As a seasoned researcher with years of experience under my belt, I find the recent increase in the Consumer Price Index (CPI) to be a significant development. The slight discrepancy between anticipated and actual numbers suggests that we might be seeing some interesting shifts in the US Fed’s monetary policy.

In September, the U.S. Consumer Price Index showed a rise in the inflation level, up by 2.4%, as compared to the same period in the previous year.

Contrarily to expectations, this figure turned out to be a bit larger, potentially leading to further modifications in the U.S. Federal Reserve’s monetary strategy.

Initially, experts predicted a 0.1% rise in the Consumer Price Index (CPI) from August to September. However, the final figure turned out to be 0.2%.

Year after year, the Consumer Price Index surpassed anticipated values, with a rate of 2.4% instead of 2.3%. Excluding fluctuating sectors such as food and energy, the Core CPI rose by 0.3% in the previous month, contrary to predictions that it would only increase by 0.2%.

Experts suggest that recent developments might significantly reverse the direction of the Federal Reserve’s monetary policy, only a few weeks after the central bank reduced interest rates for the first time in more than four years.

Instead of continuing with the planned interest rate cuts, the Federal Reserve could decide to halt this strategy, considering that Chairman Powell suggested there may be two more reductions by the end of the year.

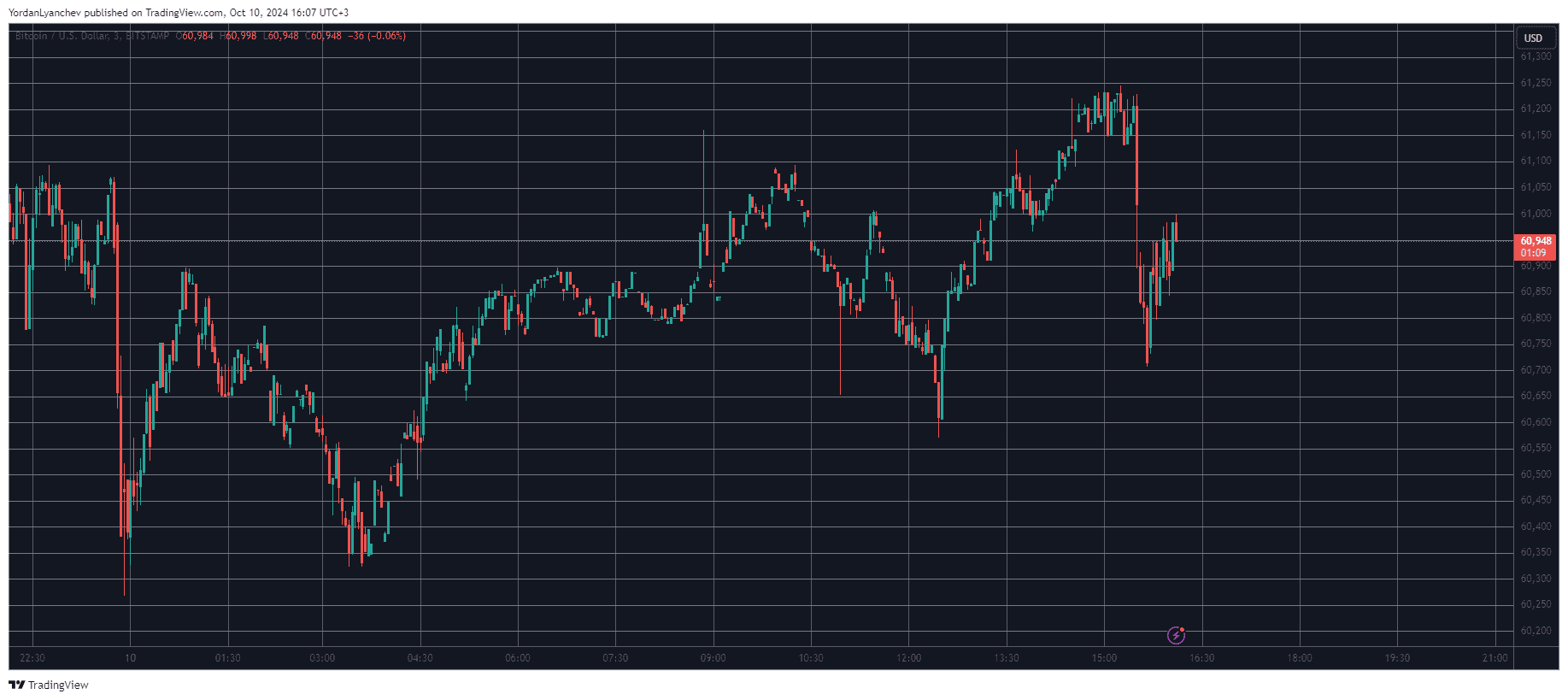

It might be because of that, the price of BTC briefly dipped after a rise to $61,250. The dip was triggered by the release of CPI data, which caused the asset to drop by approximately $500. However, it has since regained some of its lost value and is now hovering around $61,000.

Read More

- W PREDICTION. W cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- ZETA PREDICTION. ZETA cryptocurrency

- FutureNet Co-Founder Roman Ziemian Arrested in Montenegro Over $21M Theft

- AEVO PREDICTION. AEVO cryptocurrency

- DCB PREDICTION. DCB cryptocurrency

- PERI PREDICTION. PERI cryptocurrency

- BEETS PREDICTION. BEETS cryptocurrency

- USTC PREDICTION. USTC cryptocurrency

2024-10-10 16:22