As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market volatility. The recent dip in Bitcoin’s price to around $63,400 is nothing new to me – I’ve witnessed similar drops before, only to see the cryptocurrency bounce back stronger than ever.

Bitcoins price has experienced a significant decline in recent times. Only a few days ago, its value dipped down to approximately $63,400 – a level not seen since around a month prior.

Since June 7th, the BTC price has lost about 11%, with altcoins tumbling even harder.

This hasn’t deterred some analysts from remaining bullish, and CrediBULL Crypto is one of them.

$100K Bitcoin Price Still Possible

As a seasoned cryptocurrency analyst with a substantial following of 400,000 on X, I expressed my insights regarding Bitcoin’s pricing trend in a recent social media post.

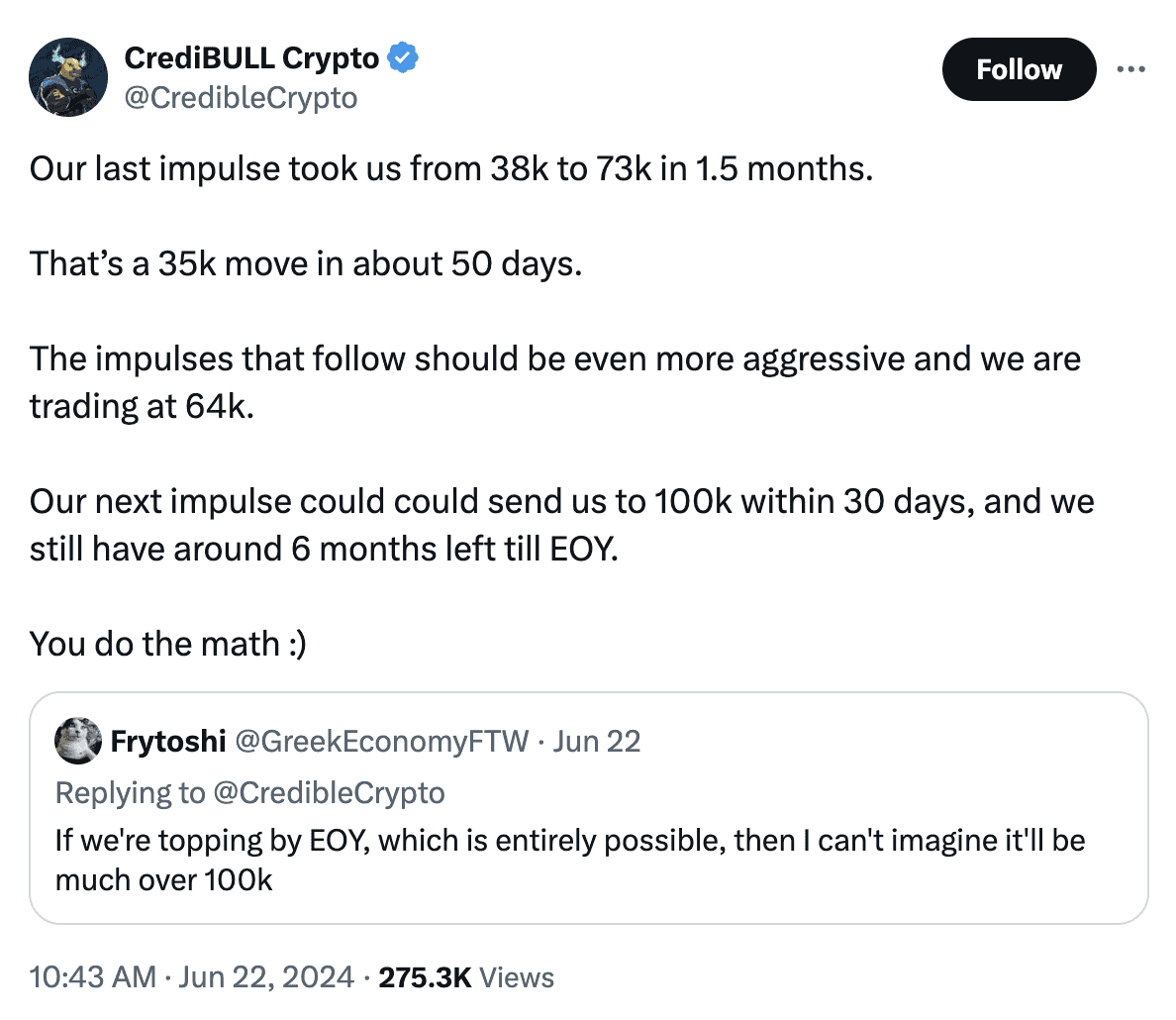

CrediBULL said:

Our last impulse took us from $38K to $73K in 1.5 months. That’s a $35K move in about 50 days.

The impulses that follow should be even more aggressive and we are trading at $64K.

If we act now, we have the potential to reach $100,000 in the coming 30 days, with nearly half a year’s time remaining before the end of the year.

As a financial analyst, I would note that in order for Bitcoin (BTC) to reach a price of $100,000 from its present value, there is a requirement for a substantial price surge representing a 56.25% increase.

But CrediBULL is not the only one with a bullish bias.

Bernstein Sees Bitcoin Target $200K by 2025

As a crypto investor, I’m excited to share that according to analysts at Bernstein Research, their new long-term projection for Bitcoin’s price by the end of 2025 is a staggering $200,000.

Important to mention, yet, the company had earlier projected that Bitcoin would hit $150K by the same time frame.

Analysts predict that approximately 7% of the entire Bitcoin supply could be represented by spot Bitcoin exchange-traded funds by the year 2025.

This prediction suggests that the current peak in Bitcoin’s price cycle is unlikely to be surpassed, but it could reach up to $1 million by 2033. By then, ETFs may have amassed around 15% of the total circulating supply of Bitcoin at that moment.

Read More

- W PREDICTION. W cryptocurrency

- AEVO PREDICTION. AEVO cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- REF PREDICTION. REF cryptocurrency

- COW PREDICTION. COW cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- DHT PREDICTION. DHT cryptocurrency

- FIDA PREDICTION. FIDA cryptocurrency

- PSP PREDICTION. PSP cryptocurrency

2024-06-23 12:16