Comeback: The Cactus Returns and Fans Rejoice

- Dead by Daylight: All Taurie Cain Perks

- Dead by Daylight Houndmaster Mori, Power, & Perks

2024-11-06 13:39