As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I have witnessed numerous price corrections and bull runs over the years. Bitcoin’s recent correction from the $68K resistance level may be disheartening for some investors, but my analysis suggests that there is still a high probability of new record highs in the coming weeks.

The price of Bitcoin has been adjusting lately, dipping down after it was unable to surpass the $68,000 mark as resistance.

However, there is still a high probability of a new record high in the coming weeks.

Technical Analysis

By TradingRage

The Daily Chart

The price has been surging strongly on the daily chart following its bounce back from the $56K level. However, the resistance at $68K has hindered further advancement, leading to a brief retreat towards $65K.

Despite maintaining the current level of support, it’s highly probable that Bitcoin will surpass $68,000 and set a new record high within the near future.

The 4-Hour Chart

On the 4-hour timeframe, the digital currency has been forming successive peak and trough prices since the initial week of July. However, the persistent resistance at the $68,000 mark has resulted in downward price movements.

In recent trading sessions, the market has exhibited a pattern of forming temporary dips in price around the $65,000 support level. If this level continues to provide stability, the market may attempt to break through the $68,000 resistance level in the near future.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Reserve

In the latest drop of Bitcoin’s price from the $70,000 mark, some market players believed that the bull market had ended. But upon closer examination of investor actions as a whole, an alternate narrative emerges.

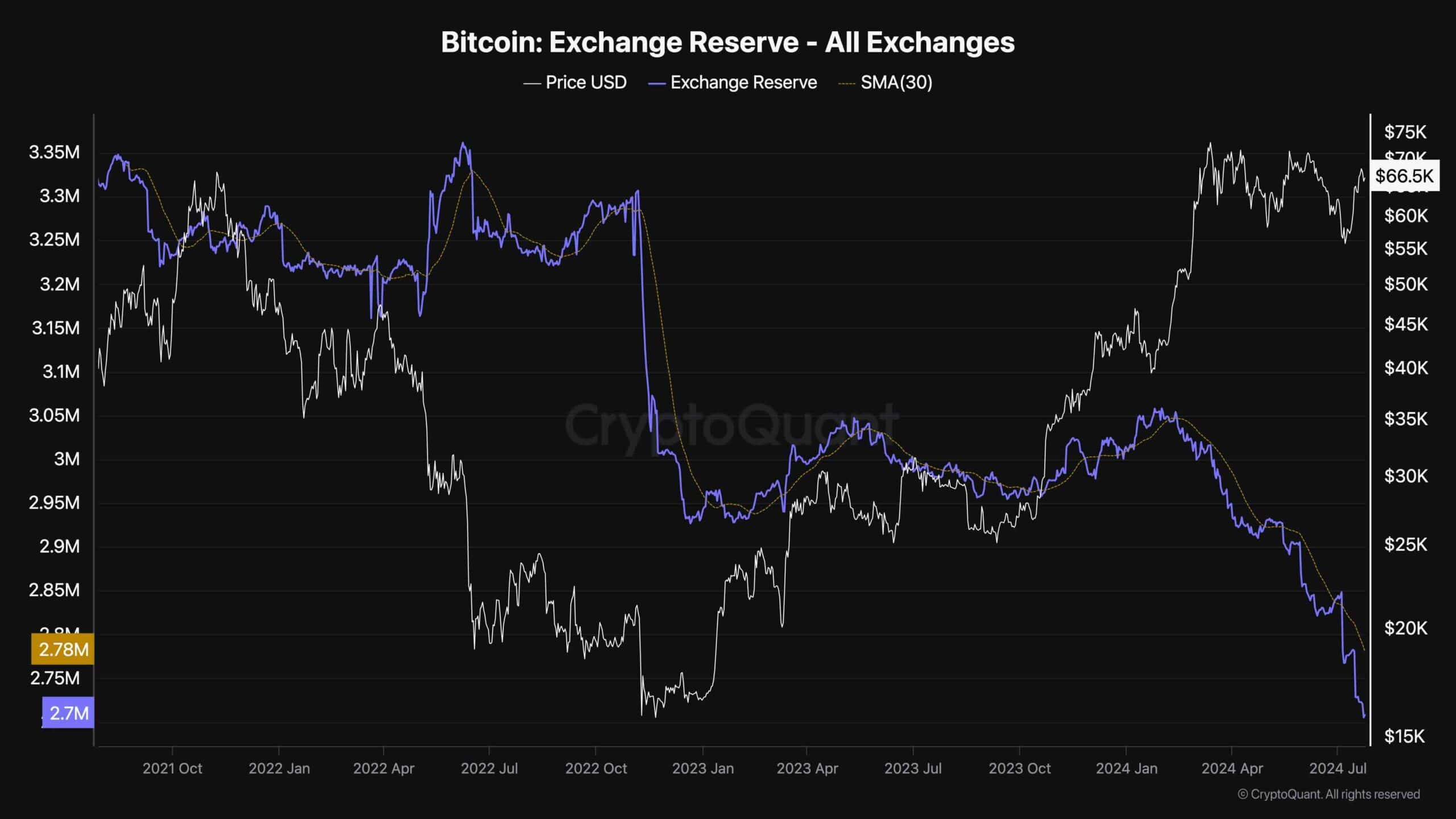

I’ve been closely monitoring the Bitcoin market for quite some time now, and one metric that has piqued my interest is the Bitcoin Exchange Reserve. This data point provides valuable insights into the flow of Bitcoins in and out of exchange wallets.

According to the graph, the exchange reserve figure has been decreasing significantly, similar to the rate observed around the January 2023 price floor. This indicates that investors hold a strong conviction in the market’s continued upward momentum, as they actively buy and transfer coins to their private wallets at an accelerated pace.

Read More

- CKB PREDICTION. CKB cryptocurrency

- EUR INR PREDICTION

- PBX PREDICTION. PBX cryptocurrency

- IMX PREDICTION. IMX cryptocurrency

- PENDLE PREDICTION. PENDLE cryptocurrency

- USD VND PREDICTION

- TANK PREDICTION. TANK cryptocurrency

- USD DKK PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- GEAR PREDICTION. GEAR cryptocurrency

2024-07-24 17:16