As a researcher with a background in cryptocurrencies and markets, I find the current volatility in the crypto market intriguing. Over the past 24 hours, we’ve seen significant fluctuations, with the total capitalization remaining relatively stable around $2.36 trillion.

As a researcher studying the cryptocurrency market, I’ve observed some significant volatility over the past 24 hours. Currently, the market boasts a total capitalization of approximately $2.36 trillion, which remains relatively unchanged compared to the figure from the previous day.

Bitcoin’s price went through major volatility, as well as most of the altcoins, so let’s dive in.

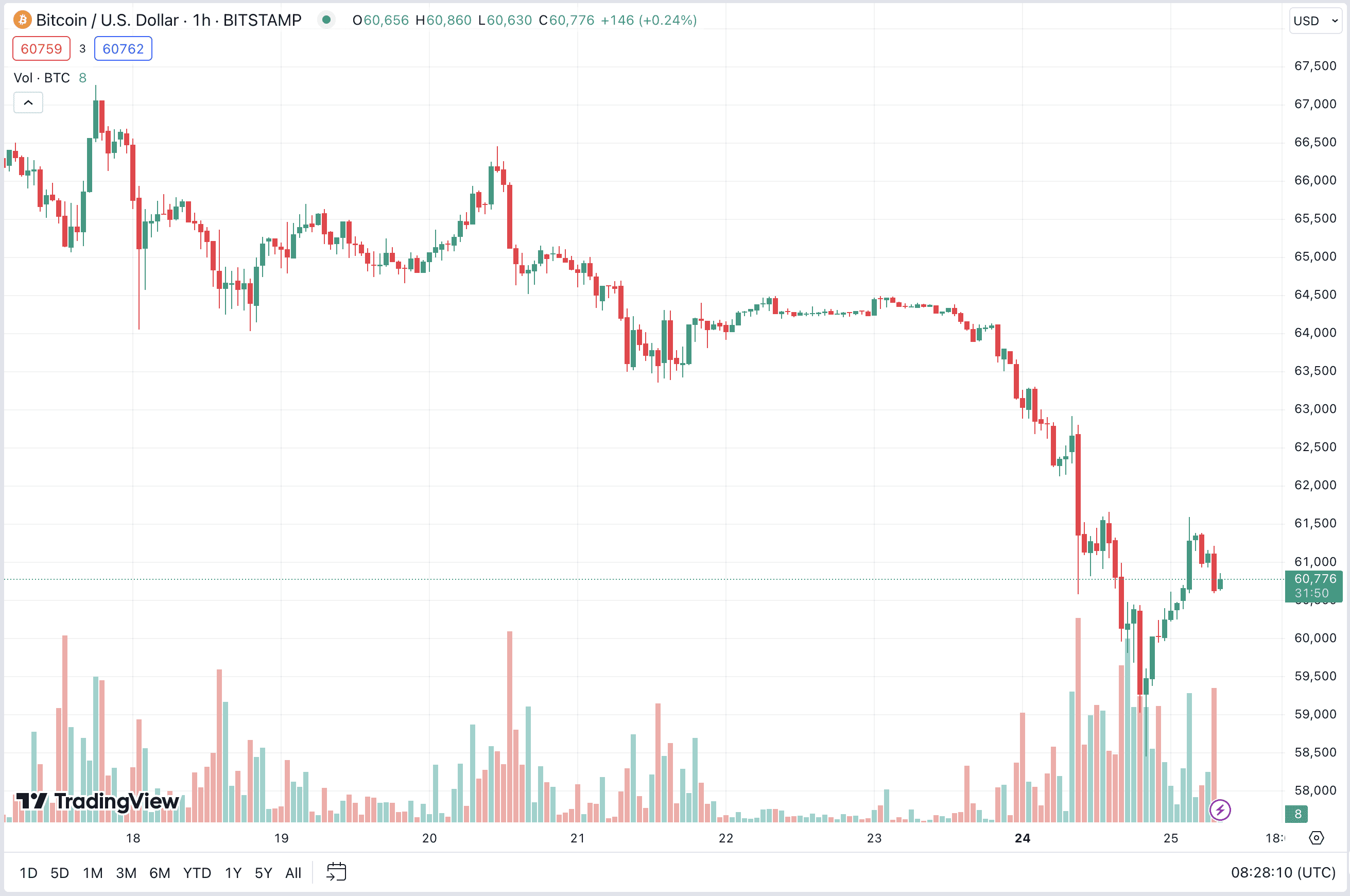

Bitcoin Recovers Above $60K

Yesterday, determined Bitcoin sellers managed to drive the cryptocurrency down towards the $60,000 mark, achieving their goal momentarily.

The price dropped to a low of around $58,400 – something that we hadn’t seen since early May.

According to the graph presented, the cost reached a local minimum at that point before rebounding, now hovering around $60,700. It’s worth pondering whether we’ve hit the limit of the downtrend or if further declines lie ahead.

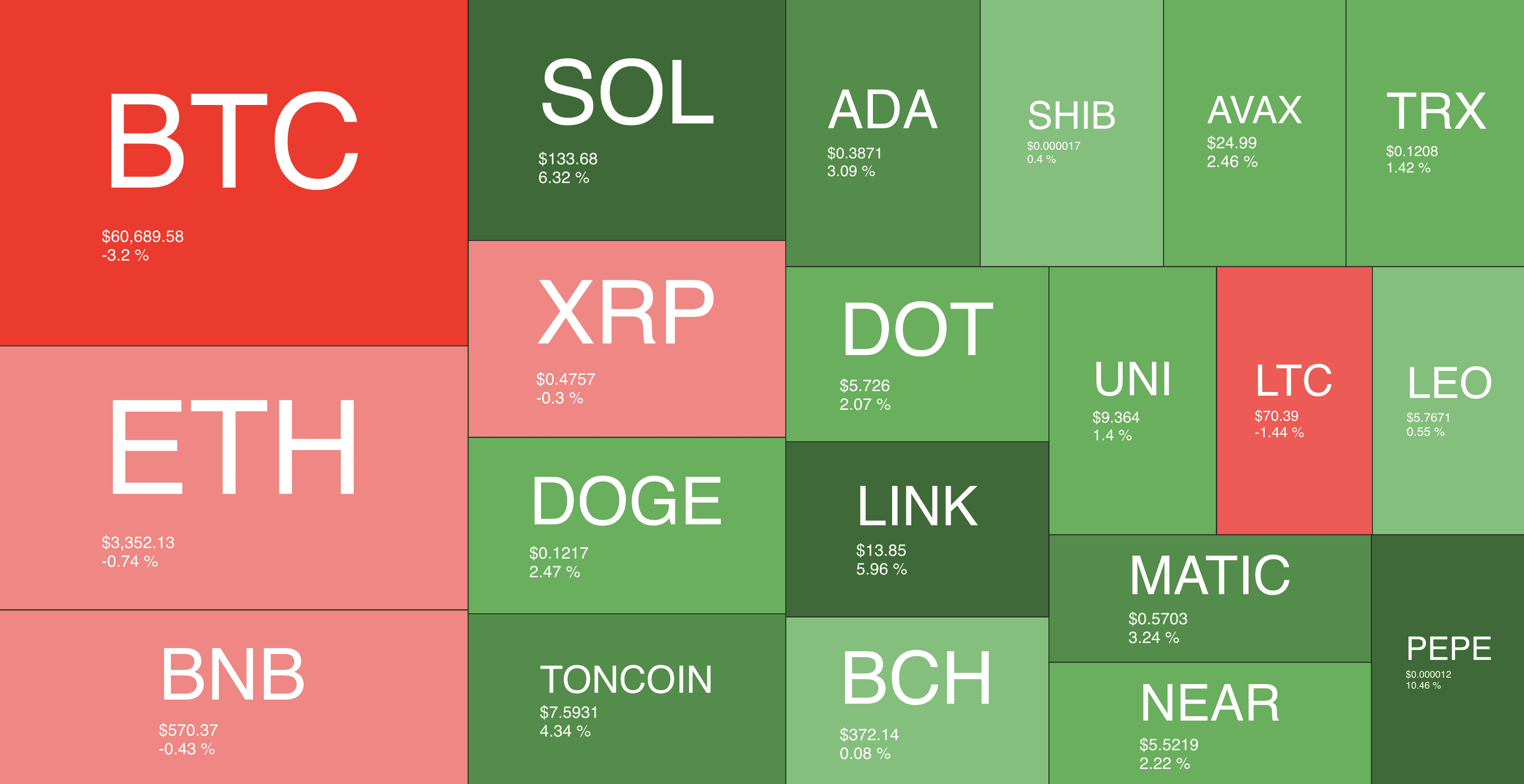

Altcoins Stage a Recovery

As a crypto investor, I’ve noticed that most alternative coins are experiencing modest upward trends on the charts today, with prices edging higher compared to yesterdays.

Polkadot has seen a nearly 2% increase in value today, with buyers aiming to drive up the cost and reach the desirable price mark of $6.

Among today’s top gainers, Chainlink (LINK) stands out with a nearly 6% price surge over the past 24 hours. Close behind is The Open Network (TON), which has experienced a noteworthy increase of approximately 4.2%.

As a researcher studying the meme coin market, I’m observing positive developments. The overall category has experienced a 3.5% growth, while specific memes are posting impressive gains. For instance, PEPE is up nearly 10%, WIF has surged by 15.7%, and FLOKI is up by 10.1%.

In total, it’s intriguing to find out if the market’s downturn has come to an end or if there are more drops to come in the near future.

Based on the widely-used Fear & Greed index analysis, the current market sentiment leans towards fear. This could indicate a potential market low, yet it may also signify prevailing uncertainty.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- BRISE PREDICTION. BRISE cryptocurrency

- GBP CAD PREDICTION

- WOO PREDICTION. WOO cryptocurrency

- WELT PREDICTION. WELT cryptocurrency

2024-06-25 11:38